“Fancy Studs” will feature revamped branding and a new lab-grown diamond fine jewelry collection.

SEC Pulls the Plug on Diamond-Related Cryptocurrency Scam

A Florida cryptocurrency company allegedly took more than $30 million from investors, promising big returns by reselling fancy colored diamonds.

Washington, D.C.—The U.S. Securities and Exchange Commission has put the brakes on an alleged diamond-related cryptocurrency scam, the regulator announced Tuesday.

The U.S. District Court for the Southern District of Florida granted the SEC’s request for an emergency court order halting an alleged Ponzi scheme that took in than $30 million from over 300 investors in the United States and Canada, promising big returns by reselling diamonds.

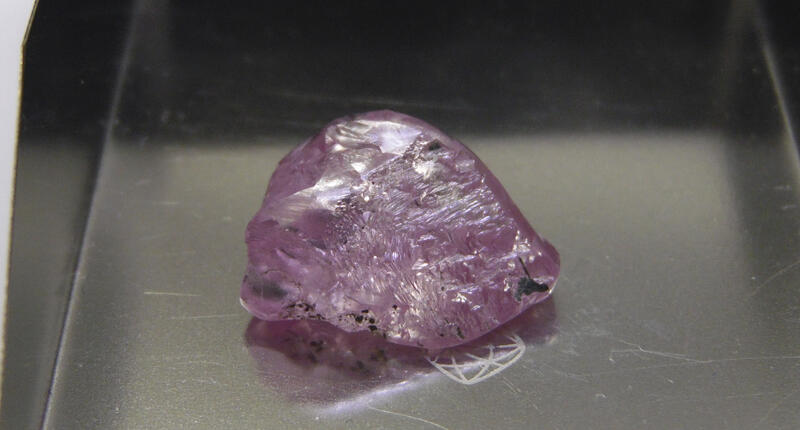

According to the SEC complaint, Jose Angel Aman of Argyle Coin, a Florida-based cryptocurrency company, and his partners, Harold Seigel and Jonathan H. Seigel (who are father and son), told investors that investing in their cryptocurrency company was risk-free because it was backed by fancy colored diamonds.

Aman’s LinkedIn profile states that he has worked in the fancy colored diamond industry for more than 25 years and attended the American Institute of Diamond Cutting.

Aman is also allegedly the owner of Diamante Atelier, a jewelry store on Worth Street, an exclusive block in Palm Beach, Florida featuring high-end stores like Gucci and Hublot.

A storefront for Diamante Atelier, which shares an address with Argyle Coin, is not visible on Google Maps. The website for the store is disabled and a call placed Tuesday did not go through.

The SEC claims that instead of using investor funds to develop the business, Aman and Jonathan H. Siegel misappropriated more than $10 million. Aman, the complaint alleges, used some of the money for personal expenses, including rent on his home and horseback-riding lessons for his son.

The remainder of the investor funds were used to pay “purported returns” to investors in Aman’s other companies, which allegedly were operating similar schemes.

Argyle Coin is just one piece of the puzzle, according to the complaint, which states that Aman and Seigel were involved in “operating a multi-layer Ponzi scheme,” offering unregistered securities through two other companies.

From May 2014 through December 2018, Aman operated Natural Diamonds Investment Co., in which Jonathan H. and Harold, who is host of a weekly Canadian radio show called “The World Financial Report,” had an interest.

Similar to the Argyle Coin pitch, the companies told investors that it would invest in rough fancy colored diamonds, cut and polish them and then sell them for a profit, according to the complaint.

Investors were told the initial return would be 24 percent and full return of the principal would be realized within two years, according to court documents.

When funds were running low

A search of Florida state’s Division of Corporation website also shows “Jose A Aman” as the officer of Falcon Financial Diamond Group Inc., Fancy Diamonds Private Investments LLC, H. Seigel Fine Auctions Inc., and Natural Diamonds Investment Co., though these were not listed in the SEC complaint.

“As alleged, Aman operated a complicated web of fraudulent companies in an effort to continually loot retail investors and perpetuate the Ponzi schemes as well as divert money to himself,” Eric I. Bustillo, director of the SEC’s Miami Regional Office, said in a statement.

Argyle Coin did not have diamonds to back up investors’ money, according to court documents. Aman allegedly pawned dozens of diamonds and pocketed proceeds of more than $750,000.

Natural Diamonds, Eagle, Argyle Coin, Aman and the Seigels have been charged with violations of the securities registration provisions.

Aman and his companies are facing an additional charge of violating the anti-fraud provisions of the federal securities laws.

The SEC is seeking to levy financial penalties as well as repayment of “ill-gotten gains and prejudgment interest”.

The accounts of Natural Diamonds, Eagle and Argyle Coin had a combined negative balance of about $120,000 as of March 31, as per court documents.

The SEC has been cracking down on fraudulent cryptocurrency companies, looking to protect consumers as the process of codifying regulations drags on.

“As with any other type of potential investment, if a promoter guarantees returns, if an opportunity sounds too good to be true, or if you are pressured to act quickly, please exercise extreme caution and be aware of the risk that your investment may be lost,” cautioned SEC Chairman Jay Clayton in the regulator’s formal statement on cryptocurrency.

The SEC isn’t the first to accuse to Aman and his associates of fraud.

A case was filed in the Palm Beach County Circuit Court earlier this month by investors Don and Ann Geddes.

Harold Seigel advised the couple to invest $200,000 in a 50-carat parcel of pink rough diamonds said to be owned by Eagle Financial, estimated to be worth $8.5 million, according to court documents.

The Geddes were allegedly told that their investment was guaranteed by International Insurance NV, an off-shore company based in Curacao.

When it was time for the Geddes to get their money, Seigel reportedly convinced them to invest their return into Argyle Coin.

“Harold Seigel and Argyle Coin represented that the Geddes would receive ‘argyle coins’ with a value of $10 per coin when they knew that the argyle coins had zero value and/or did not exist,” court documents state.

There are a number of similar lawsuits filed in Palm Beach County Circuit Court, including a suit filed by the Rounds, longtime listeners of Seigel’s show who once trusted his counsel but are now suing for the return of about $2 million, the Palm Beach Daily News reports.

In a statement emailed to National Jeweler, attorney Kevin O’Reilly, who is representing Aman and the Seigels, said: “Jose Aman, Natural and Eagle have been cooperating with the corporate monitor appointed in the Rounds case. Further, they intend to fully cooperate with the SEC to get this matter resolved amicably.”

The Florida Office of Financial Regulation will be assisting the SEC with this case, spokesperson Jamie Mongiovi said.

The Latest

Nivoda and Liquid Diamonds both have big plans for the new capital.

The 2024-2025 edition features new colors and styles, as well as storytelling elements.

GIA®’s most advanced microscope has new features to optimize greater precision and comfort.

From moringa to ecotourism in the Okavango Delta, the country and its leaders are exploring how Botswana can diversify its economy.

The mining giant also wants to offload its platinum business as part of an overhaul designed to “unlock significant value.”

The announcement coincided with its full-year results, with growth driven by its jewelry brands.

Despite the rising prices, consumers continue to seek out the precious metal.

Looking ahead, the retailer said it sees “enormous potential” in Roberto Coin’s ability to boost its branded jewelry business.

Jewelry trade show veterans share strategies for engaging buyers, managing your time effectively, and packing the right shoes.

This little guy’s name is Ricky and he just sold for more than $200,000 at Sotheby’s Geneva jewelry auction.

Though its website has been down for a week, Christie’s proceeded with its jewelry and watch auctions on May 13-14, bringing in nearly $80 million.

Despite the absence of “The Allnatt,” Sotheby’s Geneva jewelry auction totaled $34 million, with 90 percent of lots sold.

Lilian Raji gives advice to designers on how to make the most of great publicity opportunities.

The mining company wants to divest its 70 percent holding in the Mothae Diamond Mine in an effort to streamline its portfolio.

Why do so many jewelers keep lines that are not selling? Peter Smith thinks the answer lies in these two behavioral principles.

The “Argyle Phoenix” sold for more than $4 million at the auction house’s second jewels sale.

The annual list recognizes young professionals making an impact in jewelry retail.

Owner David Mann is heading into retirement.

While overall sales were sluggish, the retailer said its non-bridal fine jewelry was a popular choice for Valentine’s Day.

Christie's is selling one of the diamonds, moving forward with its Geneva jewelry auction despite the cyberattack that took down its website.

The ad aims to position platinum jewelry as ideal for everyday wear.

Retailers can customize and print the appraisal brochures from their store.

The move follows a price-drop test run in Q4 and comes with the addition of a “quality assurance card” from GIA for some loose diamonds.

The site has been down since Thursday evening, just ahead of its spring auctions.

The late former U.S. Secretary’s collection went for quadruple the sale’s pre-sale estimate.

Three fifth graders’ winning designs were turned into custom jewelry pieces in time for Mother’s Day.