Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

After Falling 8% in 2018, Silver Price Expected to Rebound

Silver averaged $15.71 last year but is expected to rise to nearly $17 an ounce this year, Refinitiv said.

New York—The price of silver is expected to climb this year after dropping nearly 8 percent last year, an analyst said Thursday at the release of The Silver Institute’s World Silver Survey 2019.

According to the survey, the average per-ounce price of silver fell by 7.8 percent to $15.71 in 2018, with prices ranging from $13.97/ounce to $17.52/ounce. The main factor impacting the silver price was the trade dispute between the United States and China, which strengthened the U.S. dollar and dragged down metal prices.

This year, Refinitiv (the new name for Thomson Reuters’ financial and risk business) predicts silver will average $16.75 an ounce, Lead Metals Analyst Johann Wiebe said.

“Silver has been lagging gold prices for a quite a while and we feel it has some catching up to do,” Wiebe explained in an email following the event. “On top of that, we expect a more favorable investment climate this year and next. This is mainly driven on a weaker macro-economic climate in the U.S. as well as China.”

In general, this is good for gold because it is so heavily investment focused, but silver will benefit too, Wiebe said. He also noted that a weaker U.S. dollar will contribute to driving the prices of all precious metals higher this year.

The GFMS team at Refinitiv researches and produces the survey for The Silver Institute, which, in addition to price, covers supply and demand for silver in investment, industrial fabrication and jewelry.

Jewelry Demand Climbs

The survey shows that globally, silver jewelry fabrication demand increased 4 percent year-over-year in 2018 to 212.5 million ounces.

While India was the standout performer—demand there rose 16 percent—the U.S. also recorded solid silver sales, with demand increasing 7 percent to hit an all-time high of 17.4 million ounces.

Wiebe said retailers in the U.S. are “still keen” to stock their cases with silver jewelry, as it generates profit margin and gives them something to offer women looking to buy a piece of jewelry for themselves for $500 or less.

However, the survey noted that

Silver jewelry also is not immune to the one of the biggest challenges currently facing all jewelry, be it gold, diamond or gemstone: How and where do jewelers and brands connect with younger consumers?

“The difficult bit is to get ahold of the millennials today,” Wiebe said in his presentation Thursday. “How do you reach the millennials? They are constantly online.”

The results of the World Silver Survey support the findings of the annual survey the Silver Promotion Service, the Silver Institute’s marketing arm, does in concert with InStore magazine.

Released last month, the SPS/InStore survey for 2018 showed that 52 percent of U.S. retailers saw silver sales increase year-over-year. The category also continues to generate the best profit margin for jewelers, with 40 percent indicating it was their top money-maker over the holiday season.

Meanwhile, Refinitiv said overall silver demand rose 4 percent to 1.03 billion ounces last year, fueled mainly by the recovery in retail investment, including the 53 percent jump in demand for silver bars.

The increase in demand was particularly pronounced in India, where silver bar demand more than doubled, rising 115 percent.

Supply Remains Tight

Global mine supply fell for the third consecutive year, slipping 2 percent to 855.7 million ounces following supply disruptions in the U.S., Canada and Guatemala.

Output dropped 17 percent in the U.S. due mainly to several issues at Americas Silver Corp.’s Galena operations, where the mine shaft was shut for more than two weeks. Operational issues also plagued Canada, with production falling 32 percent after a fire in the smelting facility and continuous maintenance problems at Teck’s Trail operation.

Offsetting those losses was record output in Mexico, which remains the No. 1 producer of silver in the world. The country’s 2018 output totaled 196.6 million ounces, followed by Peru (144.9 million ounces) and China (114.9).

The U.S. ranked as the ninth largest producer of silver in the world in 2018, with production totaling 28 million ounces, while Canada was No. 11 at 24.8 million ounces.

Silver scrap supply also fell by 2 percent year-over-year, due mainly to lower suppliers discouraging suppliers and consumers from recycling silver.

The rising demand and shrinking supply resulted in a physical market deficit of 29.2 million ounces, which is about 3 percent of annual demand and considered a balanced market.

The Latest

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

This year's theme is “Unveiling the Depths of the Ocean.”

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

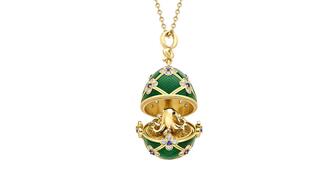

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

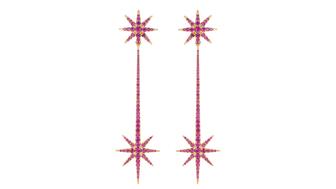

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group