Sponsored by the Las Vegas Antique Jewelry & Watch Show

Dominion Diamond Exploring Potential Sale

The company’s board of directors has set up a committee to review its “strategic alternatives.”

Yellowknife, Northwest Territories--Canadian diamond mining company Dominion Diamond Corp. said it is exploring the possibility of a sale.

In a company statement, Dominion said its board of directors has formed a special committee to “explore, review, and evaluate a range of potential strategic alternatives focused on maximizing shareholder value.”

Working together with the company’s management team and advisors, it will consider alternatives for Dominion that could include the sale of the company or “other strategic transactions.”

The members of the committee are Trudy Curran, Jim Gowans, David Smith and Josef Vejvoda.

Dominion said the board has not set a timetable for this process or made any decisions yet in terms of the “strategic alternatives,” noting that there’s no assurance of a sale or change in strategy.

TD Securities Inc. is acting as financial advisor to Dominion, Stikeman Elliott LLP is acting as legal advisor and Kingsdale Advisors is acting as strategic advisor. Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal advisor to the committee and the board of directors.

The announcement from the company doesn’t come as a surprise, as there have already been some reports this year about offers being made and talks being had.

Last month, billionaire Dennis Washington’s company, Washington Corporations, publicly made a $1.1 billion offer to acquire the company, an expression of interest which was unsolicited, Dominion said in a statement.

Dominion’s board considered the expression of interest, including with the benefit of legal and financial advice, but noted in a press release that “WashCorps does not have experience in the highly specialized diamond mining and marketing industry. WashCorps also advised that they did not have any unique plans for the business.” It also said the company had undervalued Dominion in its offer.

And just last week, Reuters reported that Dominion and Canadian diamond miner Stornaway were in talks about a potential merger.

In Dominion’s company statement, Chairman James Gowans said, “While the board of directors remains confident in the company’s long-term strategic plan and the opportunity it provides to enhance value for all shareholders, we are open to exploring all strategic alternatives that are in the best interests of the company and its stakeholders. The Board is committed to maximizing shareholder value through a fair and open process and we look forward to engaging constructively with all parties.”

Last month, CEO Brendan Bell announced he would be stepping down on June 30

The Latest

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

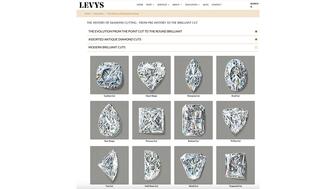

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.