De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Signet In-Store Credit Practices Being Investigated

Both the federal Consumer Financial Protection Bureau and the New York state attorney general are looking into them.

Akron, Ohio--Signet Jewelers Ltd.’s in-store credit practices and promotions have come under scrutiny from two government bodies, the retailer said in an SEC filing made late Friday.

In the company’s quarterly report to the Securities and Exchange Commission, the retailer states that the Consumer Financial Protection Bureau (CFPB) notified it via letter Sept. 6 that its Office of Enforcement is considering recommending that the CFPB take legal action against Signet for allegedly violating various provisions of the Consumer Financial Protection Act of 2010 and the Truth in Lending Act.

The Consumer Financial Protection Act was created in 2010 in the wake of the financial crisis, which many blamed in part on the “predatory” lending practices in the housing market, to give the government more oversight on financial transactions. The Truth in Lending Act has been around since the 1960s, and was created to protect consumers from unfair billing and credit card practices.

On the CFPB website under the consumer complaints section, a search of the term “Sterling Jewelers,” the name for the division that oversees Kay Jewelers and Jared the Galleria of Jewelry, brings up 585 complaints, out of the more than 900,000 total complaints on the site. (The site returned no results when the terms “Signet,” “Zale” and “Zales” were searched.)

The complaints, which are filed anonymously, include accounts of aggressive debt collectors, charges appearing on accounts that were believed to have been paid off, accounts that were opened as a result of identity theft, lack of responsiveness from customer service, and lack of clarity on the part of in-store employees.

One commenter who claimed to have visited a Jared store in Georgia over the summer wrote this: “While I was there my girlfriend was trying on rings, the manager pulled me to the side and told me he could do a quick check to see what kind of financing I would qualify for when the time comes. He clearly advised me this was not an application for credit, but a means of seeing how much credit I could be pre-approved for. I even double-checked and was clearly assured by [two other people] that this was not an application for any type of credit and would not cause a hard pull on my credit report. It turns out they were both knowingly lying and filling out a credit card application on my behalf.”

The

The New York state attorney general also is investigating the jewelry retailer’s in-store credit practices. That investigation is ongoing.

In response, Signet said that it believes the potential claims being investigated lack merit and noted that it has been cooperating with both regulators.

Signet began reviewing its credit practices in 2016, after analysts publicly began asking if the retailer was lending to too many consumers with low credit scores while also questioning how past-due accounts were being accounted for on its balance sheet.

In May of this year, the retailer announced plans to outsource its entire credit portfolio, beginning with the sale of $1.0 billion worth of prime-only accounts to Alliance Data System Corp, as well as the launch of a program run by a subsidiary of rent-to-own company Aaron’s Inc. that allows consumers who don’t qualify for credit to do a lease-purchase on jewelry.

Signet said on its most recent earnings call that it is still looking for a buyer for its non-prime accounts while also noting that the migration of the credit program resulted in lost sales in Q3.

The Latest

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

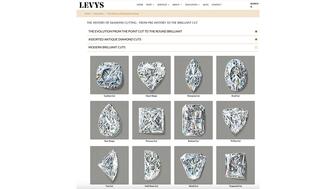

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.