Jewelers Using Payment Apps Should Know This New Tax Rule

For tax year 2022, the IRS has substantially lowered the threshold for receiving a 1099-K for business transactions made via payment apps.

A new IRS tax reporting rule, effective as of Jan. 1, requires payment app providers to issue users and the IRS a form 1099-K if the user’s business transactions total more than $600 per year.

Previously, payment app providers would need to send a 1099-K only if a user had more than 200 business transactions in a year that totaled at least $20,000.

A business transaction means any payment, including tips, for goods and services.

The rule applies to purchases made via a payment app both in store and online, like through Instagram, eBay, Etsy, or any other selling platform.

The rule does not apply to personal transactions, like splitting dinner with a friend or sending birthday money.

App users won’t pay any additional taxes for purchasing goods or services.

The change was signed into law last year as part of the American Rescue Plan, the $1.9 trillion stimulus bill passed, in part, to provide COVID-19 relief, but it also amended parts of the Internal Revenue Code.

The law will apply to tax year 2022, so those eligible for these 1099-Ks will receive them starting in 2023.

The reporting requirement is new, but the tax isn’t.

For this year, individuals are still required to report taxable income received through these platforms on their income tax return.

“Third-party information reporting has been shown to increase voluntary tax compliance and improve collections and assessments within [the] IRS,” said the agency in the FAQ section of its website about the change.

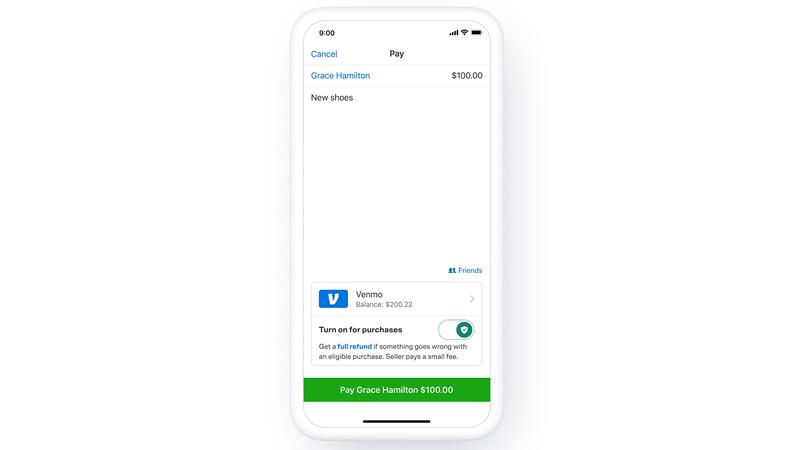

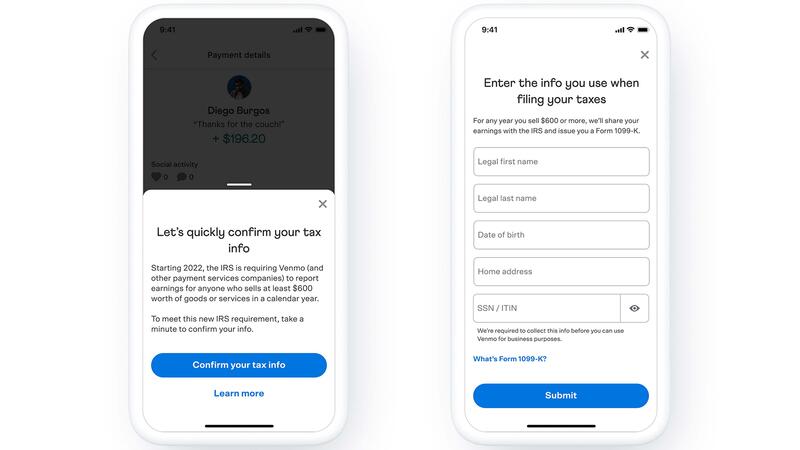

Payment providers like Cash App, PayPal, and Venmo have added updated guidance to their websites.

Users are encouraged to select “goods and services” when they are sending someone money to purchase an item. Doing so also makes these transactions eligible for coverage under PayPal and Venmo’s purchase protection program.

In its FAQ section, Venmo noted that customers may receive an in-app notification or email asking them to confirm information they use when filing taxes, like a social security number and address.

Venmo noted that some amounts may be excluded from gross income, and therefore not subject to income tax, like if a user sells a personal item at a loss.

“We encourage customers to speak with a tax professional when reviewing their 1099-K forms to determine whether specific amounts are classified as taxable income,” said Venmo in a statement on its website.

Notably, payments for a good or service made via Zelle, which sends money between U.S. bank accounts, are not subject to this reporting rule.

Zelle would not need to provide a 1099-K because while it facilitates the sending of money between financial institutions, it doesn’t hold that money or participate in settling the funds.

The change to the reporting rule follows the announcement of a plan from the U.S. Treasury to close the “tax gap,” meaning the difference between what the government is owed and what it receives in taxes.

The American Families Plan Tax Compliance agenda, announced in May 2021, aims to raise an additional $700 billion over the next decade through new tax compliance measures.

“These unpaid taxes come at a cost to American households and compliant taxpayers as policymakers choose rising deficits, lower spending on necessary priorities, or further tax increases to compensate for the lost revenue,” said the department in its plan.

The treasury found the tax gap was nearly $600 billion in 2019.

“Working to close the tax gap reflects a commitment to ending our two-tiered tax system, one where most American workers pay their full obligations, but high earners who accrue income from opaque sources often do not,” said the treasury.

For more information about changes to tax reporting rules and the 1099-K form, visit the IRS website.

The Latest

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.

The limited-edition men’s rings can be customized with one of 12 team logos.

There is a willingness to comply with new government-mandated regulations, with an insistence that they should be practical and realistic.

The program, now live in Europe, will roll out to the U.S. this summer.

Colored gemstones and signed jewels are the focus of its upcoming Geneva sale.

Stuart Brown, who was De Beers’ CFO and interim CEO, is now Lucapa’s independent non-executive chairman.

The point-of-sale software can now prompt customers to round up their credit card purchases as a donation to Jewelers for Children.

The zone’s modernization will enhance and increase India’s jewelry manufacturing capabilities while aiding small and mid-sized businesses.