A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Why Standard Chartered Shut Down Its Diamond Unit

The mid-stream sector of the diamond industry now “falls outside of the bank’s tightened risk tolerances,” the London-based lender said.

London--Standard Chartered Plc no longer will finance diamond traders and polishers after reevaluating its portfolio and determining there is too much risk for too little return in the sector.

The London-based bank began thoroughly reviewing all of its operations after CEO Bill Winters took over last year, looking to exit businesses generating low returns and/or that are vulnerable to large swings in loan impairment.

The trading and polishing sector of the diamond industry was certainly among those in Winters’ crosshairs, with the spike in defaults and bankruptcies last year--the bank was among those caught up in the massive Winsome Diamonds default--and the increased compliance reporting and regulatory capital costs associated with financing the industry.

In March, the London-based bank began to pull back, tightening its terms for lending to the diamond sector by asking dealers to provide more collateral or take out insurance protection on their loans.

Then, last week, JCKOnline.com broke the news that Standard Chartered would be exiting the diamond sector entirely.

In an official statement, the bank said that continuing to provide financing to diamond traders and polishers “falls outside of the bank’s tightened risk tolerances.”

A Standard Chartered spokesman added that it will still bank the mining and retail segments of the supply chain; its decision impacts only the mid-stream, meaning diamond traders and polishers.

A timeline for Standard’s shutdown of its diamond division has not yet been determined, though the bank said it is “working with clients to ensure a smooth exit.”

Eric Tunis, a partner at New York-based accounting and consulting firm Friedman LLP, said the news that Standard Chartered would no longer bank the diamond sector “wasn’t something that was shocking.”

There have been a number of warning signs, including the tightened lending restrictions and, very recently, the bank’s absence from the Las Vegas trade shows. Tunis said this is the first time he can recall not seeing anyone from Standard Chartered in Vegas.

He said the struggle with profitability among diamond manufacturers leading to loan defaults in the mid-stream, the slim margins banks now make when lending to diamond companies, and the general lack of robustness in the trade right now all make banks averse to financing it.

Friedman Co-Managing Partner Harriet Greenberg said compliance issues also are a factor.

Larger money center banks face hefty fines if it’s found that their clients are involved in money laundering, a practice many perceive to be rampant in the diamond industry.

“There’s a

“A lot of it is perception more than reality,” Greenberg said, noting that her firm’s clients, and many companies in the industry, have diligent quality control procedures in place.

The exit of Standard Chartered set off alarm bells around the industry, which has seen a number of banks pull back, and even pull out, in recent years.

Antwerp Diamond Bank is no more. Parent company KBC wound down its operations in 2014 after it is said it couldn’t find a buyer for the bank, though questions loom about the failed sale.

Dutch bank ABN Amro still lends to the mid-stream sector of the market, though sources in the diamond market say the bank has pulled back in recent years.

When asked to comment on Standard Chartered’s decision, Erik Jens, who heads the ABN Amro’s diamond and jewelry division, said he cannot comment on another bank’s strategy.

He noted, however, that in general banks “make risk adjusted return trade-offs on where to allocate capital. As for the diamond industry, we know that reputation and transparency still plays a role in those trade-offs, although we see the many initiatives of the industry to improve its image by self-regulation as well.

“In our opinion, for strong, corporate structured companies with a healthy balance sheet, a sustainable strategy and business plan and long-term potential and profitability, there is enough liquidity from several banks active in the sector, even attracting newcomers, including investors, in Europe, Asia, the U.S.A. and the Middle East.”

Greenberg said the exit of traditional lenders, like Standard Chartered and ADB before it, opens the door for non-bank players, such as hedge funds, to enter the sector and offer financial services.

“Anytime there’s a void, there’s an opportunity,” she said.

The Latest

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Emily Highet Morgan and Emily Bennett have joined the agency’s team.

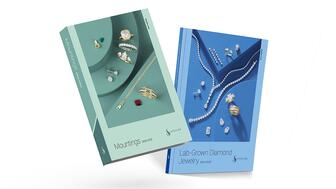

Its updated book for mountings is also now available.

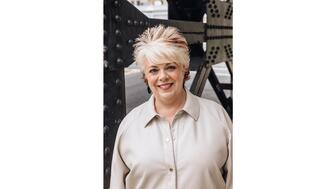

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.