A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Live from Tucson: 9 Gemstone Market Updates

Richard Drucker tackled trends, memo and grading reports for colored gemstones in a seminar at AGTA GemFair.

Tucson, Ariz.--There’s no better time or place to talk about what’s happening in the gemstone market than in Tucson when the city’s playing host to the annual gem shows.

On Thursday morning, GemWorld International’s Richard Drucker spoke at the AGTA GemFair, summarizing his conversations with gemstone dealers throughout the year regarding supply, demand and pricing trends, and some of the biggest issues facing the market right now.

Here are some highlights from his seminar.

1. More business closings. One of the major stories of 2016 concerned the growing number of businesses in the industry that shut down. The Jewelers Board of Trade’s recently released full-year numbers showed that 1,669 jewelry businesses ceased operations during the year, which is a 50 percent jump from the prior year.

Struggles with garnering enough business to stay afloat and retirement without successors both continue to plague the industry, Drucker said.

However, this also means that with less competition, there’s the possibility of a better business outlook for gemstone dealers and retailers still in the game, he added.

2. Over-reliance on memo. The memorandum issue is one that’s long has been discussed in terms of the designer-retailer relationship, but it’s become a concern in the gemstone world as well, with retailers asking for gemstones on memo.

In the case of the gemstone dealer, who has “taken all the risk” in buying the rough or polished stones and added them to their inventory, Drucker said, he or she is now selling direct to consumers more often so that money isn’t tied up in memo goods.

“Dealers, at some point, are forced to find an alternative on their own,” he said.

3. Last year was slow to start but finished strong. Many of the gemstone dealers with which GemWorld spoke said that last year was fairly weak until after the election when buyers were happy to start buying again, leading to a very strong November-December period.

Dealers also said that where the past three to four years had been fairly slow, it seemed like the gem market finally was seeing some growth again amid a resurgence in interest in color.

4. The two-tier market continues. Repeating a trend Drucker mentioned at last year’s Tucson show--and which many in the trade have echoed since then--both the high end and the lower end are doing well while the middle tier continues to be squeezed.

To

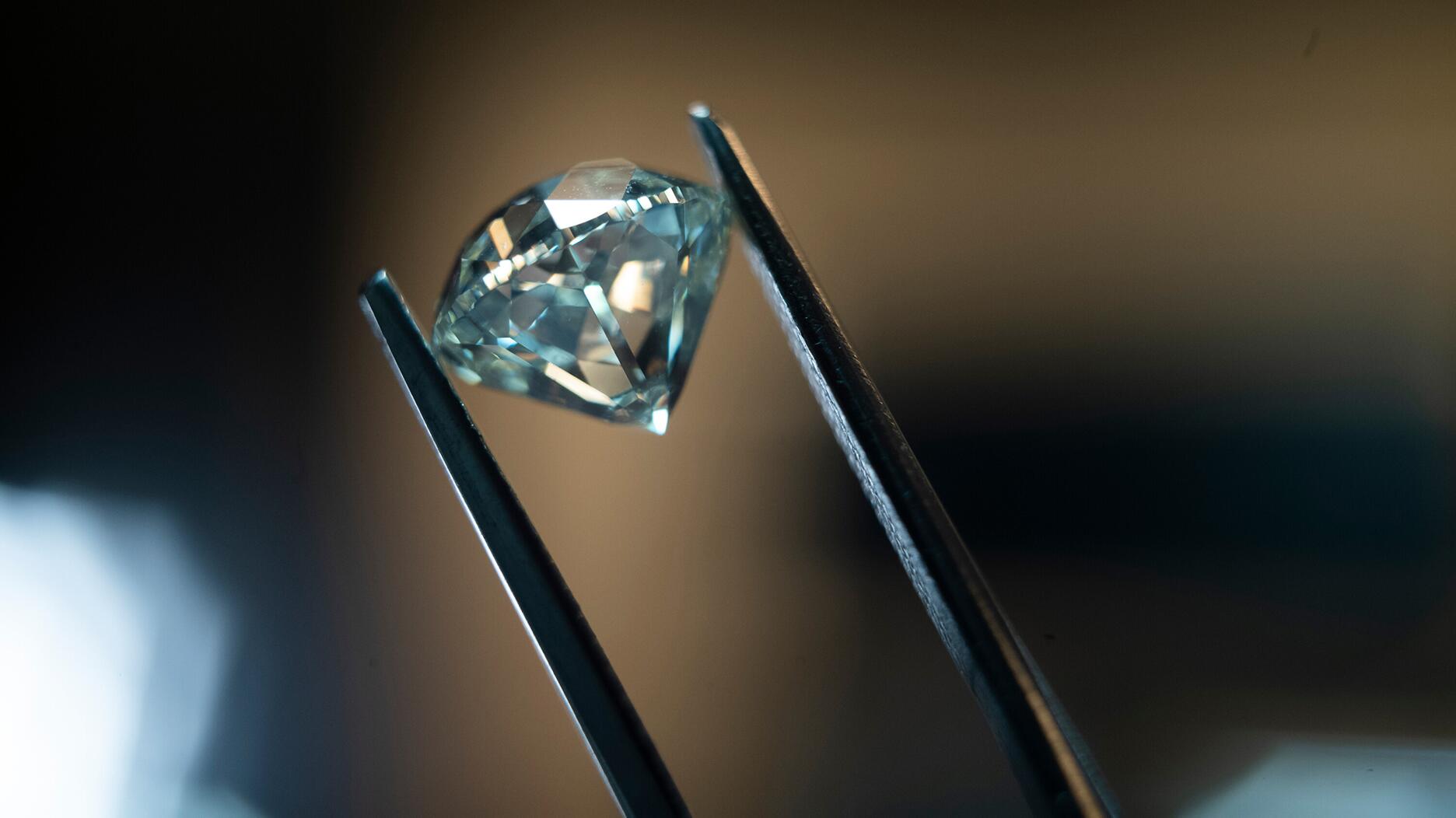

5. The continued popularity of blue gemstones and colored bridal. For anyone who was wondering, the high demand for blue gemstones won’t be going away any time soon.

While blue sapphires seem to be the king, the trend is carrying through to gems of all types: tanzanite, zircon, aquamarine and tourmaline.

And the mention of color in bridal came as no surprise, as that trend has been strong for a couple of years now. But, Drucker pointed out at the seminar that many of the rings and stones that companies have been selling for the category also could simply be fashion jewelry as well, which means that leveraging this trend could just require a rebranding from some.

6. The increasing popularity of unheated gems, better cuts, big and bold gems, and responsibly sourced stones. Stones with natural and rare beauty are doing well, and quality cutting is coming to the forefront.

Meanwhile, responsible sourcing is “becoming a big topic, and you will hear more about it,” Drucker said.

According to a recent Nielsen survey, 12 percent of baby boomers and 26 percent of Generation Xers care about it while more than half of millennials are concerned with ethical sourcing.

Earlier this week, the Jewelry Industry Summit was held in Tucson, and the AGTA also announced that a number of industry organizations--including the International Colored Gemstone Association and India’s Gem & Jewellery Export Promotion Council, among a few others--were stepping in to help with its silicosis abatement project.

7. The “big three” actually are the No. 1, No. 2 and No. 3 sellers for many dealers these days. Sapphires and fancy colored sapphires are on fire, and rubies are benefitting from the increased supply and acceptance of the material from Mozambique. Emeralds are once again seeing a resurgence as price and supply remains stable and the green stone benefits from increased promotion from Gemfields.

When it comes to sapphire supply and price, some dealers said they were seeing strong supply and lower prices, while some said there were shortages and higher prices. What that issue boils down to is quality: When it came to fine stones, prices were going up.

Production of rubies, meanwhile, used to be around 20 percent of that of sapphires but that gap is rapidly closing, Drucker reported. At the same time, there’s “no indication that demand (of average quality or lower) has risen to keep up with the supply.”

As gem dealers have told National Jeweler before, despite the lifting of the ban in Burma, there isn’t likely to be an influx of material into the U.S. market.

When it comes to emeralds, prices are expected to rise, but it’s likely production will too.

In Colombia, Muzo’s output will go up, Drucker said, now that its infrastructure has been established.

He also noted that a new source of emeralds from Ethiopia has been confirmed, though they haven’t yet seen the material and don’t know much about it.

8. Apart from the “big three,” there are a number of other gemstones doing well. According to the gemstone dealers whom GemWorld surveyed, these include spinel, garnet (especially tsavorite), peridot, rhodolite garnet, and rare and different gems.

“How are you going to set yourself apart if you don’t sell something different?” Drucker asked.

9. Colored stone lab reports concern some dealers. Drucker said that every top dealer he spoke with, except one, expressed dislike and concern about lab reports but noted that they felt like they had to use them.

A few things in particular popped up in this section of the seminar, two of which were nomenclature and origin.

In regards to the first, issues arise for some in the colored stone market when it comes to a lack of consistency and codification in naming standards from lab to lab.

With the latter, the reliance on an identification of place of origin is having a big effect on prices. And as so many new sources pop up, there are risks of inconsistencies.

The Latest

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The move will allow the manufacturing company to offer a more “diverse and comprehensive” range of products.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.