De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Gold Passes $2K Per Ounce as Jewelry Demand Plummets

And the price is likely to keep rising this year.

London—The story of gold jewelry demand and price in the first half of the year is inextricably linked to the COVID-19 pandemic.

As nations across the world enacted lockdown restrictions, primarily during the second quarter, to slow the spread of the coronavirus, demand for both gold and gold jewelry plummeted, the World Gold Council said in its most recent Gold Demand Trends report.

Even as the pandemic severely hampered consumer demand, it also provided an opportunity for investment, with central banks and governments fueling record flows into gold-backed ETFs, lifting the gold price to record highs in several currencies.

As of Friday, the precious metal was trading at $2,034.80 per ounce, according to Kitco.com, a major increase since the start of the year.

In January, the gold price averaged $1,560.67, Kitco charts show.

The gold price continued to rise until mid-March, when it fell to a low of $1,474.25 as governments worldwide began enacting stay-at-home orders.

Then it began its rise again, increasing every month until it passed the $2,000-per-ounce price point in August, reaching its highest point in eight years.

And it doesn’t seem likely it will level out anytime soon, according to some experts.

A few sources have predicted the price of gold could increase to as much as $3,000 per ounce within the next 18 months or even by year’s end.

As the gold price continues its climb, jewelry demand has gone the other way.

According to the World Gold Council, gold jewelry demand was nearly cut in half during the first half of the year, falling 46 percent year-over-year to 572 tons, which it said is the lowest since it started keeping track.

It’s also around half of the 10-year average of 1,106 tons.

In Q2, demand reached a quarterly low of 251 tons, a 53 percent decline year-over-year, as consumers across the world felt the effects of lockdown and the resulting economic slowdown.

In the U.S., demand lost some of the momentum it had gained in recent years, falling 34 percent year-over-year in the second quarter to 19.1 tons, the lowest quarter in WGC’s series.

H1 demand was also down, declining 21 percent to an eight-year low of 41.9 tons.

WGC said store closures due to COVID-19 were the “clear reason” for the decline, made even more severe because the lockdown encompassed two holidays—Easter and Mother’s Day.

Demand “collapsed” in April

While the U.S. experienced a drop-off, China and India were the biggest contributors to the global demand decline in the first half of the year, WGC said. Their size when compared to the rest of the world means weakness there has “an overwhelming impact” on global demand.

Q2 jewelry demand in China fell 33 percent year-over-year to 90.9 tons, resulting in a 52 percent decline year-over-year in the first half of the year to 152.2 tons, its lowest H1 since 2007.

As the earliest market to emerge from lockdown, China was the only one to see a quarter-over-quarter recovery from “extreme Q1 weakness,” WGC said, and a “sizable” rebound in jewelry demand from the first quarter to the second.

Even with the upswing, first-half demand in the country remained “muted,” with retailers attributing the weakness to high gold prices, falling disposable incomes, and a greater preference for lighter-weight gold jewelry products.

Q2 gold jewelry demand in India plunged due to the country’s lockdown, the loss of a festival buying occasion and the higher gold price, declining 74 percent year-over-year to 44 tons, the lowest quarterly total in WGC’s series “by some margin,” it said.

This meant H1 demand was down 60 percent to an all-time low of 117.8 tons.

The country’s lockdown lasted from late March until mid-May, running through the important gold- buying festival of Akshaya Tritiya, with sales “trivial” when compared with the previous year as stores remained closed.

As restrictions eased in the middle of the second quarter, activity picked back up in some regions.

June saw further improvement but a lack of weddings and auspicious holidays in the month, as well as recurring lockdowns and the high gold price, hampered any meaningful recovery.

Gold jewelry demand in Europe also fell to an all-time low.

The second quarter was down 42 percent year-over-year to just 8.2 tons, taking the first-half total down 29 percent to 19 tons.

The Latest

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

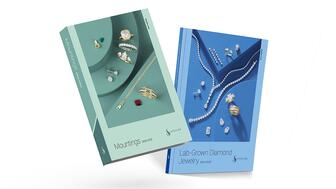

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

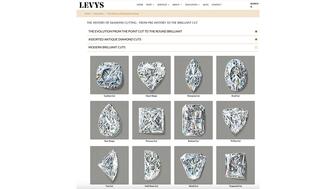

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.