The company raised its full-year sales guidance while noting it has not yet assessed the potential impact of the latest tariff news.

And the Survey Says …

What a recent study tells us about optimism in the industry, where people are buying jewelry and how much of it they are buying for themselves.

Jewelers of America, which owns this fine publication, just announced the completion of a study it commissioned, the “Fine Jewelry Industry Consumer and Retail Market Study.”

Conducted by Provoke Insights, the study surveyed two distinct groups: those who own jewelry stores (retailers) and those who, hopefully, shop in them (consumers).

While the full results of the study are being published in a white paper made available to JA members only, I was able to get my hands on a copy and will share some of what I think are the most interesting points below.

Let’s start with the retail portion of the study, which surveyed 275 JA member retailers.

When asked about the overall state of the market, survey-takers were overwhelmingly positive, with 79 percent of respondents saying they expect sales to greatly (23 percent) or slightly (56 percent) increase over the next three years.

Only 10 percent of respondents said they expect sales to decline, with the remaining 11 percent forecasting flat sales.

Still, they recognize there are challenges, chief among them being how to evolve and compete in the rapidly changing retail landscape.

Part of being able to compete today is, of course, having an updated website that is both responsive and e-commerce enabled. But that is a challenge, particularly for the smallest jewelers.

The survey shows that only 24 percent of retailers with less than five employees have an e-commerce-enabled website. That number climbs to 36 percent for jewelers with five to 10 employees, and tops 50 percent of those with 11 or more employees.

“When it comes to purchasing high-priced items, customer service is key. Local stores have a real opportunity to offer uniquely luxurious experiences.” -- Jewelers of America, “Fine Jewelry Industry Consumer and Retail Market Study”Now, on to consumers, specifically the 2,019 who were surveyed.

What the study found was that regardless of their age, consumers at least like to see a piece of fine jewelry in a store before they buy, even if they do their initial research online.

What’s more, many consumers prefer to shop at local stores over websites, big-box stores and duty-free shops. This is particularly true of those looking to give fine jewelry as a gift.

In the survey, the top location for purchasing fine jewelry was a national chain store, cited by 56 percent of all respondents.

Local stores/small businesses and department stores were next, tied at 47 percent, followed by online retailers that have

“When it comes to purchasing high-priced items, customer service is key,” JA states in the survey results. “Local stores have a real opportunity to offer uniquely luxurious experiences to compete against department stores, chains and e-commerce websites, where customers have less access to qualified jewelers and gemologists.”

But the survey also showed that jewelers of all sizes are missing out an opportunity--selling to individuals, particularly women, looking to buy jewelry for themselves at any point during the year.

Forty-three percent of survey-takers said they had purchased or received jewelry as a gift in the last year, but only 22 percent bought jewelry for themselves.

Other luxury items don’t have this problem; the survey showed that respondents aren’t timid about buying themselves designer accessories/sunglasses, watches/other timepieces, and designer handbags or leather goods.

RELATED CONTENT: 10 Jewels for the Self-Purchasing Female ConsumerThis is problematic for a couple of reasons.

First, attitudes toward marriage are changing. People are waiting longer to wed, or, in many cases, never getting married, either because there’s no longer a social stigma attached to living together out of wedlock or because they’re not in a relationship at all. An article published earlier this fall by the Pew Research Center put the number of single U.S. adults at 42 percent.

So if retailers are waiting around until consumers are getting engaged or thinking about getting engaged to sell them jewelry, then they could be waiting a long time.

Secondly, there is a lot more “noise” around the major gift-giving holidays, like Christmas, Valentine’s Day and Mother’s Day, making it harder to get one’s message heard.

As the survey says: “Focusing marketing efforts outside of major gift-giving holidays is more economical because of off-peak media costs. It can be easier to get one’s promotion or message heard by consumers when they are not inundated with holiday promotions.”

The Latest

The organization has raised more than $1.3 million for charity since its inception.

The brand’s latest iteration of a bezel-set diamond bangle features clean lines and a timeless design for a new modern silhouette.

As a leading global jewelry supplier, Rio Grande is rapidly expanding and developing new solutions to meet the needs of jewelers worldwide.

The first watch in the series commemorates his participation in the Civil Rights movement, marching from Selma to Montgomery in 1965.

The catalog contains a complete listing of all the loose gemstones in stock, as well as information about the properties of each stone.

The company added a retailer dashboard to its site and three new birds to its charm collection, the cardinal, blue jay, and hummingbird.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

An additional 25 percent tariff has been added to the previously announced 25 percent.

The jewelry and accessories retailer plans to close 18 stores as part of the proceedings.

Its Springfield, Massachusetts, store is set to close as owner Andrew Smith heads into retirement.

Designer Hiba Husayni looked to the whale’s melon shaped-head, blowhole, and fluke for her new chunky gold offerings.

She will present the 23rd edition of the trend forecasting book at Vicenzaoro on Sept. 7.

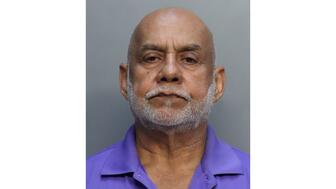

Omar Roy, 72, was arrested in connection with the murder of jeweler Dionisio Carlos Valladares.

The New Orleans-based brand’s “Beyond Katrina” jewels honor the communities affected by the storm.

Lilian Raji explains why joining an affiliate network is essential for brands seeking placements in U.S. consumer publications.

The organization has awarded a total of $42,000 through its scholarship programs this year.

The winner of the inaugural David Yurman Gem Awards Grant will be announced live at the 2026 Gem Awards gala.

As summer winds down, celebrate the sunny disposition of the month’s birthstones: peridot and spinel.

Moshe Haimoff, a social media personality and 47th Street retailer, was robbed of $559,000 worth of jewelry by men in construction outfits.

Xavier Dibbrell brings more than a decade of experience to the role.

The addition of Yoakum, who will lead Kay and Peoples, was one of three executive appointments Signet announced Thursday.

The insurance company’s previous president and CEO, Scott Murphy, has split his role and will continue as CEO.

The nearly six-month pause of operations at its Kagem emerald mine earlier this year impacted the miner’s first-half results.

The necklace uses spinel drops to immortalize the moment Aphrodite’s tears mixed with her lover Adonis’ blood after he was fatally wounded.

The diamond miner and marketer warned last week that it expected to be in the red after significantly cutting prices in Q2.

Jewelers of America’s 35th annual design contest recognized creativity, artistry, style, and excellence.