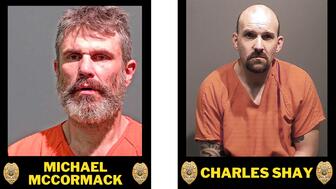

Wheat Ridge, Colorado police took a 50-year-old man into custody Wednesday following a two-month search.

As Argyle Nears Its End, Prices for Reds and Pinks Soar

The most valuable diamond sold at this year’s tender, a 2.28-carat fancy purplish-red, toppled a record set just last year.

They are climbing and will continue to do so as the closing date for the Argyle Mine in Western Australia draws closer.

And though the London-based miner always has been tight-lipped about the Argyle Pink Diamond Tender results—it doesn’t reveal the sale’s total, prices paid for individual diamonds or names of buyers (unless allowed)—it did note that the 2018 sale set numerous records, including tender total and prices per carat.

The diamond that sold for the most money was the “Argyle Muse,” a 2.28-carat fancy purplish-red oval. Purchased by an undisclosed bidder, Muse is now the most expensive diamond sold in the 34-year history of the tender.

Muse took the title from Everglow, the fancy red Optimum Diamonds LLC bought last year.

Though he declined to reveal the Everglow’s purchase price, Optimum CEO David Shara said the 2.11-carat diamond is for sale for $18 million.

It is also being offered as part of a collection of more than 60 red diamonds amassed by the CEO and his business partner; he said it is the largest collection of its kind in the world and is worth about $200 million.

For Shara, natural colored diamonds, particularly those originating from the Argyle mine, are akin to a “very specific painting from a very specific artist.”

The wealthy want to own rare diamonds from Argyle for the same reason they are paying huge amounts of money for works for art, like the $450 million a Saudi prince spent on Leonardo da Vinci’s “Salvator Mundi” last year—they want to park their money in tangible, portable assets at a time of geopolitical instability worldwide.

“That’s how people are treating these rocks,” he said.

The desire for colored diamonds is also evident in the auction market, where the stones are continually setting records.

At a jewelry auction just last week, Christie’s sold an 18.96-carat pink diamond for $50.4 million, or $2.6 million a carat excluding fees, a new price-per-carat record. And the most expensive jewel ever sold at auction is still a pink diamond, the nearly 60-carat Pink Star, which sold for $71 million.

According to Shara’s estimates, the prices paid for a 1-carat vivid pink or a 1-carat fancy red in this year’s Argyle tender were up 41 percent year-over-year, and he expects prices for Argyle pinks and reds to spike at least another 40 percent when the mine closes 18 months from now.

“That’s what the market dictated, the dealers and the privates, everyone who bought. That’s people understanding the mine will be closed in 2020 and that there will be two, maximum three, more tenders and that’s it. It’s finished.”

Rio Tinto did not respond when asked to confirm this fact, but the mining company did state in its tender results press release that in the past 18 years, the value of Argyle pink diamonds sold at the tender have appreciated more than 400 percent, outperforming all major equity markets.

Shara said despite the continual upward trajectory, he’s not concerned about the bottom falling out of the market for Argyle’s pink, red and violet diamonds. While there has been some price correction in colored diamonds, Rio Tinto’s mine is a finite resource for which the finale is drawing near.

“That’s what so fascinating about it. That’s my gamble.”

Rio Tinto’s 2018 sale of pink, red and violet diamonds from Rio Tinto’s Argyle mine in Western Australia included a total of 63 diamonds weighing nearly 52 carats.

Among them were a half-dozen “hero stones,” the top diamonds in the group to which Rio Tinto ascribes individual names.

In addition to the Muse, they were the:

—Argyle Alpha, a 3.14-carat emerald-cut fancy vivid purplish-pink;

—Argyle Maestro, a 1.29-carat square-cut fancy vivid purplish-pink;

—Argyle Alchemy, a 1.57-carat fancy dark gray-violet princess;

—Argyle Odyssey, a 2.08-carat fancy intense pink round brilliant; and

—Argyle Mira, a 1.12-carat fancy red radiant.

Glajz THG in Singapore, a manufacturer of bespoke pieces, bought the Alpha, while Gemcut Geneva was the winning bidder for the Odyssey. Gemcut Chief Executive Matthew Aldridge said the Odyssey is a match for another Argyle stone sold in the tender about 15 years ago.

New York-based diamond company Leibish & Co. bought three stones in the 2018 tender, two of which sold the day they were purchased, said the company’s director of content marketing and public relations, Meira Ovadia.

Leibish’s remaining stone is lot No. 63 from the sale, a 2.34-carat radiant-cut the company has dubbed the “Kimberley-Rose.” The diamond is fancy intense pink and SI1 clarity.

The Latest

PGI partnered with four new and seven returning designers for its annual platinum capsule collection.

Nicolosi, president and CEO of The Kingswood Company, previously sat on WJA’s board from 2011 to 2018.

Meet Ben Claus—grand prize winner of For the Love of Jewelers 2023 Fall Design Challenge.

Karina Brez’s race-ready piece is a sophisticated nod to the horse-rider relationship.

The men are allegedly responsible for stealing millions in jewelry and other valuables in 43 burglaries in 25 towns across Massachusetts.

“Horizon” invites individuals to explore the limitless possibilities that lie ahead, said the brand.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The jeweler credits its recent “Be Love” campaign and ongoing brand revamp for its 17 percent jump in sales.

The co-founder of Lewis Jewelers was also the longtime mayor of the city of Moore.

Elvis Presley gifted this circa 1967 gold and diamond watch to Dodie Marshall, his co-star in “Easy Come, Easy Go.”

Concerns about rising prices, politics, and global conflicts continue to dampen consumer outlook.

May’s birthstone is beloved for its rich green hue and its versatility.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The “Tiffany Céleste” collection reimagines designer Jean Schlumberger’s interpretations of the universe.

The brand also created a 100-carat lab-grown diamond necklace in honor of its centennial.

Tim Schlick has been promoted from his previous position as COO.

It’s the second year for the event, slated to take place in October in Toronto.

Supplier Spotlight Sponsored by GIA

“SIS x MISA Denim and Diamonds” is a collaboration between the designer and celebrity stylist Misa Hylton.

The retailer is moving to a newly designed space in the same shopping center.

Gifts that are unique and thoughtful are top of mind this year, according to the annual survey.

The necklace is featured in the brand’s “Rebel Heart” campaign starring Adam Levine and Behati Prinsloo.

The two organizations will host a joint event, “Converge,” in September 2025.

Big changes appear to be on the horizon for the diamond miner and its parent company, Anglo American.

Padis succeeds Lisa Bridge, marking the first time the organization has had two women board presidents in a row.