The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

A. Jaffe, Firestar Diamond File Bankruptcy

They are the U.S. companies connected to Nirav Modi, the diamantaire accused of defrauding an Indian bank out of billions.

New York--The U.S. companies connected to Indian diamantaire Nirav Modi filed for bankruptcy protection Monday in New York.

In separate but nearly identical filings, affiliate companies Firestar Diamond Inc. and A. Jaffe Inc. stated that filing Chapter 11 was in their best interest after reviewing the “liquidity and supply challenges” they face. Affiliate company Fantasy Inc. also filed Chapter 11.

Modi and his uncle, Gitanjali Managing Director Mehul Choksi, are accused of scamming Punjab National Bank (PNB) out of $1.8 billion--allegations both have denied.

Though Modi, who left India in January, is reportedly refusing to return to the country, the government has taken action in an effort to recoup money for the state-owned bank, seizing paintings, property and jewels belonging to the billionaire.

Authorities also shut down the factories that were the primary suppliers of merchandise to Firestar Diamond and A. Jaffe, essentially cutting off the companies’ supply, said Ian Winters, the New York attorney representing all three companies.

He said Chapter 11 provides the companies with the best forum to continue to operate; it provides reassurance to suppliers that they are going to be get paid and to customers that they are going to continue to receive merchandise, while also giving the companies transparency and protection.

(Firestar, Fantasy and A. Jaffe are not the first diamond companies with overseas ties to seek the protections afforded by bankruptcy in the U.S. Antwerp-based diamond company Exelco filed Chapter 11 in Delaware after withdrawing its case in Belgium in order to block lender KBC Group NV from seizing and liquidating its assets overseas.)

RELATED CONTENT: Nirav Modi Case Is ‘Another Nail in the Coffin’Firestar Diamond/Fantasy Inc. and A. Jaffe issued separate statements following their Chapter 11 filings.

In its statement, Firestar/Fantasy noted it expects to still be able to fulfill orders, pay vendors and “do business as they have always been doing” during the bankruptcy process.

Meanwhile, A. Jaffe said that while it is aware of the “unfortunate allegations of financial improprieties overseas,” its core team in the United States was not in any way involved with any of the alleged conduct. Winters pointed out that Modi was not an officer or a director in any of the three U.S. companies and was not involved in their day-to-day operation.

A. Jaffe did note, however, that there will be “some disruption” in supply over the next 30 days because it now must do all of its manufacturing in New York.

As

A. Jaffe, which has been in the jewelry business since 1892 and is known for its engagement rings and personalized map pieces, is looking for another investor, while Firestone Diamond/Fantasy is looking for a buyer.

Winters said there have been “serious expressions of interest” for all of the companies.

The Chapter 11 petitions were filed in the U.S. Bankruptcy Court for the Southern District of New York and list an equal amount of estimated assets and estimated liabilities for both: between $10 and 50 million.

Firestar Diamond stated in its filing that it was formerly known as both Firestone Inc. and Next Diamond Inc.

A. Jaffe Inc. lists Sandberg & Sikorski Corp. as an F/K/A, and also lists itself as doing business as (D/B/A) Sandberg & Sikorski, Firestar Fine Jewelry and Preferred 105.

The Latest

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

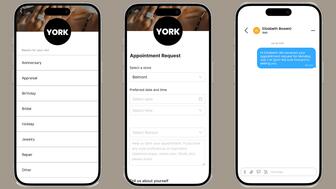

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

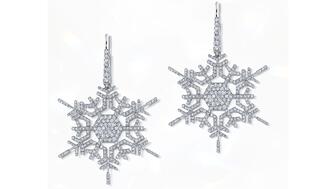

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

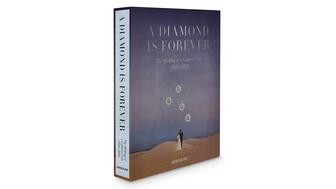

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.