The insurance company’s previous president and CEO, Scott Murphy, has split his role and will continue as CEO.

Martin Rapaport vs. De Beers

Rapaport lambasted De Beers in his annual breakfast presentation in Las Vegas and has since publicly claimed the diamond company is destroying transparency in the trade. Editor-in-Chief Michelle Graff examines the genesis of his claims.

Those who attended Martin Rapaport’s annual breakfast presentation at JCK Las Vegas, and followed the subsequent back-and-forth that ensued between the price list king and diamond giant De Beers, probably were left with a lot of questions.

At the presentation, Rapaport shouted and gestured on stage with his usual fervor while raising a number of entirely valid concerns about the diamond industry.

Among them: transfer pricing—the practice of undervaluing a resource, such as diamonds from Africa, in order to increase profitability and decrease tax liability—that allegedly takes place in Dubai, an issue that was at the center of the 2016 NGO boycott of the Kimberley Process.

We should not, he told me in a lengthy interview following the jewelry trade show, be “put to sleep” by the leadership of the industry saying perfunctorily professing that all is well when serious problems do exist.

But the bulk of Rapaport’s ire was directed at De Beers for not allowing others in the diamond trade to use the De Beers name further down the supply pipeline.

How long has been De Beers been doing this, and why?

And why is it an issue right now? (As it turns out, the clause in De Beers’ sightholder contract restricting the use of its name downstream—the one that Rapaport put up on the screen during his talk at JCK Las Vegas—has been in place for more than a decade.)

I talked to both De Beers and, as mentioned above, Rapaport following the Las Vegas jewelry trade shows to find out more.

The Source of Rapaport’s Ire

Rapaport told me that he found out about De Beers’ rules regarding the use of its name when he was investigating source certification for RapNet. Rapaport wants to begin distinguishing between diamonds that have source certification and those that don’t on his trading platform.

It was during these talks that he discovered that De Beers does not allow use of its name downstream, which is true.

It is outlined in clause 3.6.6 in the signature license of their sightholder contracts, and it reads: “You will not represent that any particular diamond or diamonds are sourced, or originate, from us or any member of the De Beers Group except with our prior written consent.”

Now the question becomes, why is De Beers doing this?

Well, according to what Rapaport said at his breakfast in Las Vegas, De Beers is denying source information

He called De Beers a “cold, cruel corporation.”

Immediately following the breakfast, De Beers responded in a statement, not to deny its policy regarding the use of its name but to supply its own reason why Rapaport was so concerned with its name-use policy: because the company had told him “no” when he asked to use the De Beers name on RapNet.

It was a rare move for De Beers, which almost never responds to public attacks.

“What Martin wants is to be able to market diamonds from De Beers Group, using the De Beers brand, on his platform for his benefit. We don’t think this is fair, and we told him so,” the statement reads in part. “Martin had planned to use the JCK show to discuss his source certification. We engaged with Martin multiple times over several weeks, but when we did not comply with his wishes, he threatened us repeatedly. We were unmoved and we continue to be so.”

I asked Rapaport about this statement when we talked right after the shows. He told me, and has since said publicly, that De Beers is lying. He said he never asked to use the De Beers name specifically and, in fact, he doesn’t want to use it. But, he asked them, why can’t he use another name on invoices connected to diamonds mined by De Beers, like Diamond Trading Co. (DTC)?

De Beers never responded to Rapaport’s statement claiming the company was lying, but Rapaport persisted, issuing another statement claiming De Beers is “destroying transparency in the diamond industry” with this policy.

So, I asked De Beers about all of this. What do they have to say about Rapaport branding them as liars and claiming they are destroying transparency in the diamond trade? And, more importantly, why won’t the company let people attach “De Beers” to its diamonds or even just “DTC”?

In response to the former, De Beers spokesperson David Johnson told me: “We stand behind our statement. De Beers hasn’t lied,” about what Martin Rapaport requested in the run-up to his Vegas breakfast.

In answer to the latter question, De Beers gives a couple reasons.

No. 1, it doesn’t want to create confusion between De Beers Jewellers (its stores, formerly known as De Beers Diamond Jewellers) and Forevermark, its diamond brand that is not sold in its stores.

No. 2, they don’t have any control over the diamonds after they’ve been sold as rough—meaning they don’t know who’s owned them, who’s traded them, if they’ve been fracture-filled, treated, etc. They don’t want the De Beers name used, except on diamonds they’ve controlled from mine to market.

As for the use of Diamond Trading Co., Johnson allowed while it is a “fairer point,” everyone in the industry knows the DTC is De Beers, adding that De Beers doesn’t think it is Rapaport’s place to tell the company how to run its business.

“It’s not really for Martin to say, ‘You will do X and you will do it this way or that way,” Johnson said, which, I would say, also is a fair point.

The company does allow those who sell its diamonds downstream to say they come from mines in one of four countries—Botswana, Namibia, Canada or South Africa—and De Beers feels that that is enough.

But, I asked, is the first point really such an issue considering the United States has only four De Beers Diamond Jewellers stores? Johnson acknowledged that there aren’t that many stores, but there are a lot of Forevermark-carrying jewelers, not just in the U.S. but around the world.

What about Martin’s claims that De Beers will eventually be going straight to the consumer with Forevermark?

It did just open a company-operated Forevermark store in China geared toward millennials and announced at its annual breakfast in Las Vegas that it will be selling online direct to consumers in the U.S., though retailers will be getting a cut of those sales. (It is also worth noting that the company is going to insert the De Beers name into Forevermark marketing materials this year, the first time it has done so.)

Rapaport's claim in that respect is not entirely baseless. At that same breakfast, Forevermark executives laid out a five-year plan for all its jewelers, which, according to the presentation, is for them to “have a Forevermark brand experience in store,” whether it is an in-store brand corner, store-in-store zone or standalone Forevermark boutique owned and operated by Forevermark jewelers (not De Beers).

Where the Truth Lies

Rapaport is entirely correct about one point: De Beers, as a publicly owned company, is going to do what’s best for Anglo American’s shareholders in the end. I think how the company moves forward with Forevermark, blockchain and “ethical” sourcing in general is definitely something the trade should pay attention to in the coming years, as interest in the origin of diamonds and being able to track them will only intensify.

Even though the clause in the sightholder contract dates back 13 years, De Beers has evoked it as recently as last summer in response to a request from sightholders seeking to participate in the GIA’s Mine to Market (M2M) provenance program, a move JCK News Director Rob Bates called “wrongheaded” in an August 2017 editorial.

But don’t think for a second that Martin Rapaport isn’t also all about doing what’s best for Martin Rapaport’s business. He likes to portray himself as a champion for the little guy but, in the end, he’s made a lot of money in this business and will continue to find ways to do so.

Charles Wyndham made a very valid point in a piece posted to his website, PolishedPrices.com, late last month about the whole Rapaport-De Beers row that’s entertaining and definitely worth reading.

Specifically commenting on Rapaport’s crowing about De Beers’ lack of transparency, Wyndham wrote:

“The Rap list has put a glass ceiling on polished diamond prices for decades, it is an outrageously opaque system based on his opinion, so to accuse De Beers about lack of transparency is ripe in the extreme.Editor’s note: This story was updated post-publication to correct Rob Bates’ title. He is the news director at JCK, not the senior editor as previously stated.

De Beers have certainly hit the nail on the head when complaining about [Rapaport’s] screaming and shouting as if he was paragon of moral rectitude, he isn’t, but then who is?”

The Latest

The nearly six-month pause of operations at its Kagem emerald mine earlier this year impacted the miner’s first-half results.

The addition of Yoakum, who will lead Kay and Peoples, was one of three executive appointments Signet announced Thursday.

As a leading global jewelry supplier, Rio Grande is rapidly expanding and developing new solutions to meet the needs of jewelers worldwide.

The necklace uses spinel drops to immortalize the moment Aphrodite’s tears mixed with her lover Adonis’ blood after he was fatally wounded.

The diamond miner and marketer warned last week that it expected to be in the red after significantly cutting prices in Q2.

Jewelers of America’s 35th annual design contest recognized creativity, artistry, style, and excellence.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

Tratner succeeds Andie Weinman, who will begin stepping back from the buying group’s day-to-day operations.

The president made the announcement via Truth Social Wednesday, adding that India also will face a penalty for its dealings with Russia.

The luxury titan’s star brand Gucci continued to struggle amid a "tough" environment.

Its opening marks the completion of the retailer’s new 11,000-square-foot store in the Texas capital.

Respondents shared concerns about tariffs and commentary on the “Big Beautiful Bill.”

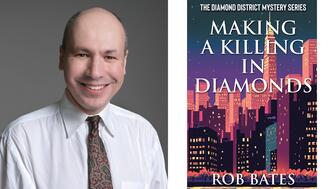

“Making a Killing in Diamonds” tells the story of Mimi Rosen, the disappearance of a scientist, and the murder of lab-grown diamond CEO.

The first-time exhibitors, set to debut at the New York City show, share a devotion to craftsmanship, storytelling, and material integrity.

The online auction house’s September sale will feature rough Brazilian emeralds of various qualities.

She’ll lead an executive committee consisting of President-Elect Bryan Moeller, Mitchell Clark, Bill Farmer, and Larry Rickert.

Announced Sunday, the deal will set the tax on goods imported into the United States from the European Union at 15 percent.

A new edition of the Italian brand’s “Ipanema” collection has debuted with gemstones that evoke Brazil’s breathtaking views.

The retailer will refer its customers to WonderCare, founded by venture capitalist and watch collector Kevin O’Leary.

The jeweler’s largest store yet is set to open in Little Rock next fall.

Anne Hathaway was seen wearing the toggle necklace three times while filming scenes for “The Devil Wears Prada 2.”

Jewellery & Gem World Hong Kong is scheduled for Sept. 15 to 21, and buyer pre-registration will be available until Sept. 7.

Renovations at Tiffany & Co. stores ate into profits in the company’s watch and jewelry division.

Mark and Candy Udell of London Jewelers will receive the honor at the 24th annual Gem Awards next March.

While struggles continue at the mining and trading end of the pipeline, consumer demand for diamond jewelry is holding steady.

The “Fantasia” jewelry collection turns the intaglio animals from her “Close Encounters” collection into 3D characters.