Carlos Jose Hernandez and Joshua Zuazo were sentenced to life without the possibility of parole in the 2024 murder of Hussein “Sam” Murray.

Pandora Lowers Yearly Outlook Following Rough Q3

Like-for-like sales were down across its top seven markets, including a 9 percent dip in the United States.

Copenhagen, Denmark—Pandora had a rough third quarter and has lowered its financial outlook for the year as the cost of its brand relaunch and weak sales in China weigh heavy on its balance sheet.

Like-for-like sales dipped 10 percent year-over-year, including double-digit declines in key markets such as the U.K. and China. (Like-for-like represents true comparable sales out of stores that have been open for at least a year, excluding currency fluctuations.)

Quarterly revenue totaled 4.42 billion Danish kroner ($656.63 million), falling 11 percent compared with 4.98 billion kroner ($740.85 million) in the third quarter of last year.

“The deliberate actions of the commercial reset hurt our short-term financial performance, but it’s unquestionably the right thing to do,” CEO Alexander Lacik said in an earnings call Tuesday morning.

“We will exit 2019 in much better shape in key areas with less dependence on promotions, more balanced inventory levels, and a more efficient product assortment.”

Like-for-like online sales jumped 12 percent, accounting for 10 percent of total revenue, slightly higher than the 8 percent in the previous third quarter.

Total revenue in the United States fell 14 percent year-over-year while like-for-like sales sank 9 percent. The U.S. remains Pandora’s top market, accounting for 20 percent of global revenue.

Pandora attributed the weak performance in the U.S. to a reduction of promotional activity—it cut back on the number of sale days by 40 percent—but noted that adjusting for the reduction, like-for-like sales were “in line with the overall retail traffic development in the U.S.”

Organic growth— sales into stores (sell-in) plus sales from newly opened stores (also excluding currency fluctuations)— in the U.S. sank 18 percent, which the company said represents a “significant reduction” in inventory among its wholesale partners, which was larger than it expected this quarter.

Pandora described its performance in China as “disappointing,” seeing a 7 percent dip in total revenue and a 16 percent drop in like-for-like sales.

Double-digit growth in sales on Tmall, a popular e-commerce site, was offset by weak sales for Chinese Valentine’s Day this August. The holiday accounts for around 32 percent of its third-quarter revenue, Pandora said.

The company has responded with a “Win-in-China” initiative, an element of its Programme Now turnaround effort, which includes commercial initiatives, like brand positioning, and optimizing its media spend.

Like-for-like sales were down across the board in Pandora’s top seven markets, including a 10 percent dip in the U.K., its second-largest market by revenue share,

By category, sales of charms fell 12 percent year-over-year while sales of bracelets and rings were both down 13 percent.

Revenue from its earrings and necklaces and pendants segments slipped 6 percent.

Looking ahead, Pandora lowered its financial guidance for the full year, forecasting negative organic revenue growth in the 7 to 9 percent range, compared with its previous guidance of a 3 to 7 percent decline.

The company attributed the change in part to higher-than-expected cuts in inventory levels with its wholesale partners.

In a press release, Lacik called the third quarter “an important milestone for Pandora,” noting consumers have responded positively to the company’s rebranding initiatives, adding that Pandora is expecting “solid” Christmas sales.

“We continue to believe that we will see an improvement in like-for-like in Q4, although the exact magnitude is clearly subject to uncertainty,” he said.

In addition to its quarterly results, Pandora announced Monday the nomination of Peter Ruzicka as its new member and chair of its board of directors.

His appointment is subject to election at its general meeting, which is scheduled for Dec. 4.

The Latest

Yood will serve alongside Eduard Stefanescu, the sustainability manager for C.Hafner, a precious metals refiner in Germany.

The New Orleans jeweler is also hosting pop-up jewelry boutiques in New York City and Dallas.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

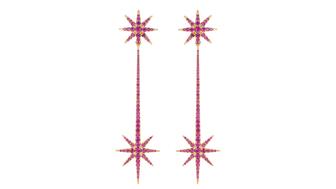

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.