The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

Demographic drop-off

Editor-in-Chief Michelle Graff looks at the reasons why people are getting out of, and not getting into, the jewelry industry.

A few weeks ago, we published a story on the latest quarterly statistics from the Jewelers Board of Trade, which showed that the size of the jewelry industry is continuing to contract, meaning more people are getting out of this business than are getting into it.

The reasons for the industry shrinkage are varied and, though they have been well documented up to this point, after I wrote my most recent JBT story, I began reaching out to retailers and others in the industry to get their perspective. What do they think is the No. 1 factor, or factors, contributing to jewelers closing?

As it turned out, very few could narrow it down to just one thing, but one answer that came up in nearly every reply was this: simple demographics.

The baby boomers, which are the second-largest generation in the U.S., second only to their millennial children, have been running the country’s jewelry stores—and essentially its jewelry industry—for years, but guess what’s happening to them? The same thing that happens to everyone: they are getting old and they want to retire.

I can’t say I blame them.

Retail has changed completely in recent years and in order to keep up in this digital age, jewelers have to figure out new ways of reaching customers and stock different kinds of product—some of which might not be the fine jewelry they are used to—all while fending off online competition and keeping up with the expectations of an increasingly demanding, but not necessarily spendthrift, consumer.

If you were in your mid-50s or 60s and staring down the last five or 10 years of a long career, would you be willing to put in the time and energy to completely change your business if you had the means, or enough of the means, to retire? I wouldn’t.

Some might say the problem is that jewelers are unable to adapt to retailing in the digital age, but I don’t think that’s always the case. I think in some cases it’s more a matter of willingness. Why change

As Dennis Petimezas, owner of Watchmakers Diamonds and Jewelry in Johnstown, Pa., put it, “If you’re 75 to 80 percent of where you need to be to successfully retire, why take the risk? ... Can a mature independent afford to make a mistake at this point and have to work even longer to then try and correct it?”

I think it’s more logical to just take the money you can get out of your business now and retire. Or, if you still need the money and/or just aren’t ready to spend all day on the golf course, do something still jewelry-oriented but perhaps a little (or a lot) less stressful than being a small business owner.

Another factor contributing to the shrinking industry is the decreasing number of young people stepping into the family business.

There are some who say the younger generation is not willing to put in the time it takes to run a small retail store, but I don’t agree with that blanket statement any more that I agree with the assertion that older jewelers are retiring simply because they can’t figure out Facebook.

The majority of companies today are running lean, with one employee shouldering a workload that once was handled by two or even three people. Staff are working long hours no matter what the profession, made longer by the fact that people are on email nearly 24 hours a day.

I don’t think it’s a matter of young people not being willing to work; I think, in many cases, it’s just a matter of them picking different career paths, working for companies that are much younger and, by extension, seem hipper and cooler.

Jewelry isn’t the only industry with this problem.

Over the summer, Fortune magazine did a video interview with GE CEO Jeff Immelt.

Immelt told the interviewer that luring young talent away from Facebook, Google and startups and to GE is one of the issues that keeps him up at night, and this concern is evident in GE’s current advertising campaign featuring Owen, a new, young programmer/developer at GE.

Have you seen these commercials? There are a couple different versions (one of which you can view below) but the message in each is clear: Young people, come work at GE. The work you’ll be doing here will transform the way the world works.

Jewelry does not have its own Owen, but that does not mean the industry’s organizations are ignorant of the need to attract young talent.

The Diamond Council of America, MJSA, the Independent Jewelers Organization, the American Gem Society, the International Colored Gemstone Association and U.S. Antique Shows, which just crowned its first “Antique Young Gun” this past weekend, all are working to pique the next generation’s interest in jewelry. Our associate editor, Brecken, profiled their efforts in our last digital magazine.

It’s not a BBDO-created national advertising campaign on the same scale as GE’s Owen. But, it is a step in the right direction, and it addresses one of the problems impacting the incredible shrinking jewelry industry.

The Latest

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

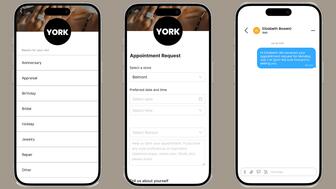

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

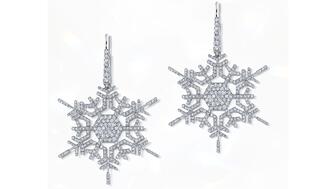

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

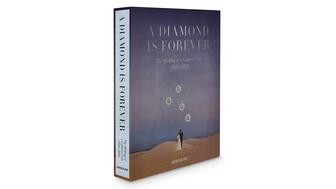

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.