It is located in Marin County, California.

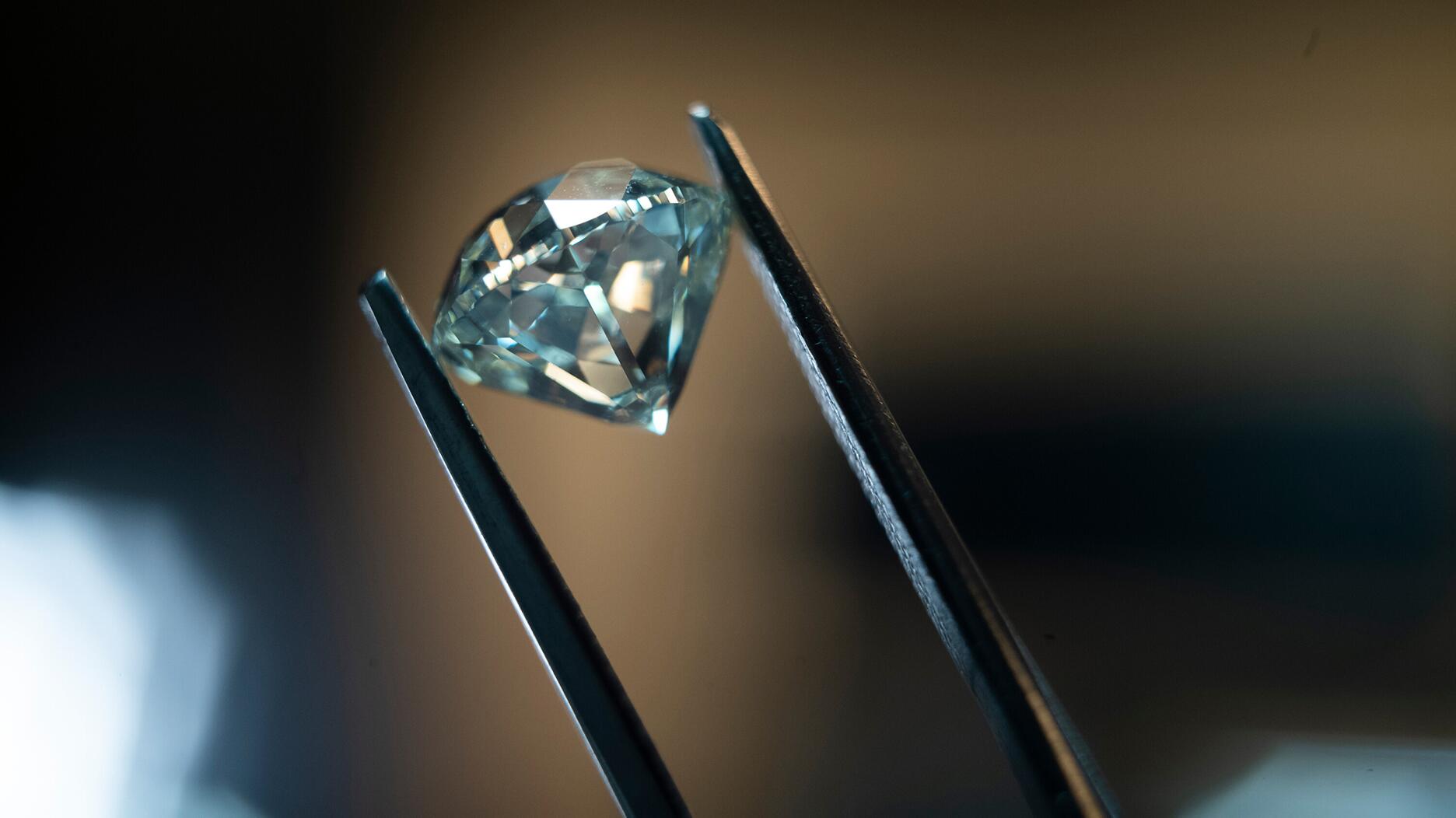

Sales, Production Slump for Miner Gem Diamonds in H1

Highlights of the first half included the recovery of a 442-carat diamond, its largest find of the year.

“Letšeng delivered satisfactory operational results notwithstanding the imposed shutdown of 30 days during the period to curb the spread of COVID-19,” said CEO Clifford Elphick.

The value of its diamonds in H1 was essentially flat year-over-year, selling for an average of $1,707 per carat compared with $1,697 per carat last year.

But then the pandemic hit, shutting down diamond mining and manufacturing operations worldwide, dampening prices, and bringing retail, and consumers, to a standstill.

Production was down 24 percent to 43.3 million, as the miner was forced to put Letšeng on care and maintenance from March 28 to April 26.

The Latest

Concerns about rising prices, politics, and global conflicts continue to dampen consumer outlook.

May’s birthstone is beloved for its rich green hue and its versatility.

Meet Ben Claus—grand prize winner of For the Love of Jewelers 2023 Fall Design Challenge.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The “Tiffany Céleste” collection reimagines designer Jean Schlumberger’s interpretations of the universe.

The brand also created a 100-carat lab-grown diamond necklace in honor of its centennial.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

Tim Schlick has been promoted from his previous position as COO.

It’s the second year for the event, slated to take place in October in Toronto.

Supplier Spotlight Sponsored by GIA

“SIS x MISA Denim and Diamonds” is a collaboration between the designer and celebrity stylist Misa Hylton.

The retailer is moving to a newly designed space in the same shopping center.

Gifts that are unique and thoughtful are top of mind this year, according to the annual survey.

The necklace is featured in the brand’s “Rebel Heart” campaign starring Adam Levine and Behati Prinsloo.

The two organizations will host a joint event, “Converge,” in September 2025.

Big changes appear to be on the horizon for the diamond miner and its parent company, Anglo American.

Padis succeeds Lisa Bridge, marking the first time the organization has had two women board presidents in a row.

Jesse Cole, founder of Fans First Entertainment, shared the “five Es” of building a fan base during his AGS Conclave keynote.

The Royal Oak Perpetual Calendar "John Mayer" was celebrated at a star-studded party in LA last week.

The announcement came as the company reported a 23 percent drop in production in Q1.

The three-time Pro Bowler continues to partner with the retailer, donating to a Detroit nonprofit and giving watches to fans.

A double-digit drop in the number of in-store crimes was offset by a jump in off-premises attacks, JSA’s 2023 crime report shows.

Inspired by the Roman goddess of love, the designer looked to the sea for her new collection.

The luxury titan posted declining sales, weighed down by Gucci’s poor performance.

The selected nine organizations have outlined their plans for the funds.

The mining company’s Diavik Diamond Mine lost four employees in a plane crash in January.