Associate Editor Natalie Francisco highlights her favorite jewelry moments from the Golden Globes, and they are (mostly) white hot.

JA Joins Group Arguing for Online Sales Tax Reform

Jewelers of America is one of 10 retail trade associations urging the U.S. Supreme Court to reconsider its 25-year-old ruling on sales tax collection.

Washington--Jewelers of America joined a group of 10 retail trade associations in urging the U.S. Supreme Court to reconsider Quill, the 1992 ruling that prevents states from collecting sales tax from online sellers that don’t have a physical presence in the state.

Filed Thursday, the 22-page amicus (friend-of-the-court) brief supports South Dakota’s just-filed petition to the court to reconsider Quill.

In it, the associations emphasize the negative impact they say “showrooming”--when consumers visit a store to touch, see and feel a product and learn about it from the sales staff but ultimately buy it online--has had on local sellers and retail centers in towns and cities across the country.

JA provided showrooming stories from jewelers for the brief, which began with this comment from a jeweler in Pittsburgh: “I am fine competing with online sellers, but I don’t like to see them start with a 7 percent price advantage,” he said, a reference to the total amount of sales tax he must collect.

A Beaumont, Texas jeweler who said that when a customer shops “his/her phone is out,” and that customer is using specific make and model information to research prices online.

And another Pennsylvania retailer included in the brief, a jeweler in the town of Mount Joy, said customers often ask the store to “cover” the tax for them.

This jeweler also noted that brick-and-mortar retailers do not have the option of simply curtailing their level of service for showrooming customers because they’d “get a bad view on Yelp!”

South Dakota Attorney General Marty Jackley petitioned the U.S. Supreme Court to reconsider Quill in early October, after the state Supreme Court shot down a bill passed by state legislators requiring companies that make more than $100,000 in sales or have more than 200 transactions per calendar year in South Dakota to remit sales tax whether they have a physical presence in the state or not.

It was a deliberate move by lawmakers in that state to get the issue of online sales tax in front of the highest court in the land.

The Marketplace Fairness Coalition spearheaded the filing of the amicus brief. Joining JA in supporting it were: the American Lighting Association, American Supply Association, American Veterinary Medical Association, Auto Care Association, Home Furnishings Association, National Association of Electrical Distributors, National Association of College Stores, National Ski and Snowboard Retailers Association and National Sporting Goods Association.

In addition, the National Retail Federation

Commenting on the case, JA President and CEO David J. Bonaparte said: “We are hopeful the court will take up the South Dakota case and recognize that Quill does not reflect the retail landscape that exists today,” he said.

The U.S. Supreme Court’s current term began Oct. 2 and runs through June 2018. The last day of oral arguments is April 25, 2018, meaning the court has about six months to take up the case.

The Latest

Yantzer is remembered for the profound influence he had on diamond cut grading as well as his contagious smile and quick wit.

The store closures are part of the retailer’s “Bold New Chapter” turnaround plan.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Through EventGuard, the company will offer event liability and cancellation insurance, including wedding coverage.

Chris Blakeslee has experience at Athleta and Alo Yoga. Kendra Scott will remain on board as executive chair and chief visionary officer.

The credit card companies’ surveys examined where consumers shopped, what they bought, and what they valued this holiday season.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Kimberly Miller has been promoted to the role.

The “Serenity” charm set with 13 opals is a modern amulet offering protection, guidance, and intention, the brand said.

“Bridgerton” actresses Hannah Dodd and Claudia Jessie star in the brand’s “Rules to Love By” campaign.

Founded by jeweler and sculptor Ana Khouri, the brand is “expanding the boundaries of what high jewelry can be.”

The jewelry manufacturer and supplier is going with a fiery shade it says symbolizes power and transformation.

The singer-songwriter will make her debut as the French luxury brand’s new ambassador in a campaign for its “Coco Crush” jewelry line.

The nonprofit’s new president and CEO, Annie Doresca, also began her role this month.

As the shopping mall model evolves and online retail grows, Smith shares his predictions for the future of physical stores.

The trade show is slated for Jan. 31-Feb. 2 at The Lighthouse in New York City's Chelsea neighborhood.

January’s birthstone comes in a rainbow of colors, from the traditional red to orange, purple, and green.

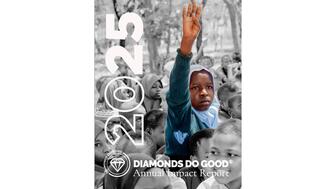

The annual report highlights how it supported communities in areas where natural diamonds are mined, crafted, and sold.

Footage of a fight breaking out in the NYC Diamond District was viewed millions of times on Instagram and Facebook.

The supplier has a curated list of must-have tools for jewelers doing in-house custom work this year.

The Signet Jewelers-owned store, which turned 100 last year, calls its new concept stores “The Edit.”

Linda Coutu is rejoining the precious metals provider as its director of sales.

The governing board welcomed two new members, Claire Scragg and Susan Eisen.

Sparkle with festive diamond jewelry as we celebrate the beginning of 2026.

The master jeweler, Olympian, former senator, and Korean War veteran founded the brand Nighthorse Jewelry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.