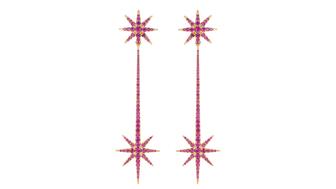

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

The Reaction to ‘Future of Retail’ Article

Peter Smith answers some of the most common questions he received from jewelers following the publication of his widely read two-part column, “What Will Become of Retail Jewelry Stores?”

An article I wrote that appeared on National Jeweler on April 12, “What Will Become of Retail Jewelry Stores?” seems to have been read by the entire industry. The number of page views on National Jeweler and comments/shares and likes on Facebook, LinkedIn and Twitter were, to say the least, overwhelming. The piece clearly struck a chord and, unfortunately, the reports of jewelry store closings seems to have accelerated in the month or so since the article was published.

I am always pleased to hear from retailers after an article posts and, without exception, I make a point to respond to them directly. However, the response to the future of retail article was so overwhelming, from all parts of the industry and from all over the world, that it rendered impossible my normal practice of responding to everyone individually.

To that end, I wanted to follow up to try to speak to the questions that came up continually in the many responses I received from retailers and also to address the questions, asked directly and inferred, about what my company, Vibhor, is doing to help.

Why did I write about that particular topic?

I was coming off a couple of trade shows and I had been involved in dozens of conversations with retailers. There was something very different about many of those conversations as opposed to years past; a deeply-rooted uncertainty about where the industry was headed and what the future held for independent retailers. The resonant themes that kept coming up included the challenges of getting millennials into stores, the changing dynamics of marketing the stores, the difficulty of getting margins in today’s environment, and the lack of interest from many of the younger generation in coming into the business. It wasn’t my intent to presume to answer many of the key questions related to those and other topics but to speak to them in a way that might get the discussion going in retail stores and around the dinner tables.

But, wait, those issues are not new …

When those issues came up in the past they tended to be more topic specific. The tone of the conversations of late appears to be much more philosophical as in, “where do I go from here?” None of us is blind to the rapid rate of retail stores going out of business and that is clearly fueling the collective angst.

I’m convinced that the contraction we are seeing will enable the very best retail stores to become even stronger. They’ll capture more market-share as more and more stores close and they’ll be rewarded for the great experiences they deliver to their customers. Those experiences, by the way, are more consistent with what happens at Apple, at Zara, with Uber etc., quick, clean and efficient; not the old model of keeping customers in the store for an age in the hope that we can product-dump them into submission.

What about those retailers who don’t change or can’t figure it out?

The contraction seems to have accelerated in the weeks since the article appeared. We are clearly in the midst of a profound change and whatever model emerges in the coming years will likely be more nimble, more relevant and with far fewer players.

To what extent have the brands and wholesalers/brands contributed to the decline?

The changes that are taking place are coming from all quarters and there’s plenty of blame to go around. That said, the marketplace and consumer behavior has clearly changed over the last decade and that, for me, is the single biggest factor. Demographics have changed, the Internet has changed how we consume advertising, DVR has enabled us to skip commercials and content providers like Netflix, YouTube, Hulu, etc. have given consumers more control over what they will watch and when. Young people just don’t watch TV the way we did and, as a result, they are much more difficult to reach.

As for the brands and wholesalers, there’s no doubt that not nearly enough of them concern themselves with sell-through when they make demands of the retailers. Asking a retailer to buy three dollars against a return of one dollar, when the brand is not working, is just asinine. The illogic of throwing more money at something that’s not delivering is a head-scratcher and yet it happens every day.

At the same time, from the brands’/wholesalers’ perspective, the idea that a retailer would sell out of fast-selling products and not replenish at all, or only at trade shows once or twice a year, is just senseless. And the fact that the supplier makes it, delivers it, is often asked to finance it and then gets the rap when the retailer doesn’t sell it is hardly fair. There has to be better balance on both sides.

You are president of a wholesale company. What is Vibhor doing to help the retailers?

We are very fortunate in that we control our own manufacturing here in the United States. That gives us the flexibility to be much more responsive with both fast delivery and custom designs. Both of those elements are hugely important in today’s environment as the customer doesn’t want to wait six weeks anymore, that’s just not the world in which we live.

We are also a provider of private label, which gives the retailer the opportunity for differentiation, as they’ve got their own name on a high-quality product that really can’t be shopped. When you add into that equation that we deliver healthy margins, an opportunity for the retailer to earn a one-for-one rebalance on non-performing inventory, and we go into the stores and train their teams on what it is and why they should care, that’s a pretty strong turn-key story.

We do the whole package, from manufacturing to displays to training. The biggest challenge, quite frankly, is the abundance of what I’ll call “yesterday’s mistakes.” If a retailer is sitting on inventory that just didn’t work, it is a real dilemma to embrace a new initiative, and yet that’s precisely what needs to happen. Fixing today’s need for a great story that is relevant and healthy for the business should not be put off because of an aged inventory situation. Embrace the former while aggressively and simultaneously working through the latter.

Who is the ideal retailer for what Vibhor does?

A retailer who believes their customer wants quality. It doesn’t really matter whether the retailer is a heavily branded store or one with few brands, the central question is whether he wants to differentiate himself with a quality product that is made here in the U.S. We’ve all heard the expression, “take the high road, it’s less crowded up there.” That’s the Vibhor retailer.

You suggested that retailers should have fewer vendors. Doesn’t that work against your own interests?

Most retailers have far too many vendors. The more you have, the less your customer sees and the more challenging it is to tell a coherent story. I am a firm believer in having a few important relationships and doing it right. That enables the retailer to speak to their target customers with much more clarity and it would certainly help alleviate the horrendous inventory mess that many retailers have to contend with. As for Vibhor, when you have a great product with healthy margins, inventory management, differentiation and training, we ought to be in the conversation no matter how narrow the retailer wants to get with his vendor base. I like our chances in a world where the retailers expects much, much more from their vendors.

Do you see the contraction continuing at the wholesale level too?

Yes, without question. First of all, if there are fewer retail doors it stands to reason that they can feed fewer wholesale mouths. Secondly, and perhaps more importantly, the days of schlepping product onto retailers are over. Wholesalers and brands had better know the jeweler’s business as well as the retailer themselves and provide real value beyond just selling product or giving terms. There will be a place for those companies that have a strong commitment to an integrated partnership that delivers mutually beneficial results. The days of one-sided wins, on the retail or on the wholesale side of things, are fast coming to a close. The relationship must be healthy for both parties and built on actions, not words or empty promises.

Vibhor was known as a maker of die-struck bands. What have you changed since you became president last year?

The biggest change was evolving the story to concentrate on core diamond essentials. That means the kind of diamond product that sells every day, from bands (for every occasion) to pendants, earrings and bracelets. We specifically did not want to be in the center-stone business, a very crowded and not very enticing place to be. The foundation of excellent manufacturing and fantastic service was already there when I joined Vibhor so we had a great base from which to grow. We considered the entire process from beginning to end and we set about challenging every aspect of what we do to deliver a better end product and a better all-around experience for our customers.

When you say a better end-product, are you referring to the quality of your jewelry?

The product was a part of it for sure. For instance, we shifted from 14 karat and 18 karat to all 18 karat and platinum. We eliminated nickel in our 18 karat and shifted to a palladium alloy. We also established a baseline for our diamond quality, so that our customers would have no doubt about where we stood. But what we really did was to define who we wanted to be and how we could make the entire process better for our customers. Of course that meant clearly establishing quality parameters all across our existing and new product developments, but it also meant improvements in our displays, in our pricing and margins, in our website, in our training, in our warranty and in our commitment to helping our retailers manage non-performing inventory.

You asked the question in your article, “What do you want to be when you grow up?” What’s your answer?

We talk about that at Vibhor all the time and I can honestly say that we are committed to becoming one of the most respected and relevant wholesale partners in our industry. We have a passion for what we do and we are all in when it comes delivering a great experience for our retailers. We start every conversation about every aspect of our business with, “How will this help the retailer?” If we agree that implementing a new initiative will ultimately be good for our partners, we will embrace it completely. If we are not convinced that it will make a difference, we move on. It’s a great place to be.

Peter Smith, author of Hiring Squirrels: 12 Essential Interview Questions to Uncover Great Retail Sales Talent, has spent more than 30 years building sales teams at retail and at wholesale. He currently is president of Vibhor Gems. Email him at peter@vibhorgems.com, dublinsmith@yahoo.com or reach him on LinkedIn.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

Black Friday is still the most popular shopping day over the five-day holiday weekend, as per the National Retail Federation’s survey.

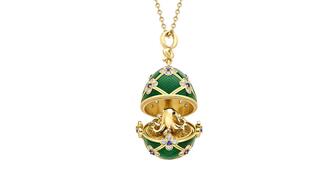

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

In addition, a slate of new officers and trustees were appointed to the board.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.

Luxury veteran Alejandro Cuellar has stepped into the role at the Italian fine jewelry brand.