Sponsored by the Las Vegas Antique Jewelry and Watch Show

Nirav Modi Case Is ‘Another Nail in the Coffin’

A banker talks about what the billion-dollar bank fraud allegations against Indian diamantaire Nirav Modi mean for the industry as a whole.

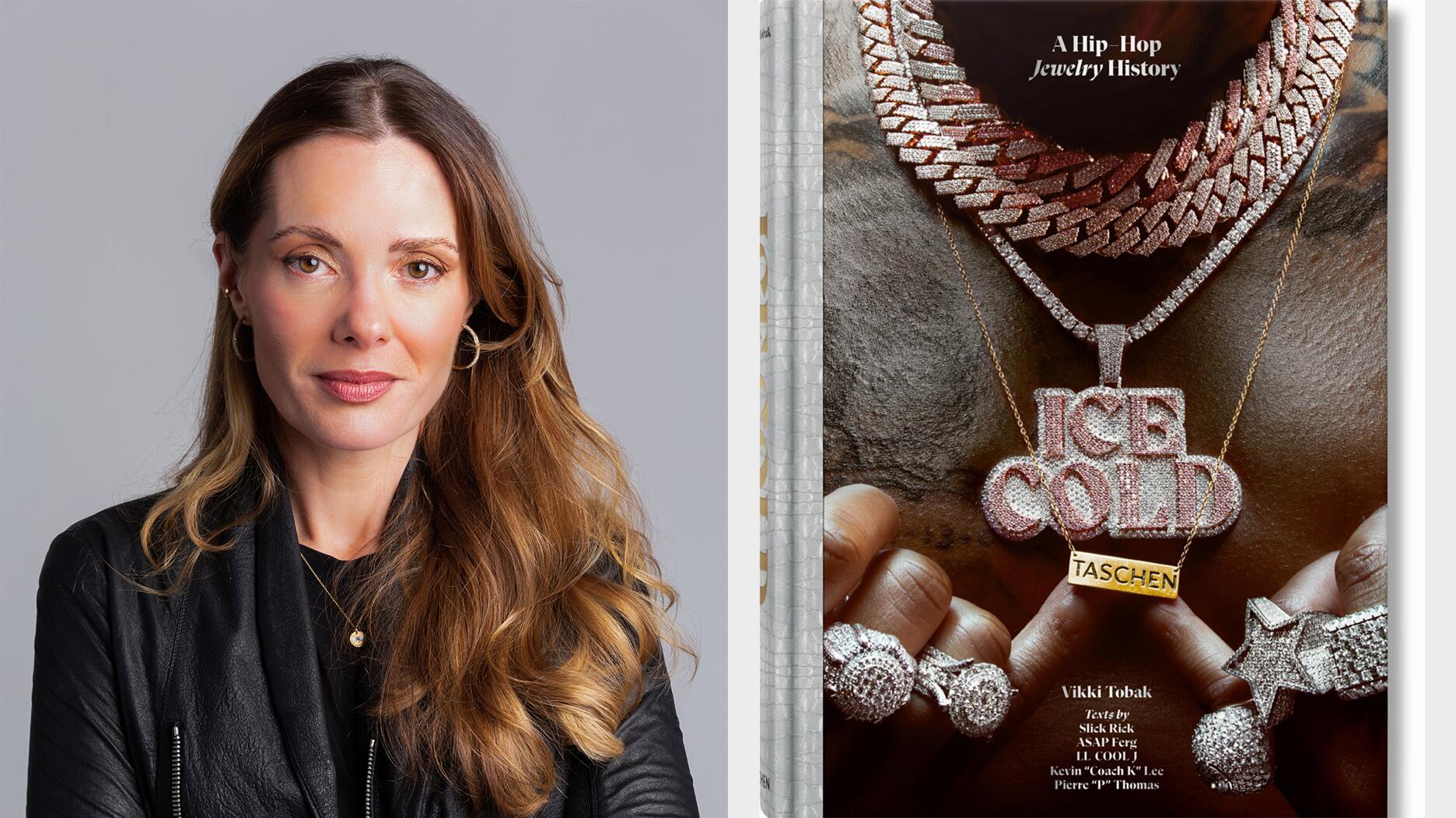

You’ve likely the seen the name Nirav Modi a lot in recent years, perhaps in one of the many stories about him supplying high-profile actresses with amazing pieces to wear on the red carpet, like the earrings Yvonne Strahovski wore to the SAG Awards. He even won an award from Town & Country earlier this year for one of his red carpet looks.

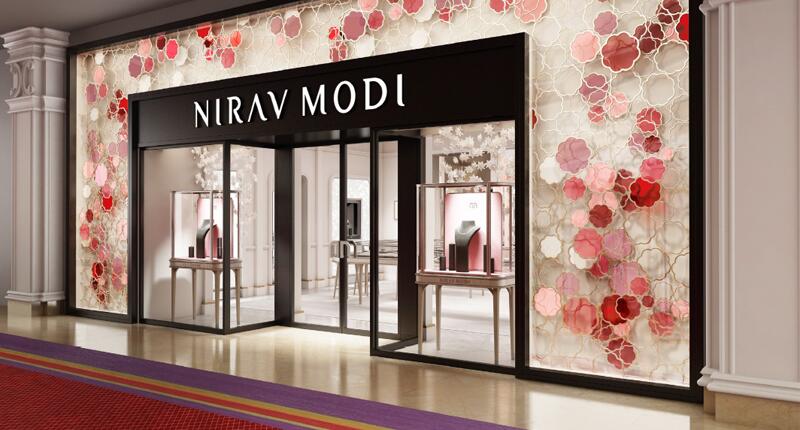

Or maybe it was in one of the stories about the opening of yet another opulent store that bears his name. There has been a Nirav Modi store on Madison Avenue in New York since 2015 but last year, the brand opened two more stores in the same month, one in the Wynn hotel in Las Vegas and the other at the Ala Moana Center in Honolulu.

More recently, however, you might have seen Modi’s name in stories of a very different sort, ones that signal that the billionaire, much like Strahovski’s character in “The Handmaid’s Tale,” could end up living a future very different from the one you might have imagined.

Last week, news broke in India that Modi and his uncle, Gitanjali Managing Director Mehul Choksi, have been accused of colluding with employees of Punjab National Bank to swindle the second-largest state-owned financial institution out of about $1.8 billion.

Here’s the story so far, according to multiple news reports on the scam, which has been making headlines in India and worldwide and has generated hashtags like #FindingNiMo, a portmanteau referencing the ongoing search for the diamantaire, who has left India.

WATCH: The Bank Fraud Case in Five Minutes

On Jan. 29, India’s Central Bureau of Investigation (CBI) registered a case against Modi, his brother Neeshal, and Choksi.

They are accused of colluding with Punjab National Bank employees to have Letters of Understanding, or LoUs, issued to banks in Hong Kong in order to secure massive loans. LoUs are sent from one bank to another and basically say: Please loan this individual or company money for this purpose (in Modi’s case, for buying diamonds) for a specified period of time; we will be responsible for repaying you.

On the surface, there is nothing wrong or illegal about an LoU. What is problematic in this case, however, is that the LoUs were issued by PNB without proper authorization and/or oversight, and more importantly, the money was never used to pay for the diamonds.

Choksi also denied his involvement through a regulatory filing made by Gitanjali, which, it is worth noting, owns Samuels Jewelers in the U.S.

I don’t want to rehash every development in this case, as it’s been widely covered by many media outlets closer to the situation with greater resources and contacts on the ground in India.

What I do want to focus on is what this case means for the diamond industry as a whole in terms of bank financing specifically; in other words, why it matters.

I spent a long time on the phone Thursday with an industry banker (who asked that his name be withheld) and asked him to help me find an apt idiom to describe this situation.

Can we say, to use a well-worn one, that this is “the straw that broke the camel’s back” when it comes to the diamond industry and financing?

No, he told me, because that camel’s already wearing a brace and taking painkillers. “This,” he said, “is just another really bad week for the camel,” or, to employ one more, it’s “just another nail in the coffin.”

“It’s not the end of the world,” he allows. “But it is another stamp, another demerit that says, ‘Just stay away from this thing. Don’t go anywhere near it. It’s not reliable. Why would you want to do business with these people?’”

Consider cases such as M. Fabrikant & Sons, W.B. David & Co. and Winsome Diamonds, and the subsequent withdrawal of banks from the industry, one by one, like gamblers folding in a game of cards: Antwerp Diamond Bank, Bank Leumi and Standard Chartered.

Regulations have only gotten tighter, the industry hasn’t evolved enough to keep up and banks, as I wrote back in June 2016 when analyzing the exit of Standard Chartered, simply see too much risk for too little reward.

“It's no longer a special club for men where you get to make nice to De Beers and you get your box of diamonds and everything stays behind closed doors,” the banker observed.

And yet, here we are.

The latest industry scandal will, presumably, make those few banks that are still financing the diamond industry pipeline even more vigilant and stringent about lending money, while giving those that aren’t involved another reason to stay out of it.

And it’s not going to be something the banks forget about in a year, or even five, my source said.

He said what’s going on in the industry with banks right now is a substantial change, a generational change that’s going to have effects in the short-term, yes, but also will be impacting how the diamond industry does business 30 or 40 years down the road.

“When you put bankers off of an industry, it’s going to take a while, at least a couple of decades,” to get them back on board, he said.

“Somebody has to figure out how to make these companies transparent, truly transparent, how to adopt it and how to test themselves.”

Are Consumers Following This Story?

What about consumer confidence in diamonds and the industry as a whole?

On Thursday morning, I arrived at work to find in my inbox a link to this column by Indian journalist Vinod Kuriyan, the chief editor of GEMKonnect and a highly respected colleague whom I’ve known for years.

Kuriyan linked to an article published that same day by the Times of India that indicates that the scope of the fraud extends beyond bank loans to include diamond companies in Surat setting the jewelry Modi and Choksi sold via their brands in the United Arab Emirates and Hong Kong with low-quality goods and, in some cases, man-made diamonds being sold as natural.

(The article does not say anything about any of the jewelry coming to the United States, and it is also worth noting that this Times of India article quotes an individual who said that there are no machines that can detect lab-grown diamonds once they are set in jewelry, which is incorrect.)

Kuriyan called the development a “knockout punch” as far as consumer confidence goes.

I don’t know if I’d go that far, but it will be interesting to see how this case develops in the coming weeks and months, as Mr. Kuriyan, who certainly understands the situation in India, notes that what started as a case of bank fraud is “snowballing into something much bigger.”

The Latest

M.S. Rau is set to open a seasonal gallery in the high-end resort town early next month.

The branded jewelry market is thriving, said Richemont Chairman Johann Rupert.

Tradeshow risks are real. Get tips to protect yourself before, during and after and gain safety and security awareness for your business.

The six designers, all participants in the show’s Diversity Action Council mentorship program, will exhibit in Salon 634.

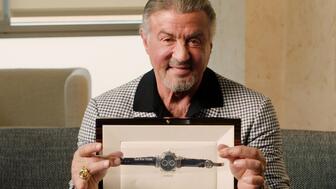

The highlight of his collection is the coveted Patek Philippe Grandmaster Chime, which could sell for up to $5 million.

The “Venetian Link” series modernizes the classic Veneziana box chain in its bracelets and necklaces.

Meet Ben Claus—grand prize winner of For the Love of Jewelers 2023 Fall Design Challenge.

The Seymour & Evelyn Holtzman Bench Scholarship will provide tuition assistance to two low-income students.

The Swiss watchmaker said the company’s plans to use a new version of the Hallmark crown on jewelry would confuse consumers.

The executive talked about the importance of self-purchasers and how fuel cell electric vehicles are going to fuel demand for platinum.

The Indian jeweler’s new store in Naperville, Illinois marks its 350th location, part of its ongoing global expansion plans.

It will award a graduating high school student with about $10,000 toward a GIA diploma and an internship with the Seattle-based jeweler.

Wheat Ridge, Colorado police took a 50-year-old man into custody Wednesday following a two-month search.

PGI partnered with four new and seven returning designers for its annual platinum capsule collection.

Nicolosi, president and CEO of The Kingswood Company, previously sat on WJA’s board from 2011 to 2018.

Karina Brez’s race-ready piece is a sophisticated nod to the horse-rider relationship.

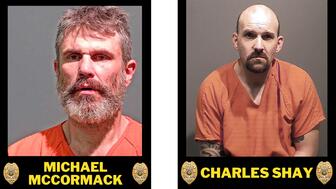

The men are allegedly responsible for stealing millions in jewelry and other valuables in 43 burglaries in 25 towns across Massachusetts.

“Horizon” invites individuals to explore the limitless possibilities that lie ahead, said the brand.

The jeweler credits its recent “Be Love” campaign and ongoing brand revamp for its 17 percent jump in sales.

The co-founder of Lewis Jewelers was also the longtime mayor of the city of Moore.

Elvis Presley gifted this circa 1967 gold and diamond watch to Dodie Marshall, his co-star in “Easy Come, Easy Go.”

Concerns about rising prices, politics, and global conflicts continue to dampen consumer outlook.

May’s birthstone is beloved for its rich green hue and its versatility.

Jacqui Larsson joins Opsydia with nearly two decades of experience in the industry.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.