Sponsored by the Las Vegas Antique Jewelry & Watch Show

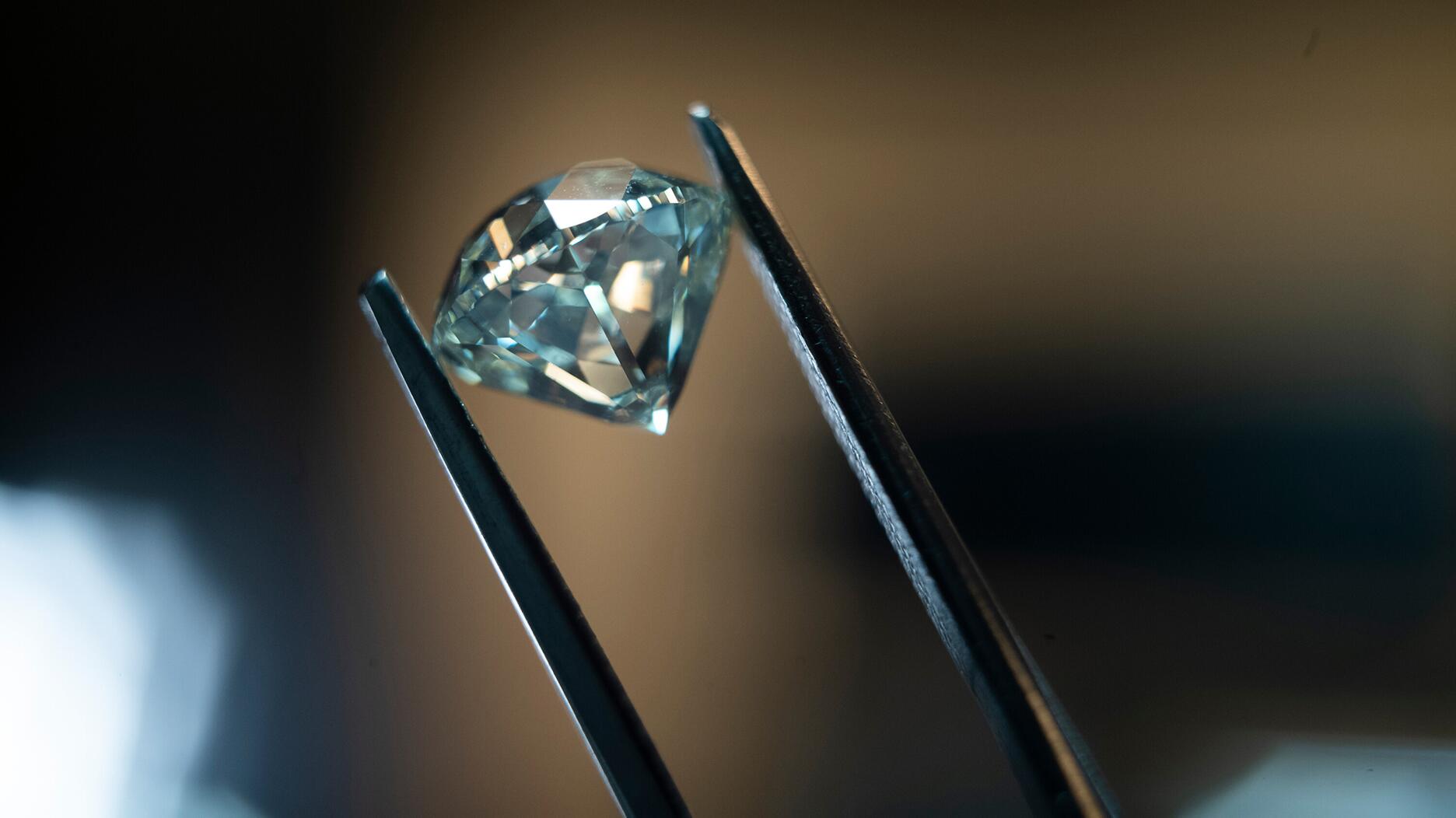

Diamond Production Down for De Beers and Rio Tinto

De Beers’ 2019 totals fell 13 percent year-over-year while Rio Tinto’s were down 8 percent.

New York—Like sales, diamond production fell by double digits in 2019 for De Beers Group, the world’s largest diamond miner in terms of value.

The miner and marketer recovered 30.8 million carats in 2019, down 13 percent year-over-year. Fourth quarter production was down 15 percent, to 7.8 million from 9.1 million previously.

South Africa experienced the steepest drop, with production down by more than half, totaling 1.9 million carats in 2019 compared with 4.7 million carats the previous year.

De Beers has only one mine left in South Africa after closing Voorspoed at the end of 2018.

Production in Botswana, De Beers’ largest source of diamonds, slipped 4 percent year-over-year to 23.3 million carats, while production in Namibia fell 15 percent to 1.7 million carats.

Recoveries in Canada dropped 13 percent to 3.9 million carats. The country’s Victor mine closed in the second quarter of 2019, though production at Gahcho Kué was up by 28 percent due to “strong plant performance.”

The full-year consolidated average realized price for rough diamonds was $137 per carat, down from $171/carat in 2018, primarily due to the company selling more lower-value rough in 2019 and a 6 percent drop in the rough diamond index.

De Beers predicts diamond production will pick up in 2020, with guidance set at 32 million to 34 million carats, due to an improving diamond market and an expected increase in production at the Venetia mine in South Africa, which is transitioning into an underground operation.

Rio Tinto, meanwhile, recorded an 8 percent drop in diamond production to 17.3 million carats compared with 18.4 million in 2018.

Production was down 8 percent at both its mines, Argyle in Western Australia (13 million carats mined in 2019) and Diavik in Canada (4 million carats mined).

The London-based miner said carat production dropped at Argyle due to lower recovered grade, which was partially offset by stronger mining and processing rates.

Lower ore availability and grade from Diavik’s underground operations impacted production there, though the company recovered more and better-quality rough from the mine’s A21 open pit.

Argyle, which is the world’s No. 1 source of red and pink diamonds, is set to close at the end of the year.

Rio Tinto expects diamond production to total 12 million to 14 million carats this year, with the decrease reflective of the planned closure of Argyle and lower grades at Diavik.

The company

The Latest

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

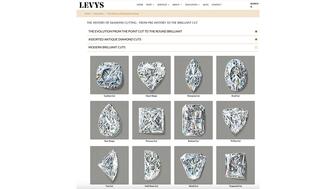

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.