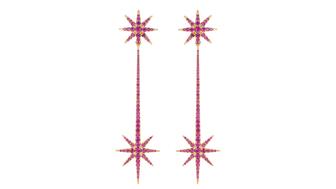

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

What To Expect This Holiday Season, By the Numbers

National Jeweler gleans holiday insight from Coresight Research and a holiday guide published by Google.

New York—The official start of fall is just a week away, which means the holiday season is nearly upon us again.

Coresight Research’s recently released “Holiday 2019: U.S. Retail Outlook Preview” gave a first look at what retailers can expect this year.

The research group estimated U.S. retail sales will see about a 4 percent year-over-year increase during November and December.

Lower gas prices may buoy holiday spending by as much as 50 basis points.

Consumer confidence is expected to remain high, though the study noted it has experienced ups and downs as a result of the U.S.-China trade conflict.

Coresight’s “Holiday 2019: US Shopper Survey,” meanwhile, dived into the shopping experience.

The survey found that six in 10 holiday shoppers were concerned about tariff-related price increases, with a majority saying if prices were to go up, they would buy fewer things, shop at cheaper retailers or buy less expensive products.

More than two-thirds of shoppers will shop both online and in stores this holiday season.

In-store shopping was the top choice for browsing, comparing and brainstorming gift ideas. Shoppers prefer in-store shopping for ease of browsing, the ability to look at a product in person and the overall enjoyment of the experience, according to the survey.

Customers surveyed said they shop online as a way to avoid crowds and save time as well as effort.

Walmart and Amazon are expected to be the most-shopped retailers this season, with Amazon receiving a big boost from its Prime members.

Walmart and Target “stand to lose the most shoppers to Amazon,” the survey said.

In addition to the Coresight surveys, Google published its own holiday guide for retailers, the “Holiday Retail Playbook 2019,” in June.

The guide noted it’s never too early to start planning, with searches for “gifts for” and “gifts from” accelerating in the final week of October.

October to December is the peak time to drive online and offline sales, according to the guide.

Whether a customer is shopping online or in a store, Google found 67 percent of holiday shopping is planned before purchasing.

However, 67 percent of shoppers said there’s still shopping to be done the last week before Christmas, with 86 percent still shopping in the final days before Dec. 25.

“Shopping demand maintains through the holidays and into the new year, so make sure you’re setting flexible and sustainable budgets across your campaigns by examining historical data and layering your account’s current year-on-year trends,” the Google guide advised.

Google

Searches on Google for “store hours” peak on Christmas Eve, the highest day of the year, with 48 percent of shoppers open to buying from new retailers during the holiday season.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

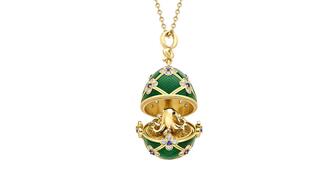

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

In addition, a slate of new officers and trustees were appointed to the board.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.