The special-edition egg pendant ingested in a New Zealand jewelry store was recovered after a six-day wait.

Gold Jewelry Demand Hits a 10-Year High in US

The World Gold Council said the market is benefitting from rising wages and increased consumer confidence.

London—Gold jewelry demand in the United States reached 28.3 tons in the second quarter, marking a 10-year high for the period, the World Gold Council said.

Year-over-year, Q2 demand was up 5 percent, continuing the upward trend in the market.

The half-year number for the United States also hit a 10-year high; at 51.9 tons, demand reached a level not seen since 2008.

The market benefitted from a positive domestic economic environment that included rising wages, lower taxes that boosted household incomes, unemployment hitting historic lows and heightened consumer confidence, the WGC said.

The council also said department stores have reported strong jewelry sales—with some even reallocating store space to gold after replacing it with silver during the downturn—and a solid performance from the high end of the market.

Globally, though, gold jewelry demand dropped 2 percent in the second quarter to 510.3 tons.

The WGC noted that while it may seem surprising that gold jewelry demand didn’t pick up during the quarter given the relatively sharp decline in the per-ounce price of gold, it noted that currency weaknesses in many markets meant that local consumers weren’t seeing lower prices. Instead, they were seeing steady, or even higher, prices.

(The average LBMA gold price was $1,305.99 per ounce in Q2 and $1,317.73 per ounce in H1, according to Bloomberg and ICE Benchmark Administration).

Looking at worldwide jewelry demand by region, the Indian and Middle Eastern markets were the main drivers behind the Q2 decline, WGC said.

In India, consumers faced a high local gold price and seasonal challenges, causing demand to drop 8 percent year-over-year to 147.9 tons.

Meanwhile, economic factors and a new value added tax (VAT) introduced in some Middle Eastern markets impacted jewelry demand.

Iran posted the region’s biggest Q2 decline, 35 percent to 6.6 tons, as the country faced renewed economic sanctions and a collapsing currency.

The United Arab Emirates (-24 percent) and Saudi Arabia (-10 percent) also were down due to the impact of the VAT, while Turkey posted a 10 percent decline as political tensions pushed the local gold price higher.

Egypt was the only country in the region to see improvement, with gold jewelry demand up 10 percent to 5.1 tons, though the year-over-year comparison is against a record-low quarter in 2017.

In addition to the United States, growth in China helped offset the poor demand in India and the Middle East. Gold jewelry

Consumers there increasingly are preferring innovative, creative pieces over traditional jewelry, and a greater emphasis is being put on innovative marketing and customer service as well, the WGC said.

Europe also saw a marginal uptick in second quarter demand from 14.4 tons to 14.5 tons, supported by a stable euro gold price, while growth in Indonesia and Vietnam helped offset weakness elsewhere in Asia.

Gold jewelry demand for the first half of the year worldwide remained virtually unchanged year-over-year at 1,031.2 tons.

The market for recycling gold was up 4 percent compared with the prior-year period, driven largely by Turkey and Iran.

The Latest

Associate Editor Natalie Francisco plays favorites with Piece of the Week, selecting a standout piece of jewelry from each month of 2025.

The “Love and Desire” campaign is inspired by the magic that follows when one’s heart leads the way, said the brand.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Two awardees will receive free tuition for an educational course at the Swiss lab, with flights and lodging included.

Berta de Pablos-Barbier will replace Alexander Lacik at the start of January, two months earlier than expected.

Sotheby’s held its first two jewelry sales at the Breuer building last week, and they totaled nearly $44 million.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

Winners will receive free registration and lodging for its fourth annual event in Detroit.

Here are six ideas for making more engaging content for Instagram Reels and TikTok, courtesy of Duvall O’Steen and Jen Cullen Williams.

The honorees include a notable jewelry brand, an industry veteran, and an independent retailer.

Carlos Jose Hernandez and Joshua Zuazo were sentenced to life without the possibility of parole in the 2024 murder of Hussein “Sam” Murray.

Yood will serve alongside Eduard Stefanescu, the sustainability manager for C.Hafner, a precious metals refiner in Germany.

The New Orleans jeweler is also hosting pop-up jewelry boutiques in New York City and Dallas.

Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

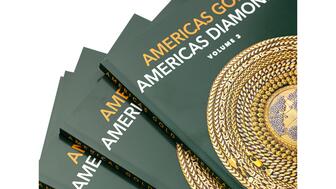

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.