WatchBox Secures $165M in Expansion Funding

The pre-owned luxury watch platform also welcomed new members to its board.

The Latest

Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

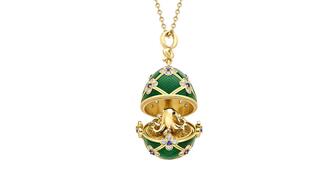

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

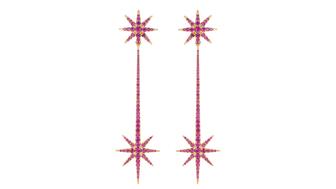

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.