From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

Richemont’s Jewelry Sales Resilient in a Rough Q4

The luxury titan behind Cartier and Van Cleef posted an 18 percent drop in quarterly sales amid the coronavirus pandemic.

Geneva—Richemont posted a double-digit drop in fourth-quarter sales as the COVID-19 pandemic took its toll, but said better days may lie ahead as it notes strong demand at its reopened boutiques in China.

Sales in the company’s fiscal fourth quarter, which ended March 31, dipped 18 percent year-over-year at actual exchange rates with the Asia-Pacific region hit especially hard.

Protests in Hong Kong coupled with the COVID-19 pandemic contributed to a 36 percent drop in sales, including a 67 percent decline in Hong Kong.

In the Americas, quarterly sales were up 9 percent year-over-year while in Europe, sales were down 9 percent.

Richemont noted its jewelry brands and online distributors were growth-drivers and “showed resilience” despite the rough quarter.

“The luxury goods industry is in a privileged position,” said Chairman Johann Rupert in a statement, adding that hard luxury products are the embodiment of “centuries of heritage and craft skills.”

“Cartier was established in 1847 and has survived two world wars; Vacheron Constantin began manufacturing watches in its current premises in Geneva in 1755,” he said. “Our maisons will survive these difficult times, supported by the strength of Richemont’s balance sheet.”

In the full fiscal year ended March 31, sales were flat at constant exchange rates, totaling €14.24 billion ($15.37 billion), slightly higher than the €14.1 billion ($15.2 billion) analysts had expected.

Excluding online sales, annual sales were down 3 percent year-over-year at constant exchange rates.

Retail sales (sales at Richemont-owned and -operated boutiques) dipped 2 percent at constant exchange rates, which the company attributed to the protests in Hong Kong and France earlier in the fiscal year as well as the impact of the COVID-19 pandemic starting in January.

Wholesale sales fell 5 percent with growth in Japan offset by declines in other regions as a result of store closures and social unrest.

Its specialist watchmakers division, which also includes A. Lange & Söhne and IWC Schaffhausen, also weighed on wholesale results as it continued to focus on optimizing its wholesale network and balancing sell-in with sell-out, said Richemont.

Online sales posted double-digit growth in nearly every region, up 14 percent at constant exchange rates and accounting for 19 percent of sales for the year, up from 16 percent a year ago.

Sales in Richemont’s jewelry division were up 2 percent at actual exchange rates in the fiscal year, reaching €7.22 billion ($7.80 billion) with strong online sales.

Richemont attributed the increase in part to the opening of

Jewelry collections that performed particularly well included Cartier’s new “Clash de Cartier” collection and Van Cleef & Arpels’ “Juste un Clou” and “Perlée” lines.

As for the jewelry brand’s watch offerings, Cartier’s revamped Baignore and Santos de Cartier did well alongside Van Cleef & Arpels’ Alhambra collections.

Buccellati, the Italian jewelry brand Richemont acquired in September 2019, also performed well, especially the “Macri” collection.

The jewelry segment posted mid- to high single-digit sales growth in the Americas, Europe, and Japan, which offset a decline in the Asia-Pacific region.

The company recently renovated its Van Cleef & Arpels store on Los Angeles’ Rodeo Drive and relocated the Cartier boutique in China World Beijing.

Its specialist watchmakers division faced a “challenging environment” with sales slipping 4 percent to €2.9 billion ($3.13 billion).

The division performed well in the Americas and Japan, but retail and wholesale sales were down overall.

The company highlighted the performance of Panerai’s new “Submersible Carbotech” collection and the anniversary editions of A. Lange & Söhne’s “Lange 1.”

Richemont’s operating results sank 20 percent as a result of lower sales, higher gold prices, “strict” cost control, and a stronger Swiss franc, which was partly mitigated by a stronger U.S. dollar.

By region, full-year sales in the Americas grew 6 percent at constant exchange rates to €2.81 billion ($3.03 billion).

European sales were up 4 percent, while sales in Japan dipped 1 percent. Sales in Asia-Pacific, the company’s largest region, fell 6 percent.

The Middle East and Africa posted a 3 percent dip in sales.

As for fiscal guidance, Rupert said there is “very limited visibility as to what the year ahead holds.”

But he said there are signs of improvement, noting the company’s 462 boutiques in China have seen “strong demand” since reopening in March.

The Latest

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

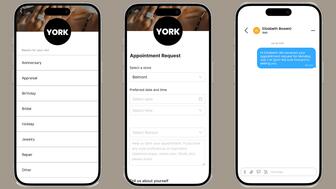

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

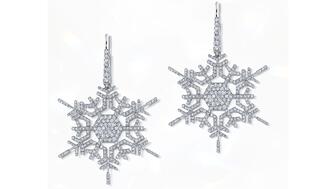

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet