Carlos Jose Hernandez and Joshua Zuazo were sentenced to life without the possibility of parole in the 2024 murder of Hussein “Sam” Murray.

Eurostar Diamond Traders Goes Into Bankruptcy

The diamond wholesaler’s debt reportedly tops $500 million.

Antwerp—Eurostar Diamond Traders, one of the world’s largest diamond manufacturers, has entered into bankruptcy.

The Antwerp Corporate Court ruled in favor of bankruptcy Thursday.

Prior to that ruling, the Antwerp Court of Appeal had denied the company’s request for a judicial reorganization, according to Belgian newspaper De Tijd.

The appeals court reportedly valued the company’s debt at 500 million euros ($560.4 million) and stated Eurostar had “lost the trust of its main creditors”, which includes ABN AMRO, Standard Chartered Bank, KBC Bank and Bank of India.

Eurostar Diamond Traders did not respond to National Jeweler’s request for comment Monday, but founder and Chairman Kaushik Mehta told Rapaport News that the company will appeal the decision.

The company pointed the finger at its major creditors, ABN Amro and Standard Chartered, accusing the banks of taking an aggressive approach regarding its debts.

ABN Amro did not respond to a request for comment when contacted Monday. Standard Chartered declined to comment on the case.

Founded by Mehta in 1978, Eurostar climbed the ranks to become one of Belgium’s largest diamond companies, setting up shop across the world in Botswana, China, Hong Kong, India, the United Arab Emirates and the United States, according to the company website.

At its height, the company brought in billions of dollars and landed the Mehta family the title of one of Belgium’s wealthiest families, according to De Tijd.

It’s been a rough road in recent years as the company battled a dip in sales and the loss of its status as a De Beers sightholder, which gives a company exclusive access to De Beers’ rough diamonds.

Eurostar had been a sightholder since 1986, but, as of Monday, did not appear on the De Beers’ current list of sightholders.

In its latest annual report, Eurostar cited falling demand for diamonds, especially in Asia, high prices for rough diamonds, and a lack of credit as the reasons behind its struggle, as per De Tijd.

During proceedings in September, Eurostar allegedly claimed its diamonds were worth more than $132 million, but the numbers weren’t quite adding up.

In November, the company reportedly admitted to the court that its diamonds were only worth $25 million, a figure the Antwerp court is still questioning following an evaluation.

The stock was reportedly estimated to be worth only $10 million and not all the stones were owned by Eurostar.

In denying the company’s request to reorganize, the Court of Appeals ruled that Eurostar

The Latest

Yood will serve alongside Eduard Stefanescu, the sustainability manager for C.Hafner, a precious metals refiner in Germany.

The New Orleans jeweler is also hosting pop-up jewelry boutiques in New York City and Dallas.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

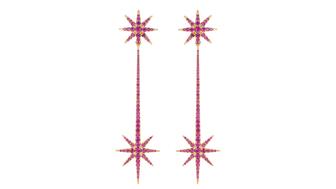

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.