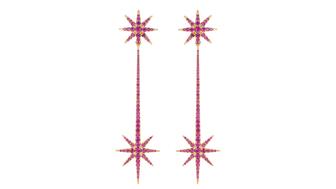

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

These Are the Fastest-Growing Retailers in the US

They top the “Hot 100 Retailers” list, compiled annually by Stores magazine and Kantar Consulting.

Washington—A Dublin, Ireland-based fast fashion company was the fastest-growing retailer in the United States last year, according to the annual list published by Stores magazine.

The “Hot 100 Retailers” ranks both public and privately held companies by percentage of U.S. sales growth between 2016 and 2017. Companies’ sales must total at least $300 million a year to be considered for inclusion.

It is compiled for Stores magazine, the publication of the National Retail Federation, by Kantar Consulting.

Coming in at No. 1 this year was U.K. clothing and accessories retailer Primark, which sells trendy, cheap clothing and accessories (think Forever 21, H&M, Zara, etc.) and opened its first U.S. stores in 2015. According to Kantar/Stores, the retailer’s annual sales grew 103 percent year-over-year to $489 million in 2017.

At No. 2 was Bass Pro Shops (94 percent sales growth to $7.3 billion), followed by home improvement and appliance retailer Build.com (47 percent sales growth to $1.3 billion), list mainstay Amazon.com (45 percent growth to $103 billion) and, at No. 5, online home goods retailer Wayfair (36 percent sales growth to $4.1 billion).

Commenting on the list, Stores Media Editor Susan Reda said strong consumer confidence and high job growth—two of the factors that led the NRF to raise its retail growth forecast for the year—have consumers spending more on home buying, home improvement and travel. This is, in part, why Build.com and Wayfair were in the top five.

The Hot 100 also represents a compendium of the retailers with the best strategies for growth in the omnichannel climate, said Bryan Gildenberg, Kantar’s chief knowledge officer.

“This year, the classic ‘four Ps’ of marketing have become the ‘four Ss’—the Hot 100 use speed, seamlessness, specialization and scale by acquisition as their core platforms of growth,” he said.

Rounding out the top 10 were the following.

6. Handbag retailer Tapestry (owns the Kate Spade, Stuart Weitzman and Coach brands, formerly Coach Inc.), 33 percent sales growth

7. PetSmart, 28 percent sales growth, buoyed by the acquisition of Chewy.com

8. Discount retailer Five Below, 28 percent sales growth

9. Ulta Salon, 28 percent sales growth

10. Pet Retail Brands, 27 percent sales growth

(While some retailers above show the exact same percentage of growth, percentages have been rounded. The rankings are based on exact percentages.)

The list also recognizes what it calls “sustained sizzlers,” retailers that have been on the list each year since it

The entire “Hot 100 Retailers” list was published in the August issue of Stores magazine and is available on the Stores website.

The magazine story analyzing the list is also available on Stores.org.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

Black Friday is still the most popular shopping day over the five-day holiday weekend, as per the National Retail Federation’s survey.

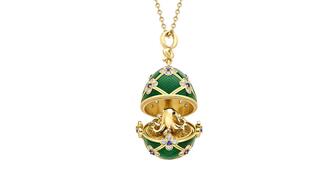

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.

Luxury veteran Alejandro Cuellar has stepped into the role at the Italian fine jewelry brand.