From Coco Gauff’s hoops to Madison Keys’ diamond medallion, these are Senior Editor Lenore Fedow’s standout jewelry looks of the season.

Global Luxury Goods Market Settles into ‘New Normal’

Bain & Co. said spending on global luxury goods grew 4-6 percent last year and it forecasts the same for 2019.

Milan—The global personal luxury goods market has reached a “new normal” pattern of growth after strong performances in both 2017 and 2018, according to Bain & Co.

In its recently released “Bain Luxury Goods Worldwide Market Study, Spring 2019,” the management consulting firm reported that the market grew 6 percent year-over-year in 2018 to approximately $293.63 billion in sales.

An acceleration in domestic spending from mainland China consumers and an increase in European tourism drove the growth, though the report also noted that moderate growth is being seen in most markets.

Bain expects sales to remain steady in 2019—4 to 6 percent growth (at constant exchange rates), with sales totaling between $306.07 and $311.71 billion.

In the Americas, the U.S. luxury market was “tepid, with mild growth” throughout 2018.

The new tax reform plan created some uncertainties for consumers and negatively impacted domestic spending on personal luxury goods, Bain said, while malls and department stores continued to struggle with decreasing foot traffic.

Mono-brand stores in the region, meanwhile, maintained a positive growth trend.

Bain & Co. is forecasting 2 to 4 percent growth in the Americas this year, with a rise in domestic consumption in full-price stores but fewer Chinese tourists.

Meanwhile, despite socio-political turmoil in the U.K. and France, Europe also saw positive growth last year due to an influx of tourism spurred by the Euro’s weakening against all major currencies.

Ongoing turmoil in the region, as well as a weakening macro-economic outlook, continue to pose a threat to luxury goods spending, with a modest 1 to 3 percent growth forecast for 2019.

Mainland China continues to reign as a dominant market for luxury goods, as local consumers show a strong preference for purchasing in the domestic market; price harmonization, consumer-centered marketing strategies and government initiatives are all to thank for this trend.

“Solid” consumer confidence and a willingness to spend, especially when it comes to the younger generations, are expected to drive year-over-year-growth of 18 to 20 percent in mainland China in 2019.

Japan is still an “exclusive and attractive” market for luxury brands, Bain said, with forecasted growth of 2 to 4 percent in 2019 and tourist spending expected to rise ahead of the Tokyo 2020 Olympics next summer.

The remaining Asian regions also have a positive outlook, Bain added—apart from Hong Kong and Macau, which continue to lose ground to mainland China—and is expected to

A growing middle class with increasing disposable incomes is propelling Indonesia, the Philippines and Vietnam, while sustained growth in South Korea comes from local consumers and a slight tourism rebound.

Meanwhile, the luxury markets across the rest of the world are expected to be flat or see a slight decrease in 2019, with the Middle East remaining stagnant as consumer spending moves away from the domestic market.

Macro Trends in Luxury

In its report, Bain also identified five trends that likely will shape the next generation of luxury for the long term.

1. A new generation

Bain said the Chinese Gen Z demographic is “the segment to watch”—they’ll have significant spending power as “proud and empowered impulse buyers.”

2. Post-ownership

Bain said it anticipates a paradigm shift in consumption that will favor access over ownership; think: the sharing economy, rentals and the second-hand market.

3. Afterlife

Sustainability and social responsibility will be the focus, based on ideals centered on the environment, human labor and animal welfare.

4. Beyond physical

Digital will disrupt the entire luxury value chain and put the focus on luxury experiences over products.

5. Above volume/price

Customer networks will be the new measure of value.

“It’s important to highlight the role that insurgent brands will play in the luxury sector,” said Federica Levato, a partner with Bain and co-author of the study. “They will challenge established brands, pushing for a real paradigm shift with a more creative approach that goes beyond the product itself and impacts all facets of business, ultimately creating a more direct and continuous dialogue with consumers.”

The Latest

The trendy earrings feature asymmetrical drops, one with a grossular garnet and the other with a diamond.

Four social media marketing experts discuss their go-to methods and favorite tools for making high-quality short-form video content.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

Sponsored by American Gem Trade Association

In its holiday report, PwC said the season will be more like jazz—improvisational and less predictable—than an easy-to-follow melody.

The designer, who is the creative force behind her namesake brand, has now started a new mini line focusing on chains for fathers and sons.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

The awards include tuition for a course at the Swiss lab, economy flights, and hotel accommodation.

The 21-day program was designed to help jewelry retailers identify opportunities and eliminate inefficiencies with AI.

A set of four Patek Philippe “Star Caliber 2000” pocket watches is part of Sotheby’s upcoming auction in Abu Dhabi.

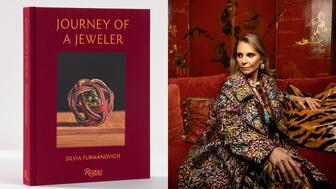

The Brazilian jeweler’s latest book marks her namesake brand’s 25th anniversary and tells the tale of her worldwide collaborations.

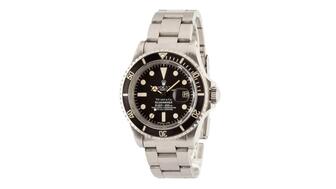

The Submariner Ref. 1680 with a Tiffany & Co. dial came from the original owner, who won it as a prize on the game show in the 1970s.

The new integration allows users to manage shipments directly from the Shopify dashboard.

At Converge 2025, Editor-in-Chief Michelle Graff attended sessions on DEI, tariffs, security, and more. Here are her top takeaways.

Six people were shot last week at an Oakland cash-for-gold shop as employees exchanged gunfire with individuals trying to rob the store.

The jeweler has expanded its high jewelry offering, which launched last year, with new pieces featuring its cube motif that debuted in 1999.

Ben Bridge Jeweler and Lux Bond & Green were a part of the pilot program.

Associate Editor Natalie Francisco shares eight of her favorite jewelry looks from the 77th annual Primetime Emmy Awards, held Sunday night.

It’s predicting a rise in retail sales this holiday season despite economic uncertainty and elevated inflation.

It included the sale of the 11,685-carat “Imboo” emerald that was recently discovered at Kagem.

The newly elected directors will officially take office in February 2026 and will be introduced at the organization’s membership meeting.

Associate Editor Lauren McLemore headed out West for a visit to Potentate Mining’s operation hosted by gemstone wholesaler Parlé Gems.

Fordite is a man-made material created from the layers of dried enamel paint that dripped onto the floors of automotive factories.

Gilbertson has worked as a researcher, jeweler, lapidary artist, appraiser, and business owner throughout his decades in the industry.

A decision likely won’t come until January 2026 at the earliest, and the tariffs remain in effect until then.

The new, free app offers accessible educational content, like games and podcasts, for U.S. retailers.