De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

US Gold Jewelry Demand Up 2% in 2019

But the jump in the gold price in Q3 contributed to a 6 percent decline in global demand in the full year.

London—Gold jewelry demand may have had a good year in the U.S. last year, but it was a different story when looking at its performance globally in 2019.

In the United States, demand was up for the third consecutive year in 2019, rising 2 percent to reach a 10-year high of 131.1 tons, according to the World Gold Council’s most recent Gold Demand Trends report.

The WGC attributed this performance to improved consumer confidence amid a “relatively robust” economic environment.

Demand increased in the fourth quarter as well, up 2 percent to 49.2 tons, marking the twelfth consecutive quarter to see year-over-year growth.

But these positive results weren’t the case for global gold jewelry demand.

According to the WGC, demand in 2019 fell 6 percent overall to 2,107 tons.

The second half was largely affected by the jump in the gold price in the third quarter (prices reached $1,546/ounce in September, according to Kitco), impacting affordability.

Fourth quarter jewelry demand sank to its lowest level since 2011, plummeting 10 percent to 584.5 tons.

The WGC also noted the drop in global volumes last year had much to do with weakness in India and China.

In India, a 17 percent drop in the fourth quarter led to a 24 percent decline for the second half of the year.

Key factors influencing the second-half performance were the higher gold prices, a domestic economic slowdown and “muted” rural demand.

In China, meanwhile, fourth quarter demand sank 10 percent to 159.7 tons.

This also represented the fifth consecutive quarter of decline for the market, causing full-year 2019 demand to slide 7 percent to 637.3 tons.

Subdued demand in both the quarter and the year were attributed to China’s slowing economy, rising inflation, global trade disputes, and higher gold prices.

Another factor was the younger generation’s shifting tastes toward lighter jewelry pieces with fashionable designs; traditional “mass-appeal” 24-karat gold jewelry continued to lose market share to innovative products.

Meanwhile, 2019 gold jewelry demand was down 2 percent in both the Middle East and Europe, and in other Asian markets, excluding China, higher gold prices dented demand across the region to lead to full-year losses.

However, while global demand by volume was down for the full year, demand by value was up.

Consumers spent even more on gold in 2019, with gold jewelry demand increasing 3 percent to a five-year high of $94.3 billion.

Much

Other Gold Trends

Overall gold demand across all categories—jewelry, ETFs, technology, bar and coin demand, and more—was down 1 percent in 2019.

According to the WGC, it was “broadly a year of two distinct halves:” resilience and growth across most sectors in the first half of the year, while the second half was marked by widespread year-over-year declines.

It said global demand in H2 was down 10 percent compared with the same period in 2018 as year-over-year losses in the fourth quarter compounded those in Q3.

Meanwhile, the total gold supply was up slightly in 2019, rising 2 percent year-over-year to 4,776.1 tons.

Mine production in Q4 fell 2 percent to 889.5 tons, the lowest fourth-quarter mine output since 2016 and closing out a year of declines in all quarters.

In full-year 2019, gold mine production totaled 3,463.7 tons, representing a 1 percent decrease, the first annual decline in production since 2008.

The recycled gold supply, meanwhile, was up 16 percent year-over-year in Q4, totaling 335 tons and bringing the annual supply to 1,304.1 tons in 2019—the highest since 2012, when the gold price was much higher.

The Latest

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

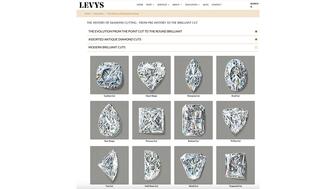

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.