Sponsored by the Las Vegas Antique Jewelry & Watch Show

Diamond Prices Remain Relatively Unchanged in Sept.

Diamond prices fluctuated little between August and September, the latest report from the Rapaport Group shows.

New York--Diamond prices fluctuated little between August and September, the latest report from the Rapaport Group shows.

Prices for 1-carat, half-carat and 3-carat diamonds all dropped very slightly, 0.2 percent, while prices for 0.3-carat diamonds rose 0.3 percent month-over-month.

Year-to-date (Jan. 1 to Oct. 1), prices have dropped for 1-carat (down 2 percent) and 3-carat diamonds (10 percent) but are up 0.3 percent and 3.5 percent for 0.3-carat and 0.5-carat diamonds, respectively.

The Rapaport Monthly Report stated that the holiday season in the United States is “not expected to be stellar” due to cautious consumer spending among economic volatility and “political uncertainty,” a reference to the presidential election, which will be over in about a month.

The report also mentions the fact that industry’s “much-anticipated generic marketing campaigns” are not yet established enough to make a real difference; Stephen Lussier of De Beers and the Diamond Producers Association said as much last week when the DPA screened the first commercials for “Real is Rare.”

“The key is, it’s a first step in this journey,” he said, referencing the industry’s years-long effort to get a generic marketing campaign off the ground. “We’re not setting out to transform Christmas this year.”

Rapaport’s outlook differs from the forecasts released by the National Retail Federation and PricewaterhouseCoopers this week, and the projection made last month by Deloitte. All three are calling for a solid year-over-year increase in holiday sales.

De Beers & Alrosa Sales

Also last week, De Beers Group reported provisional results for the eighth sales cycle of the year, which ran from Sept. 6 to Oct. 3.

Preliminary results indicate that the diamond miner and marketer sold $485 million in rough diamonds to sightholders and via its auction platform.

CEO Bruce Cleaver said De Beers’ sales were slightly above expectations given the normal seasonal demand patterns, the shorter-than-normal period between sales cycles seven and eight, and the upcoming holidays at some of the world’s major diamond cutting centers, such as Diwali in India.

(A figure for a year-over-year comparison is not available, as this is the first year De Beers has been releasing cyclical sales results.)

The company also revised its provisional sales figure for sales cycle seven, from the $630 million figure shared last month up to a final of $639 million.

Here’s how De Beers’ rough diamond sales have tracked so far this year.

First sales cycle: $545 million

Second: $617 million

Third: $666 million

Fourth: $636 million

Fifth: $564 million

Sixth: $528 million

Seventh: $639 million

Alrosa, too, issued a report on its sales results for September.

The Russian mining company said rough diamond sales totaled $435.1 million, while polished sales were $18.9 million, equaling total diamond sales of $454 million for the month.

Alrosa Vice President Yury Okoemov said the company saw “good demand” in all categories of rough and that sales were up “significantly” over September 2015, though the company did not provide a year-over-year figure for comparison.

The Latest

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

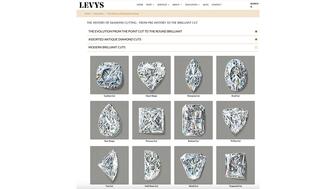

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.