The organization has raised more than $1.3 million for charity since its inception.

Tiffany’s Q1 Sales Dragged Down By Weak Tourist Spending

Trade tensions between the United States and China took a toll on the jeweler.

New York—Tiffany & Co. reported a dip in worldwide sales in the first quarter, weighed down by weak tourist spending.

Net sales in the first quarter, which included both Valentine’s and Mother’s Day, totaled $1 billion, compared with $1.03 billion in the previous first quarter, a 3 percent drop.

Worldwide same-stores sales fell declined by 2 percent.

“Our first quarter results reflect significant foreign-exchange headwinds and dramatically lower worldwide spending attributed to foreign tourists,” CEO Alessandro Bogliolo said in the news release on the results.

Trade tensions between the United States and China also have taken a toll on the retailer, as tariffs haven risen to 25 percent on jewelry sent to China from the U.S., as noted in the filing.

Gross profit fell about 5 percent to $619.2 million, or about 62 percent of sales, compared with $650.9 million, or 63 percent of sales, a year ago.

“The sharp decline we saw [in foreign tourist spending] really presented itself for the first time in June of last year and we have been running down significantly since that point in time,” Chief Financial Officer Mark J. Erceg said during the company’s earnings call Tuesday morning.

Net sales in the Americas, where the most Tiffany stores are located, were down 4 percent to $406 million. Same-store sales in the region fell 5 percent.

European sales fell 4 percent to $102 million while same-store sales were down 7 percent.

Asia-Pacific sales dropped 1 percent to $324 million as tourist spending slowed, and same-store sales were down by 5 percent.

Sales in Japan fell 4 percent to $145 million, again linked to lower tourist spending, while same-store sales were down 4 percent.

Sales from the “other” segment, which includes five Tiffany stores in the United Arab Emirates, were a bright spot on the balance sheet, climbing 17 percent to $26 million as wholesale diamond sales grew.

However, same-store sales in the UAE fell by 17 percent.

By category, sales of pieces from Tiffany’s jewelry collections, which includes lines like “Tiffany T” and “Paper Flowers,” increased 1 percent.

Sales of engagement jewelry fell 6 percent while jewelry from designers such as Elsa Peretti, Paloma Picasso and Tiffany & Co. Schlumberger dropped 14 percent.

As of April 30, there were 321 Tiffany stores in operation compared with 314 a year ago. There are 124 stores in the Americas, one more than a year ago.

Looking ahead, Tiffany expects worldwide net sales to increase by a low-single-digital percentage over last year.

Earnings

“At the core of our business, global sales attributed to local customers, led by sales in China, grew over last year’s very strong sales results,” he said.

He said growth in sales to local customers “reflects progress” and said Tiffany is set to improve in the second half of the year.

The Latest

The brand’s latest iteration of a bezel-set diamond bangle features clean lines and a timeless design for a new modern silhouette.

The first watch in the series commemorates his participation in the Civil Rights movement, marching from Selma to Montgomery in 1965.

As a leading global jewelry supplier, Rio Grande is rapidly expanding and developing new solutions to meet the needs of jewelers worldwide.

The catalog contains a complete listing of all the loose gemstones in stock, as well as information about the properties of each stone.

The company added a retailer dashboard to its site and three new birds to its charm collection, the cardinal, blue jay, and hummingbird.

An additional 25 percent tariff has been added to the previously announced 25 percent.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

The jewelry and accessories retailer plans to close 18 stores as part of the proceedings.

Its Springfield, Massachusetts, store is set to close as owner Andrew Smith heads into retirement.

Designer Hiba Husayni looked to the whale’s melon shaped-head, blowhole, and fluke for her new chunky gold offerings.

She will present the 23rd edition of the trend forecasting book at Vicenzaoro on Sept. 7.

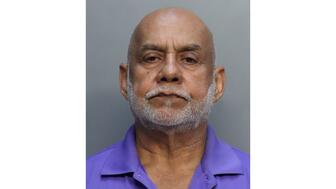

Omar Roy, 72, was arrested in connection with the murder of jeweler Dionisio Carlos Valladares.

The New Orleans-based brand’s “Beyond Katrina” jewels honor the communities affected by the storm.

Lilian Raji explains why joining an affiliate network is essential for brands seeking placements in U.S. consumer publications.

The organization has awarded a total of $42,000 through its scholarship programs this year.

The winner of the inaugural David Yurman Gem Awards Grant will be announced live at the 2026 Gem Awards gala.

As summer winds down, celebrate the sunny disposition of the month’s birthstones: peridot and spinel.

Moshe Haimoff, a social media personality and 47th Street retailer, was robbed of $559,000 worth of jewelry by men in construction outfits.

Xavier Dibbrell brings more than a decade of experience to the role.

The addition of Yoakum, who will lead Kay and Peoples, was one of three executive appointments Signet announced Thursday.

The insurance company’s previous president and CEO, Scott Murphy, has split his role and will continue as CEO.

The nearly six-month pause of operations at its Kagem emerald mine earlier this year impacted the miner’s first-half results.

The necklace uses spinel drops to immortalize the moment Aphrodite’s tears mixed with her lover Adonis’ blood after he was fatally wounded.

The diamond miner and marketer warned last week that it expected to be in the red after significantly cutting prices in Q2.

Jewelers of America’s 35th annual design contest recognized creativity, artistry, style, and excellence.

Tratner succeeds Andie Weinman, who will begin stepping back from the buying group’s day-to-day operations.