NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

Gemfields Pulls Out of Colombia and Sri Lanka

The colored gemstone miner said it has opted to focus on its projects in Africa.

London--Gemfields announced recently that it is abandoning plans to begin mining emeralds in Colombia and sapphires in Sri Lanka.

In Colombia, the company had entered into agreements to acquire controlling interests in two emerald projects located predominantly in the Boyacá state.

In Sri Lanka, Gemfields had a joint venture with East West Gem Investment Limited that would have added sapphires to the portfolio of colored gemstones it mines.

CEO Ian Harebottle said in a statement that the company believes its current portfolio of assets in Africa, as well as other expansion opportunities in Zambia, Mozambique and Ethiopia, are all “likely to deliver considerably higher returns, with shorter payback periods, than some of the other jurisdictions it had previously been evaluating.”

The company currently owns a 75 percent state in the Kagem emerald mine in Zambia, a 75 percent stake in the Montepuez ruby mine in Mozambique and a 50 percent stake in the Kariba amethyst mine in Zambia.

It also owns 100 percent of Oriental Mining SARL, a company incorporated in Madagascar with exploration licenses covering emeralds, rubies, sapphires, tourmalines and garnets, and acquired 75 percent of Web Gemstone Mining in Ethiopia, which holds an emerald exploration license. Drilling commenced at the latter last summer and preliminary groundwork for a bulk sampling exercise scheduled for July is underway.

The company announced that it was withdrawing from Colombia and Sri Lanka at the same time it released its financials for its third quarter ended March 31.

At Kagem, production during the three-month period was down, totaling 4.5 million carats of emerald and beryl with an average grade of 193 carats per ton. This is compared with 7.1 million carats with an average grade of 297 carats per ton in the same period last year.

The company attributes the difference to the “varied nature” of the emerald mineralization, exceptionally high rainfall, and a renewed focus on opening new areas for future production.

Total operating costs for the mine were $9.6 million, compared with $11.2 million a year ago.

The lower production at Kagem is expected to reduce targeted total production for the 2017 financial year to between 20 and 25 million carats, the company said, but added that it believes it still will deliver on the longer-term production ramp-up in the coming years. (Gemfields has said before that it would like to expand the emerald mine to reach an annual production of more than 40 million carats

An auction of predominantly higher quality rough emeralds from the Kagem mine was held in Lusaka, Zambia in February. The sale brought in revenues of $22.3 million, with an average realized value of $63.61 per carat.

The next auction of predominantly commercial quality rough emeralds from Kagem is taking place in Jaipur, India through Thursday.

Meanwhile, at the company’s ruby mine, Montepuez, production was down year-over-year, from 2 million carats to 1.2 million carats. Gemfields said this is largely due to the lower grade but higher value ore being processed, noting that the quantity of premium quality rubies recovered increased by 92 percent.

Total operating costs at Montepuez for the three-month period were $6.5 million.

Since production at the site will focus on processing predominantly lower grade but higher value ore for the remainder of the financial year, Gemfields said the targeted total production is now estimated at 8 -10 million carats, down from the previous guidance of 10 to 12 million carats.

The next mixed quality auction of rough rubies and corundum is slated for June in Singapore.

The Latest

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

Its updated book for mountings is also now available.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

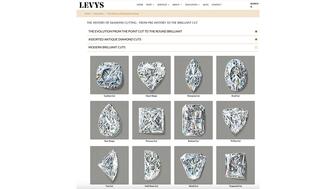

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.

The limited-edition men’s rings can be customized with one of 12 team logos.

The program, now live in Europe, will roll out to the U.S. this summer.

Colored gemstones and signed jewels are the focus of its upcoming Geneva sale.