The necklace is featured in the brand’s “Rebel Heart” campaign starring Adam Levine and Behati Prinsloo.

Gemfields Reports $60M Loss in 2018

A new tax levied in Zambia played a significant part in putting the colored stone miner in the red for the full year.

London—Gemfields recorded a net loss in 2018, hurt in part by a new tax levied in Zambia and a costly court case.

In its full year ended Dec. 31, which was first full fiscal year for the company since the July 2017 takeover of its biggest investor, Pallinghurst, Gemfields reported revenue of $206.1 million, a 252 percent increase over 2017. This was the first time it crossed the $200-million mark, the colored gemstone miner noted.

EBITDA also increased, from $30.5 million to $58.9 million.

Even with revenue hitting a new high, the company recorded a $60.4 million loss for the fiscal year, hurt by the fair-value loss on the Sedibelo platinum mines, in which Gemfields holds a 6.5 percent stake, a $22.6 million impairment charge applied to Kagem because of newly implemented tax changes in Zambia and a costly court case.

Starting Jan. 1, the Zambian government introduced a 15 percent export duty on gemstones and metals to help reduce the country’s debt. When combined with the existing 6 percent mineral royalty already levied on gemstones, it increases Gemfields’ total tax on revenue at Kagem to 21 percent.

Also last fiscal year, a group of Mozambicans filed a lawsuit against the London-based colored gemstone miner over alleged human rights abuses at the company’s Montepuez ruby mine. In January, Gemfields agreed to pay $7.6 million on a no-admission-of-liability basis to settle the lawsuit.

Gemfields’ share price reflected the challenges it faced at its operations throughout the year, falling 40 percent by the end of the year.

RELATED CONTENT: Fallout from Nirav Modi Scandal Hits GemfieldsIn its annual results release, Chairman Brian Gilbertson said the company’s biggest challenge in the coming months will lie in Zambia. In addition to the higher taxes, he noted that the mineral royalty is no longer tax-deductible for corporations.

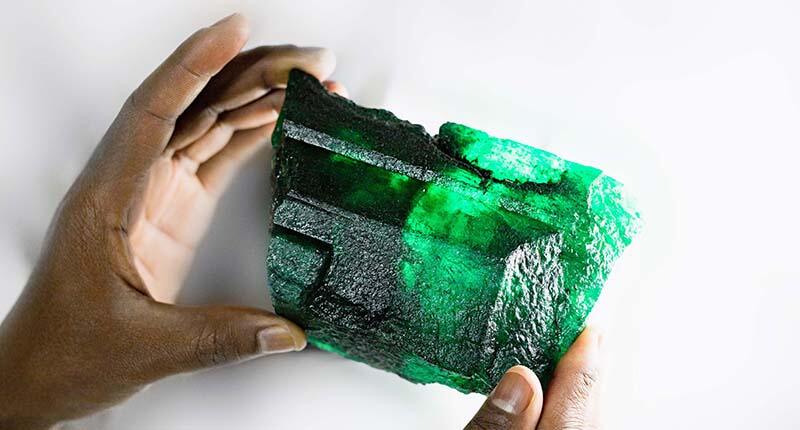

Because of the new taxes enacted, Gemfields has recognized an impairment loss of $22.6 million in respect to Kagem, its emerald mine there that faces other market headwinds as well.

Production in the “premium” category at Kagem reached 224,000 carats, representing a 400 percent increase in the category’s production in the 12-month period to June 2017 (Gemfields included pre-acquisition figures for the full-year t June 30, 2017, where possible to allow for better comparability).

Kagem also set new records for ore production and total carats produced. However, as production soared, the emerald market struggled.

As a result, the four emerald auctions during the year generated revenues of $60.3 million, which Gemfields called “tolerable” given the financial and regulatory oversight challenges facing Indian customers.

Higher-quality emerald auctions held during the year yielded a slight increase in average per-carat price, achieving $65.55 compared with $63.63 per carat in the 12-month period ended June 2017.

The per-carat average for commercial-quality emeralds was flat, achieving $3.54 per carat on average in 2018 compared with $3.53 per carat in the year up to June 2017.

Gemfields also faces challenges in Ethiopia, where it was mining emeralds.

In July 2018, a mob overran its mining operations and a month later looted the site. Its 110-person team there has been reduced to a handful, the company said, as it works to find a way to restart bulk sampling.

RELATED CONTENT: Gemfields Opens $15M Automated Sort House in MozambiqueMeanwhile, Gemfields’ operations in Mozambique, where it mines ruby and corundum, generated revenues of $127.1 million from the two Montepuez auctions of mixed-quality rubies held during the year, with the June auction seeing record results of $71.8 million.

In 2018, the mining area produced a total of 2.9 million carats of ruby and corundum.

Faberge, meanwhile, reported record revenues of $13.4 million in 2018 and saw triple-digit growth in online sales.

The Latest

The two organizations will host a joint event, “Converge,” in September 2025.

Padis succeeds Lisa Bridge, marking the first time the organization has had two women board presidents in a row.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

Jesse Cole, founder of Fans First Entertainment, shared the “five Es” of building a fan base during his AGS Conclave keynote.

The Royal Oak Perpetual Calendar "John Mayer" was celebrated at a star-studded party in LA last week.

The three-time Pro Bowler continues to partner with the retailer, donating to a Detroit nonprofit and giving watches to fans.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

A double-digit drop in the number of in-store crimes was offset by a jump in off-premises attacks, JSA’s 2023 crime report shows.

Inspired by the Roman goddess of love, the designer looked to the sea for her new collection.

The luxury titan posted declining sales, weighed down by Gucci’s poor performance.

The selected nine organizations have outlined their plans for the funds.

The mining company’s Diavik Diamond Mine lost four employees in a plane crash in January.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

Emmanuel Raheb recommends digging into demographic data, customizing your store’s communications, and retargeting ahead of May 12.

Located in the town of Queensbury, it features a dedicated bridal section and a Gabriel & Co. store-in-store.

A 203-carat diamond from the alluvial mine in Angola achieved the highest price.

Ruser was known for his figural jewelry with freshwater pearls and for his celebrity clientele.

The “Rebel Heart” campaign embodies rebellion, romance, and sensuality, the brand said.

Editor-in-Chief Michelle Graff shares the standout moments from the education sessions she attended in Austin last week.

The overhaul includes a new logo and enhanced digital marketplace.

The money will go toward supporting ongoing research and aftercare programs for childhood cancer survivors.

A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The move will allow the manufacturing company to offer a more “diverse and comprehensive” range of products.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.