It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Jewelry Business Closures Climb 34% in Q1

A number of different factors are influencing the trend and it’s not expected to reverse course anytime soon.

Warwick, R.I.--The number of companies exiting the jewelry industry continues to climb due to a number of different factors, and the trend is not expected to reverse course anytime soon.

Data released this week by the Jewelers Board of Trade shows that in the United States and Canada, a total of 335 businesses ceased operations in the first quarter 2016, compared with 250 in the first quarter 2015. That’s a 34 percent increase.

Closings among manufacturers drove up the first quarter percentage increase as they more than doubled, from 15 in the first quarter 2015 to 34 this year.

The number of wholesalers ceasing operations rose from 38 to 46, a 21 percent year-over-year increase, while the number of retailers closing climbed from 250 to 255.

“The factors are in place for there to be fewer stores, for that pace to pretty much continue as it is.” --Anthony Capuano, JBT presidentThere also was a jump in the number of consolidations (sales/mergers), which rose from 28 in Q1 2015 to 53 in the first quarter this year, an 89 percent jump.

In an interview with National Jeweler on Monday, former JBT President Dione Kenyon, who will continue with JBT on a part-time basis through the summer, said the same factors that have been contributing to business closings since they began to spike in 2014 continue to do so today.

Among them are the retirement of baby boomer-aged store owners; competition from online sellers; and consumers with less discretionary income and more choices.

Both Kenyon and JBT’s new president, Anthony Capuano, agreed that the trend will continue for the foreseeable future.

Addressing specifically the closing of retail stores, which increased 29 percent in the first quarter, Capuano noted that the aging ownership of the family-owned independent jewelers and the shift to online retailing, “aren’t going to go away overnight.”

“The factors are in place for there to be fewer stores, for that pace to pretty much continue as it is,” he said.

Despite the continually climbing closures, Kenyon pointed out that there are bright spots in the industry, jewelers who have embraced technology and/or began thinking outside the box who are doing well.

There are also certain product categories that appear to have a head of steam among consumers.

According to statistics just released by De Beers, U.S. diamond jewelry sales grew 4 percent year-over-year in

It’s also worth noting that independent jewelers aren’t the only brick-and-mortar retailers closing their doors.

Department store chains, for example, have been forced to shutter hundreds of stores--most recently, Sears announced it would be closing 78 additional locations--and according to The Wall Street Journal, even more are needed.

The WSJ cited a report from Green Street Advisors stating that six of the U.S.’s largest department store chains need to shutter a total of 820 stores among them in order to get back to the same level of profitability they enjoyed a decade ago.

The Latest

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

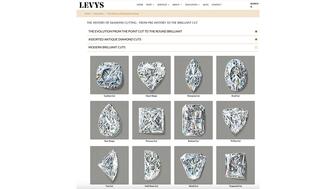

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.

The limited-edition men’s rings can be customized with one of 12 team logos.

There is a willingness to comply with new government-mandated regulations, with an insistence that they should be practical and realistic.

The program, now live in Europe, will roll out to the U.S. this summer.

Colored gemstones and signed jewels are the focus of its upcoming Geneva sale.

Stuart Brown, who was De Beers’ CFO and interim CEO, is now Lucapa’s independent non-executive chairman.

The point-of-sale software can now prompt customers to round up their credit card purchases as a donation to Jewelers for Children.

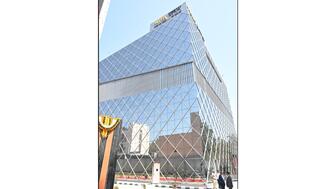

The zone’s modernization will enhance and increase India’s jewelry manufacturing capabilities while aiding small and mid-sized businesses.

Select independent jewelers and retailers can now purchase moissanite through Charles & Colvard Direct.