Sponsored by the Gemological Institute of America

What’s the Future of Physical Retail?

From fewer stores to socially distanced shelving, here’s how COVID-19 has changed the in-store experience.

“When can we reopen?,” “How do we do that safely?,” and “How do I keep my business afloat in the meantime?” they asked themselves, government officials, retail organizations and each other.

Uncertainty abounded, and they had to find a way to strike a balance between customer safety and the health of their businesses, if that was even possible.

They had to be quick on their feet when day-to-day operations fundamentally changed, from offering curbside pickup and doing engagement ring consultations over Zoom in the early stages of the pandemic to implementing in-store mask policies and installing hand sanitizer stations as reopenings rolled out.

Months later, the number of COVID-19 cases was still climbing and what retailers thought were temporary safety protocols, from sanitation stations to social distancing signage, now seem here to stay for the foreseeable future.

The list of questions grows longer by the day but the overarching unknown is, what is retail going to look like in the wake of COVID-19?

We reached out to retail experts and dug through data to find some answers.

The Necessity of Physical Retail

Bringing customers into a physical store, a problem long before COVID-19 became a pandemic, grows increasingly difficult amid safety concerns while online sales continue to climb.

The continued growth of e-commerce begs the question, how necessary are physical stores to the retail landscape?

Online shopping has been growing and gaining market share over the years, according to the latest U.S. Census Bureau data.

In 2009, e-commerce sales in the United States totaled $134.9 billion, accounting for a little less than 4 percent of total sales. Fast-forward a decade and they’ve ballooned to $601.7 billion.

That’s growth of nearly 350 percent in 10 years, but e-commerce still only has a sliver—11 percent—of total retail sales.

When the pandemic took hold, retailers that already had an online presence, or quickly figured out how to get one, found online sales to be their saving grace as physical stores were closed to help stem the spread of the virus.

The heightened popularity of online shopping exacerbated fears that in-store shopping was soon to be shown the door.

“There will be some changes that happen as a consequence of this, but I don’t think for one second that it’s going to fundamentally change people’s need and want to get out into retail stores,” he said.

Smith, who is also president of diamond brands Mémoire and Hearts On Fire, believes brick-and-mortar stores will remain relevant due in part to the human need to be around others.

A 2017 survey by Retail Dive asked 1,425 shoppers their reasons for shopping in stores rather than online. About one-fifth, or 18 percent, said they just liked the experience of going into a store.

The ability to touch and feel items was also a major draw, cited by 62 percent of those surveyed, while 49 percent liked the instant gratification of taking their purchase home immediately.

One in five consumers liked the easy returns process afforded by in-store shopping.

Only 13 percent cited the ability to ask store associates questions as a reason to go into a store, signaling some improvements could be made in that area for shoppers used to having a world of information at their fingertips when shopping online.

Nicole Leinbach Reyhle, the retail maven behind website Retail Minded, also believes stores are here to stay and have something special to offer consumers.

“Physical retail offers connectivity to consumers that online doesn’t.”

Customers may be staying home right now but that won’t last forever, she says, and returning customers are on the lookout for brand connectivity both online and in stores.

As for whether or not a retailer absolutely needs a physical store, that’s hard to say.

Reyhle says retailers need to consider their audience, because a retailer looking to sell locally and one looking to broaden its horizons each have different needs.

A Look to the Majors

Some retailers definitely benefit from having a storefront, but just how many do they need? And where should they be?

Major retailers have been reassessing their physical footprint in recent years, downsizing as they move out of struggling malls and other slow-traffic areas.

The pandemic only hastened retailers’ need to rightsize their store count.

Signet Jewelers Ltd., the parent company of stores including Zales and Kay Jewelers, began leaving Class B malls and shuttering its regional banners before the COVID-19 pandemic took hold.

The jewelry giant, which ranks No. 1 on both the “$100 Million Supersellers” and “Top 50 Specialty Jewelers” lists, plans to close nearly 400 locations in North America and the United Kingdom this fiscal year.

Signet noted in its quarterly results what many other retailers have also seen.

Online sales have been one of the only bright spots on the balance sheet, forcing the specialty jeweler to take a second look at its store count and double down on its online capabilities.

“COVID has pushed all retailers to have to reconsider how they connect with their audiences as well as what their overhead is to maintain a healthy business,” says Reyhle.

Neiman Marcus, which slipped one spot to No. 19 on this year’s $100 Million Supersellers list, took those factors into consideration when it decided to close 24 of its 67 locations this summer, a total of seven department stores and 17 Last Call discount stores, as part of its Chapter 11 bankruptcy proceedings.

The most notable closure was its nearly new three-level store in Hudson Yards, an upscale shopping center on Manhattan’s West Side.

The 188,000-square-foot megastore was a beacon of department store glamour, replete with personal shopping services, a spa, a pop-up florist, and four trendy food spots. The store’s opening night party in March 2019 was packed with stars and other beautiful people, but the foot traffic that followed was less exciting.

When COVID-19 forced Hudson Yards to close temporarily, the already struggling Neiman Marcus was in a tough spot.

In the announcement about store closures, the retailer said an analysis of consumer behavior signaled customers’ penchant for online shopping would stick, and so that’s where it would refocus its efforts.

“The COVID-19 pandemic reaffirmed the importance of our stores as a key place to build customer relationships in the context of our digital ecosystem,” said a company spokesperson.

The retailer said it will focus on the luxury customers it has through its two Bergdorf Goodman stores, located across from each other on Fifth Avenue in New York, and serve its Neiman Marcus customers both online and at its other 36 physical Neiman Marcus locations.

Retailers hoping to survive this pandemic may need to refocus, just like Neiman Marcus.

“Right now, retailers need to take advantage of any potential slow time or downtime they have to prepare for the rebirth of their businesses.” — Nicole Leinbach Reyhle, Retail Minded

The Retail Renaissance Ahead

Soothsayers have foretold the end of retail as we know it for years. From the 2008 financial crisis to COVID-19, the retail apocalypse is drawing nigh, they say.

Perhaps the retail landscape is, instead, undergoing a renaissance, incorporating a blend of in-store and online shopping to better serve a changing world.

Online shopping isn’t anything new, but when stores shuttered it drew in some people who were new to the experience.

An Inmar Intelligence survey on online grocery shopping, for example, found nearly 80 percent of consumers have shopped online for groceries since the onset of COVID-19, compared with 57 percent who did so before the pandemic.

Retailers may have been learning new lessons throughout the pandemic, but consumers have been getting schooled too, says Rehyle.

Customers began familiarizing themselves with all available shopping options, from buy online, pick up in store (otherwise known as BOPIS) to contactless delivery.

Fine jewelry consumers accustomed to hands-on service, complimentary beverages and themed in-store soirees instead found themselves having their purchases handed to them through the passenger-side window of their cars, watching trunk shows on Instagram Live and getting on Zoom to pick out an engagement ring or anniversary gift.

“A lot of customers have experienced for the first time what a Zoom store visit might look like or connecting via FaceTime with a store associate to browse a physical store remotely,” Rehyle notes.

Shoppers are enjoying the convenience and peace of mind these options offer, particularly at a time when in-store visits might feel unsafe.

Some consumers will decide they prefer online shopping while others will incorporate BOPIS and other e-commerce options into their shopping routines, she says.

For those who opt to still shop in physical retail spaces, they’re going to find that their favorite stores look different.

Spreading Out

Health and safety are the main concerns for a majority of consumers in the wake of COVID-19 and that’s going to be reflected in the retail world.

Walmart (No. 2 on the $100 Million Supersellers list), Costco (No. 4), JC Penney (No. 8) and Target (No. 14) are among the major retailers requiring masks to be worn in stores. Hand sanitizer stations are a fixture in stores large and small.

Some retailers are using floor decals to promote social distancing or guide store traffic to prevent a pile-up in the aisles.

Shoppers can expect to see more spaced-out shelving as well.

“We’ll see not only social distancing within merchandising efforts, but I also think that we will use signage to communicate more to customers than we have in the past,” says Rehyle.

As the retail experience changes, signage will be a key tool for communicating to customers what to expect, starting with that “masks required” sign on the front door.

As consumers navigate the new surroundings, signage can point them in the right direction, from which way to walk to how to request to see an item.

Getting a closer look at an item comes with its own set of problems as retailers try to keep the merchandise as clean as possible.

“We’re going to start to see product packaging be a little bit different,” says Rehyle. “You don’t want to touch something that you’ve probably seen a few other people touch already.”

She foresees an increase in packaging that is designed to resist or prevent the spread of germs.

And stores may dial up their sanitation protocol to clean not only surfaces, but inventory as well.

Many jewelers, big and small, already have implemented a policy of cleaning pieces after every customer try-on.

Shoppers will see these changes and safety features and more, but only if the stores remain open.

In some areas of the U.S., restrictions eased and stores reopened in the spring, only to be shut down again when COVID-19 cases rose.

Given the unpredictable—and unknown—nature of the virus, agility is going to be important to retailers when looking at the store layout.

Melissa Gonzalez, CEO of retail strategy firm The Lionesque Group, said her company is recommending modular designs to some of its clients.

A modular design is one that creates a space using independent parts that can be deconstructed and reconstructed quickly, like Lego blocks.

“We’re really going to have to create agile environments going forward, whether it’s the storefront that can quickly pivot from a point of storytelling to a point of pick-up, or a cash wrap that can serve somebody who does self-check-out through their mobile device,” she said in a July webinar about the physical retail landscape.

As consumers look to minimize interactions, technology is going to play an even greater role in the shopping experience.

Safe But Still Engaging

Physical retail is reliant on immersive experiences but when high-touch environments pose a threat, it’s time to rethink things.

“There’s a lot of ways you can immerse a consumer in a non-touch way and ignite the other senses,” Gonzalez said on the webinar.

Retailers will need to integrate technology, like augmented reality and artificial intelligence, to fill the gap online shopping can’t.

Helzberg Diamonds (No. 17 on the $100 Million Supersellers list) introduced the Virtual Ring Experience to some of its stores in 2019, using augmented reality technology to blend the in-store and online experiences.

Shoppers can browse through their options on a tablet and get a visual on what each ring would look like on their hand.

Helzberg’s also been experimenting with the Diamond Room Experience, allowing shoppers to view the diamond of their choice up close on a 24-inch high-resolution screen.

Amid new tech elements and safety protocols, retailers staying true to the feel of their brand and their stores is important to avoid losing their voice, and their customers.

“You don’t want it to become so clinical that it feels icky and the consumer questions, do I need to go there again?” — Melissa Gonzalez, The Lionesque Group

Remembering the brand is key to immersing customers, and adding a little humor and levity to the situation can help too.

“We all know this is a serious moment, so I don’t think you’re making light of that. But you’re still making it feel good because shopping is supposed to be an emotional experience,” said Gonzalez.

She recommended intertwining “little moments of surprise and delight” in the experience, whether that’s a special note in the bag at curbside pickup or a fun message in a QR code.

Retailers need to look at all the touchpoints in which they can deliver a five-star experience, says Rehyle.

“Customers have always appreciated stronger customer support, but now more than ever, if they’re willing to go into a physical store, for many of them, they look at that as a compromise to their health, a risk they’re taking. They need to feel as if they’re getting a heightened experience,” she says.

She refers to it as “red carpet” customer care: “You need to be starstruck, treat your customers like royalty, and get their autographs.”

The purpose of purchase has changed from the utilitarian experience it’s been in the past.

Shoppers now are looking for an experience more than an item, and retail will continue to be about “shoppertainment,” says Rehyle.

“We’ve talked about these things in the past but now I think it’s going to be what will separate those brands that survive versus those that don’t.”

The Latest

The suspect faces charges in the August robbery of Menashe & Sons Jewelers and is accused of committing smash and grabs at two pawn shops.

The “Lumière Fine” collection was born from designer Alison Chemla’s interest in the transformative power of light.

Show off your spooky side with these 12 festive jewels.

The “Brilliant & Beyond” panel coincides with the “Love & Marriage” exhibition curated by Davis Jewelers in Louisville, Kentucky.

Consumers are feeling more optimistic about their present situation while the short-term future remains a little scary.

From sunlit whites to smoky whiskeys, introduce your clients to extraordinary diamonds in colors as unique as their love.

The company, which organizes a watch show in Geneva every spring, will bring a selection of watch brands to the 2026 Couture show in Vegas.

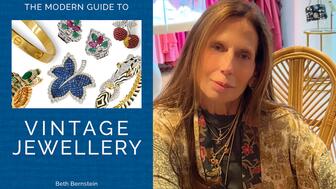

“The Modern Guide to Vintage Jewellery” follows the evolution of jewelry design from the ‘30s to the ‘80s with buying and styling advice.

For her annual Halloween story, Senior Editor Lenore Fedow explores the symbolism behind spiders, beetles, and other eerie insects.

Notable jewelry designers, members of the press, and retailers are up for an award at next year’s gala.

Leaders from Jewelers of America and National Jeweler discuss the gold price, tariffs, and more in this one-hour webinar.

After experiencing motherhood, growth, and loss, founder and designer Erin Sachse has created 10 irreplaceable jewels.

It is part of Sotheby’s “Royal & Noble Jewels” sale along with an ornate hair ornament and an old mine-cut light pink diamond ring.

One of the individuals was apprehended at the airport as he was trying to flee the country.

The retailer, which has faced struggling sales in recent quarters, is looking to streamline its operations.

Hill Management Group will oversee, market, and produce next year’s spring show.

London-based investment firm Pemberton Asset Management acquired the auction house for an undisclosed amount.

The workshop will give attendees the chance to try out and ask questions about three different diamond verification instruments.

The footage shows two of the jewelry heist suspects descending from the second floor of the museum and then escaping via scooter.

Founder and designer Rosanna Fiedler looked to a vintage Cartier clutch when designing the sunlight-inspired drop earrings.

The luxury conglomerates faced a challenging Q3 amid geopolitical and economic tensions.

The struggling diamond mining company, which owns the historic Cullinan mine, has launched a rights issue to raise about $25 million.

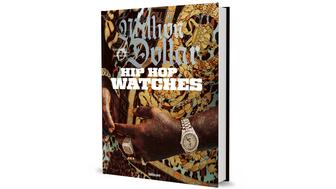

The book details the journey of watches as symbols of hard-earned success in hip-hop for artists like 2Pac, Jay-Z, and more.

Alexis Vourvoulis, who most recently worked at Tiffany & Co., brings more than two decades of jewelry experience to her new role.

The superstar’s August engagement put the stamp of approval on an already hot engagement ring trend.