Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

Here’s What’s New With the Paycheck Protection Program

President Joe Biden revised PPP to prioritize small business owners who may have missed out on previous rounds.

Launched in April 2020 as part of a $3 trillion COVID-19 relief bill, the Paycheck Protection Program offers forgivable loans to small business owners.

Its rollout was rocky, fraught with administrative and technical issues for both banks and small businesses, from system crashes to a lack of direction from the federal government.

The program also took heat after reports surfaced that money was going to big businesses as mom-and-pop stores struggled, an issue this most recent round of changes looks to address.

The Biden-Harris Administration noted that while the changes are no substitute for passing a more comprehensive relief bill, they will provide some assistance to small businesses struggling amid the COVID-19 pandemic.

Here are the latest changes.

1) There’s a 14-day application period reserved for businesses with fewer than 20 employees.

The updated program has set aside a two-week period, from Feb. 24 to March 10, during which only businesses with fewer than 20 employees can apply.

This group represents 98 percent of all small businesses, but has received only 45 percent of PPP funding to date, according to the Small Business Administration (SBA).

The White House’s statement noted that these businesses, in particular, sometimes struggle to gather the necessary paperwork to apply for the loans.

The exclusive application period will allow lenders to focus solely on serving this group.

The deadline for all PPP applications in this latest round of funding is March 31.

2) Greater support is available for self-employed individuals.

In previous rounds of the PPP, sole proprietors, independent contractors, and self-employed individuals were sometimes excluded from the program because of the loan calculation formula, approving some for loans as little as $1.

The self-employed account for a majority of all businesses, said the Biden Administration, noting that 70 percent are owned by women and people of color.

The loan calculation formula will be revised to offer more relief to self-employed applicants.

There will also be $1 billion set aside for businesses that fall into this category and are located in low-to-moderate income areas.

3) Restrictions for owners with non-fraud felony convictions have been eliminated.

Business owners with a non-fraud felony arrest or conviction may be eligible under the updated program.

Previously, a business was ineligible for PPP if it was at least 20 percent owned by an individual with an arrest or conviction related to financial assistance fraud within the previous five years or any other felony within the previous year.

The bipartisan proposal will remove the one-year lookback restriction.

The exception does not apply to those incarcerated at the time of the application.

4) Small business owners behind on federal student loan payments may be eligible.

The new program would eliminate the restriction preventing small business owners who are delinquent on federal student loans from applying.

The previous program excluded businesses with at least 20 percent ownership by someone who is currently delinquent or has defaulted on a federal debt within the last seven years, including student loans.

Millions of Americans are delinquent on student loans, noted the White House, including a disproportionate number of Black individuals.

The SBA will work alongside the Departments of the Treasury and Education to remove the restriction.

5) Non-citizen small business owners can now apply.

Applications will be open for non-citizen small business owners who are lawful U.S. residents. They will be able to use Individual Taxpayer Identification Numbers (ITIN) to apply.

While the program allowed lawful U.S. residents to apply, there was confusion surrounding access for some ITIN holders, like Green Card holders or those here on a visa.

The SBA will issue clear guidance to prevent eligible applicants from being denied access to the program.

Additional Measures

On top of the five changes listed above, the administration said it will take additional steps to ensure relief is distributed fairly.

Looking to address waste, fraud and abuse, the next round of PPP loans will be approved contingent on passing SBA fraud checks, the Treasury’s Do Not Pay database—a service that checks payment eligibility—and public records.

Manual loan reviews will be conducted by the SBA for the largest PPP loans and a random sampling of other loans.

In an effort to promote transparency and accountability, the PPP application has been redesigned to “encourage self-reporting of demographic data and better illustrate the impact the PPP is having across various population segments.”

The SBA website will also be updated with resources for business owners to navigate the relief options available to them and information about how to complete the applications.

The Administration has been reaching out to small business owners, as well as CEOs of major banks, to better understand the challenges both owners and lenders face and to revamp the program to better serve small businesses.

To learn more about PPP or to apply, visit the SBA’s website.

The Latest

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

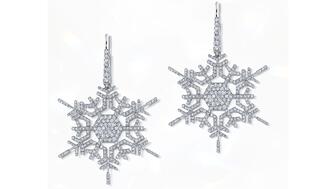

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.

Was 2025 a good year for jewelers? Did lab-grown diamonds outsell natural? Find out on the first episode of the “My Next Question” podcast.

Whether you recognize their jewels or are just discovering them now, these designers’ talent and vision make them ones to watch this year.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Plus, JSA’s Scott Guginsky discusses the need for jewelers to take more precautions as the gold price continues to climb.

Morris’ most cherished role was being a mother and grandmother, her family said.

“Vimini” is the first chapter of the “Bulgari Eternal” collection that merges archival pieces with modern creations.

The third edition will be held in Half Moon Bay, California, in April.

The grant is in its first year and was created to recognize an exceptional fine jewelry designer whose star is on the rise.

Data built on trust, not tracking, will be key to success going forward, as the era of “borrowed attention” ends, Emmanuel Raheb writes.

Heath Yarges brings two decades of experience to the role.

Pete’s boundless curiosity extended beyond diamond cut and he was always eager to share his knowledge with others, no matter the topic.

Cartier, Van Cleef & Arpels, Buccellati, and Vhernier had another successful holiday season, Richemont reported this week.

Our Piece of the Week is Lagos’ “Bee” brooch that was seen on the red carpet for the first time on Sunday.

Trevor Jonathan Wright led a crew in a string of armed robberies targeting South Asian-owned jewelry stores on the East Coast.

The program recognizes rising professionals in the jewelry industry.

A new lifestyle section and a watch showcase have been added to this year’s event.