It is part of Sotheby’s “Royal & Noble Jewels” sale along with an ornate hair ornament and an old mine-cut light pink diamond ring.

Silver price expected to fall again in 2015

The per-ounce price of silver is expected to decrease this year as the dollar continues to strengthen and investments move out of the commodities sector.

New York--The per-ounce price of silver is expected to decrease this year as the dollar continues to strengthen and investments move out of the commodities sector. However, the metal could end the year on a strong note poised for growth in 2016.

London-based analyst Andrew Leyland, manager of precious metals demand at Thomson Reuters GFMS, told National Jeweler in an email that they are predicting the average silver price to decrease to $16.50 per ounce in 2015, down from just above $19 last year.

According to Kitco.com, in the first three months of 2015, silver has hit a high of $18.23 and a low of $15.47, with an average price of $16.70 per ounce for the period of January to March.

“The driving factor behind silver prices this year won’t be supply or physical demand but its attractiveness as an asset class for institutional investors, in our view,” Leyland said. “We’re continuing to see money move out of the commodities sector, into equities and fixed income, and this, along with a stronger dollar, has been underpinning weakness.”

He added that Thomson Reuters GFMS expects the silver price to end the year on a strong note and for the average to increase by a full dollar, to $17.50 per ounce, next year.

The price of silver likely will hit its lowest point of the year just before the Federal Reserve raises interest rates, the analyst said. “Higher rates in theory should be negative for the silver price as it’s a non-yielding asset. The market has been anticipating this, however, and we believe the rate hike is already priced in.”

The London Bullion Market Association also released its prediction for 2015 prices, with analysts forecasting an average price of $16.76 per ounce for silver--slightly higher than the Thomson Reuters GFMS forecast--with prices ranging throughout the year from $13.91 to $19.36.

The contributors named a number of factors behind this prediction, including the expected strengthening of the dollar, disinflation and slow growth from China and the Eurozone, all of which will push down the silver price, as well as positive price factors such as continued support of silver exchange-traded funds and expectations that the retail environment will continue to take advantage of the “attractive prices.”

According to Kitco.com, silver’s average per-ounce price last year was $19.08, reaching its high in February at $22.05.

From about July onward, the silver

The lower price of silver is continuing to have a positive effect on silver jewelry demand, and Thomson Reuters GFMS said that it is continuing to see a trend toward heavier pieces and movement away from plated products toward sterling silver.

The Latest

Hill Management Group will oversee, market, and produce next year’s spring show.

One of the individuals was apprehended at the airport as he was trying to flee the country.

From sunlit whites to smoky whiskeys, introduce your clients to extraordinary diamonds in colors as unique as their love.

The retailer, which has faced struggling sales in recent quarters, is looking to streamline its operations.

London-based investment firm Pemberton Asset Management acquired the auction house for an undisclosed amount.

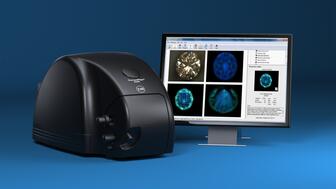

The workshop will give attendees the chance to try out and ask questions about three different diamond verification instruments.

As the holiday season quickly approaches, consider stocking one category that sometimes gets overlooked: earrings.

The footage shows two of the jewelry heist suspects descending from the second floor of the museum and then escaping via scooter.

Founder and designer Rosanna Fiedler looked to a vintage Cartier clutch when designing the sunlight-inspired drop earrings.

The luxury conglomerates faced a challenging Q3 amid geopolitical and economic tensions.

The struggling diamond mining company, which owns the historic Cullinan mine, has launched a rights issue to raise about $25 million.

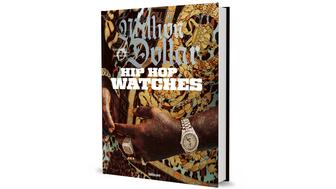

The book details the journey of watches as symbols of hard-earned success in hip-hop for artists like 2Pac, Jay-Z, and more.

Alexis Vourvoulis, who most recently worked at Tiffany & Co., brings more than two decades of jewelry experience to her new role.

The superstar’s August engagement put the stamp of approval on an already hot engagement ring trend.

Retailers should offer classic styles with a twist that are a perfect fit for layered looks, experts say.

The nearly 7-carat fancy vivid purplish pink diamond could sell for around $9 million.

The retailer’s new collection of engagement rings and fashion jewelry is set with natural diamonds that are traceable via blockchain.

Chief Artistic Officer Nathalie Verdeille has reimagined the iconic design in both figurative and abstract creations.

Five dollars buys one vote toward an industry professional you want to see dressed up as a hero, or a villain, this Halloween.

Recently acquired by KIL Promotions, the November edition of the public show in San Mateo, California, will be held Nov. 7-9.

The stone’s two zones, one pink and one colorless, may have formed at two different times, the lab said.

Hollywood glamour meets Milanese sophistication in the design of Pomellato’s new store in Beverly Hills, California.

The New York City store showcases a chandelier with 1,500 carats of lab-grown diamonds designed by an FIT student.

The Museum of Arts and Design's new exhibition features 75 pieces by the designer, best known for her work in the “Black Panther” films.

Making its auction debut, "The Glowing Rose" is expected to fetch $20 million at the November jewelry sale in Geneva.

They were attacked on Oct. 15, as approximately 40 miners without licenses marched on the mine’s gate.