NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

Simon, Brookfield to Acquire JC Penney

The proposed deal would keep 650 locations open and save 70,000 jobs.

Plano, Texas—JC Penney may be saved after all.

Simon Property Group and Brookfield Property Partners are finalizing an $800 million deal to buy the department store chain.

The mall owners will pay $300 million in cash and assume $500 million in debt, according to a statement by Joshua Sussberg of the law firm Kirkland & Ellis, which is representing JC Penney.

The move would allow the retailer to avoid liquidation, said Sussberg.

The deal would keep 650 of its 850 locations open and save 70,000 of its 85,000 jobs.

“We are in a position to do exactly what we set out to do at the very beginning of these cases, and that is preserve 70,000 jobs, a tenant for landlords, a vendor partner and a company that has been around for more than a century,” he said during a hearing last week.

Licensing company Authentic Brands Group may join in on the plan, according to a Business Insider report.

The company has joined forces with Simon and Brookfield before, acquiring Forever 21 earlier this year and Aeropostale in 2016.

When the deal goes through, creditor Wells Fargo has agreed to give JC Penney $2 billion in revolving credit, leaving it with $1 billion in cash.

The retailer filed for Chapter 11 bankruptcy protection in May as it struggled with the effects of the coronavirus pandemic and its mounting debt.

In exchange for forgiving some of its $5 billion in debt, its lenders, including H/2 Capital Partners, will take ownership of some of its stores and distribution centers.

In June, Sussberg valued JC Penney’s real estate portfolio at $1.4 billion when its stores are operating and $704 million when they’re not.

The retailer will seek approval for the deal in early October and expects to emerge from bankruptcy before the holiday season.

The Latest

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

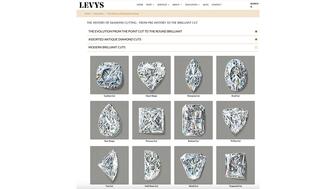

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.

The limited-edition men’s rings can be customized with one of 12 team logos.

There is a willingness to comply with new government-mandated regulations, with an insistence that they should be practical and realistic.

The program, now live in Europe, will roll out to the U.S. this summer.

Colored gemstones and signed jewels are the focus of its upcoming Geneva sale.