A double-digit drop in the number of in-store crimes was offset by a jump in off-premises attacks, JSA’s 2023 crime report shows.

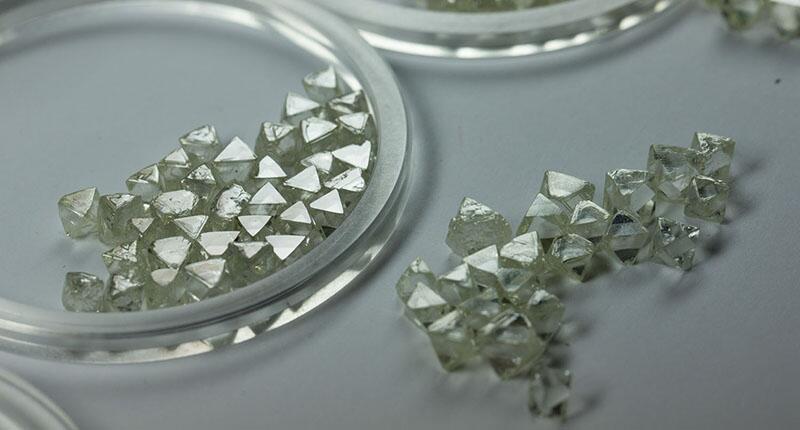

Alrosa Ends Difficult Year With Strong Q4

The miner’s sales were down for the full year, but it is not as bad as it could have been considering sales ground to a halt mid-year due to the pandemic.

Moscow—Sales fell by double digits for Alrosa in 2020, but the company ended the year on an upswing it says has continued into 2021.

The diamond miner reported Thursday that revenue from rough and polished diamond sales totaled $2.8 billion in 2020, down 16 percent year-over-year. But fourth quarter sales rose 33 percent year-over-year to $1.22 billion.

In volume terms, Alrosa’s annual sales totaled 32 million carats, down 4 percent year-over-year but up more than double in the fourth quarter, as the recovery in consumer demand that started in the second half of the year in China and the United States accelerated.

“Many U.S. retailers launched their holiday offers early to ensure a more even distribution of demand and allow for social distancing,” the company said in the release announcing Q4 and full-year results.

“As a result, the Christmas holiday season in the U.S. kicked off with strong online sales as the pandemic pushed consumers to shop online. Another sustainable trend in the retail sector is the steady recovery of sales in mainland China, where travel restrictions make Chinese consumers spend more domestically.”

Jewelers interviewed by National Jeweler in the month of December said the same; consumers were shopping early to avoid the crowds.

And they were spending money that couldn’t be used for travel, dining out and other experiences on jewelry, particularly diamond jewelry.

RELATED CONTENT: Strong Start Has Jewelers Hopeful for the Holidays

In a Jan. 7 webinar hosted by National Jeweler, guests Edahn Golan, Peter Smith and Sherry Smith all commented on diamond jewelry’s strong performance in 2020, which they attributed to it being a low-risk choice in an uncertain time and the pandemic spurring proposals.

“When people feel stressed and anxious and you’ve got all of this uncertainty in your life, you’re going to make safe choices,” Peter Smith said. “Diamonds are a very safe choice. I’m waiting to see the first T-shirt that says, ‘I’ve got too many diamonds.’

“That just doesn’t happen. They just continue to be a safe choice.”

RELATED CONTENT: Watch—Our Webinar on 2021 Predictions

In addition to sales declining, Alrosa’s production also dropped in 2020, falling 23 percent in the fourth quarter to 7.1 million carats and declining 22 percent on the year to 30 million carats total.

Alrosa and the world’s other main diamond supplier, De Beers Group, dialed back production last year to save money as COVID-19 halted

Alrosa started the year with a production goal of 34 million carats but scaled back to 28-31 million carats about halfway through 2020, ultimately ending the year right in the middle of that range.

It also allowed customers additional flexibility—which the miner has extended into 2021—and implemented a “price-over-volume” strategy, which helped stabilize rough diamond prices during the crisis, all in the interest of the sustainability and stability of the diamond industry, Alrosa said.

In the early months of 2021, Alrosa said diamond cutters and polishers are increasing production to 100 percent capacity after having to cut back in 2020 due to COVID-19.

They anticipate stable orders in the first quarter of the year, as diamond dealers and retailers look to replenish inventories following the holiday season and, in China, ahead of the new year on Feb. 12.

The Latest

Inspired by the Roman goddess of love, the designer looked to the sea for her new collection.

The luxury titan posted declining sales, weighed down by Gucci’s poor performance.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The selected nine organizations have outlined their plans for the funds.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

Emmanuel Raheb recommends digging into demographic data, customizing your store’s communications, and retargeting ahead of May 12.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

Located in the town of Queensbury, it features a dedicated bridal section and a Gabriel & Co. store-in-store.

Ruser was known for his figural jewelry with freshwater pearls and for his celebrity clientele.

The “Rebel Heart” campaign embodies rebellion, romance, and sensuality, the brand said.

Editor-in-Chief Michelle Graff shares the standout moments from the education sessions she attended in Austin last week.

The overhaul includes a new logo and enhanced digital marketplace.

The money will go toward supporting ongoing research and aftercare programs for childhood cancer survivors.

A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The move will allow the manufacturing company to offer a more “diverse and comprehensive” range of products.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.