President Trump said he has reached a trade deal with India, which, when made official, will bring relief to the country’s diamond industry.

Signet Jewelers Fined $11M Over In-Store Credit Cards

The jewelry giant disputed allegations that its in-store credit practices were deceitful but said it will pay the fine to put an end to litigation.

Akron, Ohio—Signet Jewelers has agreed to pay $11 million in fines after its in-store credit practices caught the eye of regulatory agencies, though the jewelry giant has not admitted to any wrongdoing.

Sterling Jewelers, the unit comprised of Kay Jewelers and Jared the Galleria of Jewelers along with a few regional brands, has been ordered to pay $10 million to the U.S. Consumer Financial Protection Bureau and $1 million to the office of New York Attorney General Letitia James.

James accused the company of pushing employees to sign customers up for in-store credit cards by setting sign-up quotas and linking the number of customers signing up to employees’ performance reviews and compensation.

The New York attorney general also said Sterling misled customers into thinking they were signing up for a rewards program but then used their information to file credit card applications. Consumers didn’t know they had signed up for a credit card until they received a credit report inquiry or the card showed up in their mailboxes.

Even in situations when customers knew they were applying for credit cards, employees allegedly misrepresented the terms by telling customers they were being enrolled in “no interest” promotional financing plans when, in fact, there were monthly financing fees.

Lastly, the attorney general’s office said consumers were enrolled in credit insurance—a type of policy that pays off a debt in the case of an unforeseen circumstance—connected to their in-store credit cards without their knowledge or consent.

“By tricking consumers into enrolling in store credit cards, Sterling Jewelers betrayed customers’ trust and violated the law,” James said in an official statement. “This settlement holds the company accountable for its misconduct and ensures that no more consumers are deceived.”

Signet said in a statement that while it disagrees with the allegations, the company has chosen to settle to avoid the time and cost of continued litigation.

“We have used this opportunity to internally reaffirm the transparency and fairness of our credit-related policies, and we look forward to continuing to provide our customers with access to suitable credit options,” the jewelry retailer said.

Signet took a deep dive into its credit practices back in 2016 after analysts began commenting on the amount of subprime debt weighing heavy on its books, meaning the company might have been lending to too many consumers with low credit scores.

The company announced plans to outsource its credit portfolio back in May 2017, selling $1 billion worth

The Consumer Financial Protection Bureau notified Signet in September 2017 via a letter that its Office of Enforcement might recommend legal action against the company for violating provisions of the Consumer Financial Protection Act of 2010 and the Truth in Lending Act.

In addition to paying the fines, Signet will be required to thoroughly inform consumers about the in-store credit cards and credit insurance as well as complete a written compliance progress report for James’ office, as per a consent order filed in federal court in New York City.

The $11 million pre-tax charge will be recognized in the company’s fiscal fourth quarter results, which it is slated to report in March.

The Latest

The designer’s latest collection takes inspiration from her classic designs, reimagining the motifs in new forms.

The watchmaker moved its U.S. headquarters to a space it said fosters creativity and forward-thinking solutions in Jersey City, New Jersey.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The company also announced a new partnership with GemGuide and the pending launch of an education-focused membership program.

IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

From cool-toned metal to ring stacks, Associate Editor Natalie Francisco highlights the jewelry trends she spotted at the Grammy Awards.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

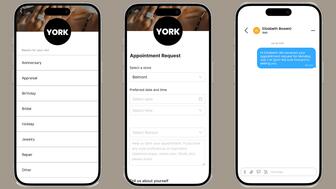

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The new members’ skills span communications, business development, advocacy, and industry leadership.