Anglo American to Merge With Canadian Copper Miner

Anglo plans to merge with Teck Resources Ltd. to form Anglo Teck. The deal changes nothing about its plans to offload De Beers.

The new $50 billion company, called Anglo Teck, will be the second-largest listed producer of copper in the world.

Copper is in high demand right now because of the mineral’s use in renewable energy solutions, like wind turbines, solar panels, and electric and hydrogen fuel cell vehicles.

Anglo Teck also will be a major producer of iron ore via mines in South Africa and Brazil—iron ore is used in “green” steel production—and will operate the Red Dog zinc mine in Alaska and the zinc and lead smelting and refining facilities at Trail Operations in British Columbia.

As part of the deal, Anglo American will relocate its headquarters from London to Vancouver, Canada, where Teck is based.

Anglo American Chief Executive Duncan Wanblad will serve as CEO of Anglo Teck, while Teck’s President and CEO Jonathan Price will be deputy CEO.

While the merger of the companies is a major development in the mining world, it changes nothing about Anglo American’s position on De Beers Group.

In Tuesday’s announcement of the merger, the company said it is still committed to its “portfolio simplification,” which includes offloading De Beers.

Anglo American publicly confirmed it was looking to sell De Beers, as well as its steelmaking coal, nickel, and platinum businesses, in May 2024, as part of a broader strategy to downsize its portfolio and focus on mining minerals that will be used in “green” energy solutions.

The downsizing followed a failed takeover attempt by rival BHP Group.

Anglo American fully exited the platinum business last week when it sold its remaining stake in Valterra Platinum (formerly Anglo American Platinum), which operates in South Africa and Zimbabwe.

De Beers has proved to be a tougher sell in the current market, though CEO Al Cook told National Jeweler in May that he expects the deal to be finalized in the first half of 2026.

In Tuesday’s announcement of the merger, Anglo American head Wanblad said the company has made “significant” progress in downsizing its portfolio and that now is the “optimal” time to take the next step.

“We have a unique opportunity to bring together two highly regarded mining companies whose portfolios and capabilities are deeply complementary, while also sharing a common set of values,” he said.

“Together, we are propelling Anglo Teck to the forefront of our industry in terms of value accretive growth in responsibly produced critical minerals.”

The merger of Anglo American and Teck Resources is taking place under the Canada Business Corporations Act and is subject to certain closing conditions, including the approval of both Anglo American and Teck shareholders.

The deal is expected to close in 12-18 months.

The Latest

From Coco Gauff’s hoops to Madison Keys’ diamond medallion, these are Senior Editor Lenore Fedow’s standout jewelry looks of the season.

The trendy earrings feature asymmetrical drops, one with a grossular garnet and the other with a diamond.

Four social media marketing experts discuss their go-to methods and favorite tools for making high-quality short-form video content.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

Sponsored by American Gem Trade Association

In its holiday report, PwC said the season will be more like jazz—improvisational and less predictable—than an easy-to-follow melody.

The jewelry giant will relocate its existing facility to a larger space in Anne Arundel.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

The designer, who is the creative force behind her namesake brand, has now started a new mini line focusing on chains for fathers and sons.

The 21-day program was designed to help jewelry retailers identify opportunities and eliminate inefficiencies with AI.

A set of four Patek Philippe “Star Caliber 2000” pocket watches is part of Sotheby’s upcoming auction in Abu Dhabi.

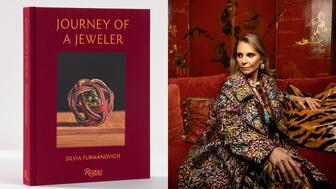

The Brazilian jeweler’s latest book marks her namesake brand’s 25th anniversary and tells the tale of her worldwide collaborations.

The Submariner Ref. 1680 with a Tiffany & Co. dial came from the original owner, who won it as a prize on the game show in the 1970s.

The new integration allows users to manage shipments directly from the Shopify dashboard.

At Converge 2025, Editor-in-Chief Michelle Graff attended sessions on DEI, tariffs, security, and more. Here are her top takeaways.

Six people were shot last week at an Oakland cash-for-gold shop as employees exchanged gunfire with individuals trying to rob the store.

The jeweler has expanded its high jewelry offering, which launched last year, with new pieces featuring its cube motif that debuted in 1999.

Associate Editor Natalie Francisco shares eight of her favorite jewelry looks from the 77th annual Primetime Emmy Awards, held Sunday night.

It’s predicting a rise in retail sales this holiday season despite economic uncertainty and elevated inflation.

It included the sale of the 11,685-carat “Imboo” emerald that was recently discovered at Kagem.

The newly elected directors will officially take office in February 2026 and will be introduced at the organization’s membership meeting.

Associate Editor Lauren McLemore headed out West for a visit to Potentate Mining’s operation hosted by gemstone wholesaler Parlé Gems.

Fordite is a man-made material created from the layers of dried enamel paint that dripped onto the floors of automotive factories.

Gilbertson has worked as a researcher, jeweler, lapidary artist, appraiser, and business owner throughout his decades in the industry.

A decision likely won’t come until January 2026 at the earliest, and the tariffs remain in effect until then.

Located in the revamped jewelry hall at the retailer’s New York City flagship, this opening is Tabayer’s first shop-in-shop.

The new, free app offers accessible educational content, like games and podcasts, for U.S. retailers.