Emmanuel Raheb recommends digging into demographic data, customizing your store’s communications, and retargeting ahead of May 12.

Rough demand is picking up, but why?

I came across this great article on IDEX Online on Thursday by my colleague Edahn Golan in Israel attesting to an increase in rough-diamond demand ahead of De Beers’ upcoming sight. The sight, scheduled for Nov. 2-6, is the ninth...

I came across this great article on IDEX Online on Thursday by my colleague Edahn Golan in Israel attesting to an increase in rough-diamond demand ahead of De Beers’ upcoming sight.

The sight, scheduled for Nov. 2-6, is the ninth of the year and is usually a small sight, partly because the Diamond Trading Co. (DTC) sightholders buy what they need for the holiday rush prior to the first week of November.

According to the article, however, this ninth sight is seeing a lot of sightholders submitting applications—requests to the DTC for extra rough—that will result in the sight totaling around $350 million, above the pre-determined allocation believed to be about $300 million.

This is great news for an industry where the DTC sights sunk as low as an estimated (by Rapaport Group) $129 million earlier this year, though still doesn’t represent a return to pre-crisis levels, when sights ranged between $600 million and $700 million.

What’s the source of this excess demand for rough?

In the article, though, Edahn presents another strong possibility: anticipated healthy demand in China for diamond gifts to mark the Chinese New Year, celebrated in February. He also mentions the fact that Indian banks are stepping up their lines of credit, lining the pockets of various industry players with cash that hasn’t been seen in months and fueling the pursuit of rough among buyers.

Perhaps more interesting than these theories, however, is what the article doesn’t say. Nowhere in the story does Edahn ever utter the words “United States” or “holiday season.”

This is further proof that many in the diamond industry have stopped worrying so much about the U.S. market—What’s happening there? When will demand return? When will debt-ridden consumers feel comfortable enough to start spending again?—and simply moved on to emerging markets such as China.

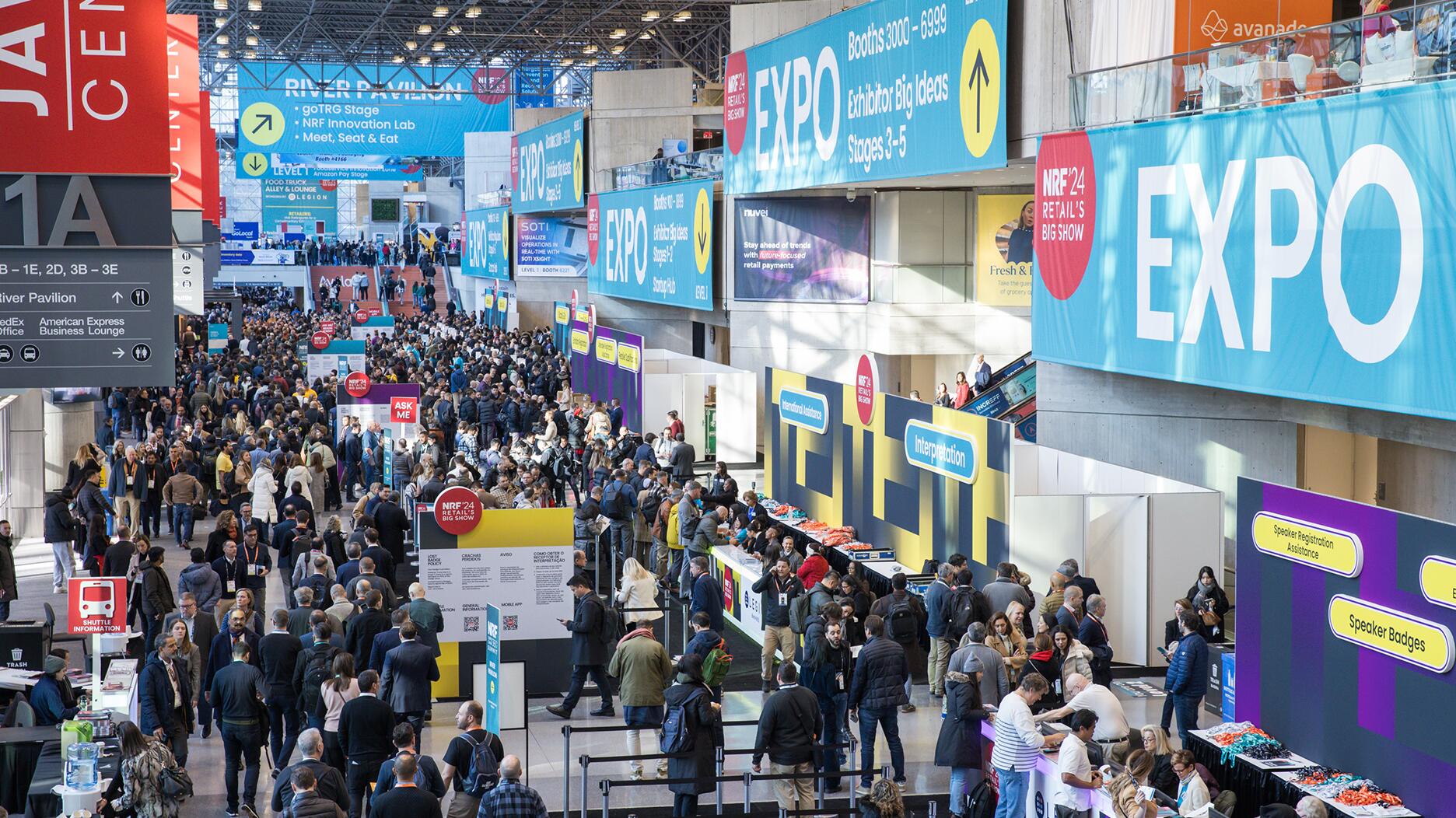

*Image courtesy of the De Beers Group

The Latest

Located in the town of Queensbury, it features a dedicated bridal section and a Gabriel & Co. store-in-store.

The mining company’s Diavik Diamond Mine lost four employees in a plane crash in January.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

A 203-carat diamond from the alluvial mine in Angola achieved the highest price.

Ruser was known for his figural jewelry with freshwater pearls and for his celebrity clientele.

The “Rebel Heart” campaign embodies rebellion, romance, and sensuality, the brand said.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

The overhaul includes a new logo and enhanced digital marketplace.

The money will go toward supporting ongoing research and aftercare programs for childhood cancer survivors.

A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The move will allow the manufacturing company to offer a more “diverse and comprehensive” range of products.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.