NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

Live From Las Vegas: Industry’s Level of Optimism ‘Striking’

JCK Events shared highlights from its new State of the Industry Jewelry Report, which found that many in the industry are feeling positive right now.

Las Vegas--If one recent survey is any indication, the industry is feeling pretty optimistic right now.

JCK Events conducted a survey in conjunction with GfK this spring and created a report based on the findings, the 2018 JCK State of the Industry Jewelry Report.

On Friday morning in Las Vegas, Reed Jewelry Group Senior Vice President Yancy Weinrich shared select highlights from the report at a breakfast held before the jewelry trade shows opened for the day.

Performed in February and March, the survey included feedback from 549 respondents. Most of them were retailers, but survey-takers also included manufacturers and wholesalers as well as some jewelry designers.

Weinrich added that 79 percent of the respondents have been in the industry for more than 11 years, meaning they’ve weathered changes before and bring a long-term perspective to the results.

When looking at the results, she said they discovered a “level of optimism about individual business prospects and the overall direction of the general economy that was striking.”

Though the male respondents were slightly more optimistic than the females, the overall sentiment was positive by a margin of two to one.

In fact, Weinrich said the confidence in the industry and future outlook for the general economy far outstrips that of the general public. Forty-six percent of those who took the jewelry survey said the economy was doing better in the last 12 months, which was nearly twice as many as who said the same in the population at large.

Those expecting continued improvement in the next year are slightly fewer than that, but still outnumber the American public by almost 50 percent.

She said the industry is “overwhelmingly positive” about the likely effects of the recent tax overhaul, with only 13 percent concerned it might hurt the economy.

In questions of trade policy, however, there was more caution and concern; more respondents were worried the changes in the policy toward the Asia-Pacific region, in particular, might hurt the economy.

Nevertheless, the industry sentiment, according to the survey, seems to be positive, especially when it comes to respondents’ own businesses.

Coinciding with the release of the survey, JCK Events introduced a number designed to reflect the state of the industry: the 2018 JCK Jewelry Industry Confidence Index, which will be based on the percentage of jewelers who express optimism regarding their stores.

For the first measure of the index, when

“This is a number that we’re eager to watch over the years, testing its resilience and learning about the attitudes of our professionals in the jewelry industry over time,” Weinrich said.

When it comes to the industry’s biggest challenges, the most commonly mentioned were: online competition, overall economic climate, a lack of general consumer demand and a lack of millennial demand.

According to the survey, the top strategy for dealing with these challenges is improving the in-store buying experience, which “shows that retailers particularly believe that buying jewelry is not something that can only migrate to the virtual world,” she said.

Even with the larger number of brick-and-mortar stores closing, many in the industry aren’t behind going all-in on e-commerce, as buying jewelry goes beyond product to also include seeing and feeling pieces in person, becoming educated and being guided by a trusted professional.

The industry also is turning toward non-traditional advertising and social media as ways to drive the consumers into the store.

Eighty-one percent of survey-takers ranked social media marketing as one of their most successful business practices, while 90 percent indicated they plan to increase their efforts in this area, with Facebook and Instagram dominating.

“Social media is obviously seen as a cost-effective front for taking on online competition,” Weinrich said.

The survey also delved into lab-grown diamonds.

Though only one in five respondents reporting selling the stones, those that are in the business reported that sales were good; 62 percent said sales were up in the last year, and 78 percent expect them to increase again in the coming year.

Also among the top trends for survey-takers was the sale of “responsibly sourced jewelry,” with 73 percent reporting that they sell it, and 49 percent reporting sales were up year-over-year in 2017.

“While this may bolster the growth of blockchain in the industry in the immediate future, it also provides a foothold for lab-grown diamonds to leverage going forward,” Weinrich said.

Meanwhile, sales of watches and charms were “visibly down” from 2016 to 2017, with the former being affected by the disruption of smartwatches and wearable tech, while sales of custom pieces were up 59 percent among respondents as the customization trend across all consumer categories picks up.

The full version of the 2018 JCK State of the Industry Jewelry Report can be purchased at JCKLasVegas.com/IndustrySurvey.

The Latest

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

Its updated book for mountings is also now available.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

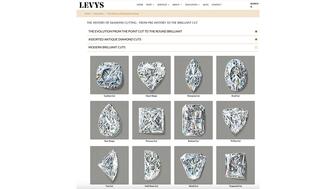

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.

The limited-edition men’s rings can be customized with one of 12 team logos.

There is a willingness to comply with new government-mandated regulations, with an insistence that they should be practical and realistic.

The program, now live in Europe, will roll out to the U.S. this summer.

Colored gemstones and signed jewels are the focus of its upcoming Geneva sale.