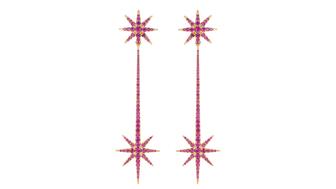

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

Gold Price Expected to Continue to Climb in 2020

The latest Reuters poll has the metal averaging more than $1,400/oz. next year, while some analysts predict the spot price could hit $2,000.

New York—Gold is expected to average more than $1,400/oz. next year, up from $1,360 this year, a recent Reuters poll shows.

Reuters publishes a precious metals price poll every quarter, combining predictions from two dozen or more analysts.

In the latest poll, done at the beginning of September, analysts predicted gold would average $1,393/oz. in the third quarter, $1,416 in the fourth quarter and $1,360 for the entire year.

The 2020 average for gold is forecast to rise to $1,425/oz.

The Reuters poll represents averages, not the actual price gold hits at any point during the day, and includes predictions from more than 30 participants, which is why it is less bullish than the note released by Citi analysts in mid-September, which predicted spot gold prices could top $2,000 an ounce in the next year or two.

Still, both sources point toward the gold price going up.

Unlike other metals, which are tied to market fundamentals such as supply and demand, gold is “very responsive” to certain macro-economic developments, said Johann Wiebe, a lead metals analyst on the GFMS team at Refinitiv.

Currently, those include the Federal Reserve lowering interest rates and the ongoing U.S.-China trade war.

“People are uncertain; that’s why the gold price goes up,” he said, noting the best example of gold prices reacting to macro-economic conditions was when it skyrocketed during the 2008 financial crisis, as investors lined up to buy gold investment bars and coins amid the global financial meltdown.

In the jewelry industry, the high price of gold led retailers to push buyback programs while swapping out gold for silver in display cases.

While Wiebe recognizes there is a lot of uncertainty in the world right now, he said Refinitiv is more modest in its exact forecast for gold and will need to see economic factors take a firmer hold before it predicts gold will breach $2,000 an ounce.

Platinum and Palladium Prices

Wiebe said platinum will remain less expensive than gold for the foreseeable future, though the Reuters poll has the white metal’s price rising next year too.

In the third quarter, the poll has platinum averaging $858/oz. and climbing to $880 in the fourth quarter, finishing the year with an average of $851.

In 2020, the poll has the average platinum price at $926/oz.

Analysts are also bullish on palladium.

Ten years ago, the white metal averaged around $300/oz., data supplied by Refinitiv shows (see chart below).

Supply is just not high enough, Wiebe said, and the market is in repeated, severe deficit.

In the Reuters poll, analysts predicted palladium will average $1,478 in the third quarter and $1,465 in the fourth, finishing the year at $1,448/oz. The predicted average for 2020 is only slightly lower, at $1,444.

Silver Shadows

The price of silver is expected to mirror that of gold in the near term, rising in the fourth quarter and again next year.

The Reuters poll has silver averaging $15.79 an ounce in the third quarter before increasing to $16.13 in the fourth. The metal’s average for 2019 is expected to land at $15.59.

Next year, the price of silver is expected to increase to an average of $16.73.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

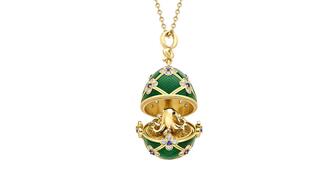

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

In addition, a slate of new officers and trustees were appointed to the board.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.