Tobak, author of “Ice Cold: A Hip-Hop Jewelry History,” shares how the exhibition came to be, and the pieces people may be surprised to see.

This Digital Gem Trading Platform Will Launch Early Next Year

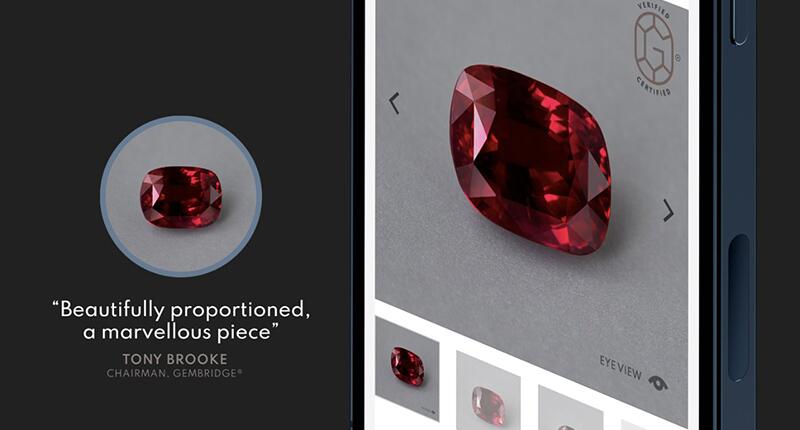

Gembridge provides a secure business-to-business marketplace that verifies its members and stones from door to door.

Singapore—A new platform will launch early next year, aiming to provide a secure marketplace for gemstone trading.

The first quarter will see the official rollout of Gembridge, where verified members can buy, sell and consign stones via a secure and insured door-to-door service.

Behind the development of web-based Gembridge.com is industry veteran Tony Brooke, who has more than four decades of experience in the gemstone sector, as well as Nick Marrett and Mark Taylor, both of whom have more than 20 years of experience in the digital sector working with such companies as Google, Apple, eBay, Airbnb, American Express, Unilever and more.

It’s this combination of experience that the team believes sets them apart and will help make their product a success with trade members.

“We feel that we, more than pretty much anybody else, have got what it takes to really make this work,” Brooke told National Jeweler.

To register, new businesses are verified through an international KYC process, as well as a peer-review from existing Gembridge members.

After passing that process, industry companies can sell items with a listing on the platform, buy items through the showcase or list a requirement request for a specific item they’re looking for which other members can fulfill.

The items sold on the platform are shipped to members through Gembridge’s global hubs in Bangkok, Geneva, and Bahrain, where they are verified by a third party—the ICA GemLab in Bangkok, to start, but more labs are coming on board—to ensure the listing, initial gem report and stone all match.

ICA GemLab has even created a new verification report for the process with minimal turnaround time.

More hubs are also being added to Gembridge’s lineup as we speak; Brazil will be online next.

Interested parties also can opt for a secure viewing room at a hub through Brinks, where they can examine a stone, pay for it and walk away with it if they so choose.

Consignment is also an option as Gembridge provides an insurance policy allowing for that as well.

Gembridge takes a sales commission for each transaction—5 percent from the seller and 3 percent from the buyer.

In addition to partnering with Brinks for logistics, Anglo East Group for insurance, Ingenique Solutions for KYC/AML compliance and ICA GemLab for verification, Gembridge has also involved KPMG as corporate finance advisors, which put the business model together.

Gembridge is licensed to trade by

It’s because of this licensing and the access to information they receive that they can perform a “bank-level” verification of potential members, as Marrett referred to it.

It also means Gembridge can offer members more services that might have been hard to access up to now, such as financing, as banks and other institutions are more likely to sign on to partner with a platform in which its members have been vetted to such a degree.

The team launched its Minimum Viable Product in July, enlisting 25 top players of the global gem industry to test its trading platform, including KGK in India, Diamrusa and Sant Enterprises in Thailand, Crown Color in Hong Kong, RareSource in North America, Berr and Partners in Switzerland, and Jureidini Gems & Jewellery in the Middle East.

The full platform will launch in early 2021; interested trade members can pre-register now.

It will serve the wholesale business-to-business market to start, but eventually will expand to include business-to-consumer trading in the third quarter of 2021, the founders said.

They are also planning to add a consumer-to-consumer aspect eventually for those wanting to sell heirloom jewelry, for example, but are still working that part out.

The Latest

Stars adorned themselves in emeralds, platinum, and myriad bird motifs, writes Associate Editor Natalie Francisco.

M.S. Rau is set to open a seasonal gallery in the high-end resort town early next month.

Tradeshow risks are real. Get tips to protect yourself before, during and after and gain safety and security awareness for your business.

The branded jewelry market is thriving, said Richemont Chairman Johann Rupert.

The six designers, all participants in the show’s Diversity Action Council mentorship program, will exhibit in Salon 634.

The highlight of his collection is the coveted Patek Philippe Grandmaster Chime, which could sell for up to $5 million.

Meet Ben Claus—grand prize winner of For the Love of Jewelers 2023 Fall Design Challenge.

The “Venetian Link” series modernizes the classic Veneziana box chain in its bracelets and necklaces.

The Seymour & Evelyn Holtzman Bench Scholarship will provide tuition assistance to two low-income students.

The Swiss watchmaker said the company’s plans to use a new version of the Hallmark crown on jewelry would confuse consumers.

The executive talked about the importance of self-purchasers and how fuel cell electric vehicles are going to fuel demand for platinum.

The Indian jeweler’s new store in Naperville, Illinois marks its 350th location, part of its ongoing global expansion plans.

It will award a graduating high school student with about $10,000 toward a GIA diploma and an internship with the Seattle-based jeweler.

Wheat Ridge, Colorado police took a 50-year-old man into custody Wednesday following a two-month search.

PGI partnered with four new and seven returning designers for its annual platinum capsule collection.

Nicolosi, president and CEO of The Kingswood Company, previously sat on WJA’s board from 2011 to 2018.

Karina Brez’s race-ready piece is a sophisticated nod to the horse-rider relationship.

The men are allegedly responsible for stealing millions in jewelry and other valuables in 43 burglaries in 25 towns across Massachusetts.

“Horizon” invites individuals to explore the limitless possibilities that lie ahead, said the brand.

The jeweler credits its recent “Be Love” campaign and ongoing brand revamp for its 17 percent jump in sales.

The co-founder of Lewis Jewelers was also the longtime mayor of the city of Moore.

Elvis Presley gifted this circa 1967 gold and diamond watch to Dodie Marshall, his co-star in “Easy Come, Easy Go.”

Concerns about rising prices, politics, and global conflicts continue to dampen consumer outlook.

May’s birthstone is beloved for its rich green hue and its versatility.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.