Alrosa Lands on US Sanctions List After Russia Invades Ukraine

The sanctions are not a total ban on doing business with Alrosa in the U.S., but they still will have an impact on the jewelry industry.

The Department of the Treasury’s Office of Foreign Assets Control (OFAC) released an extended list of sanctions on Thursday, building on those imposed earlier this week to target the Russian financial system, including all its largest financial institutions and the ability of state-owned and private entities to make money.

Named on the list is Alrosa, the world’s biggest diamond producer by volume, mining 32.4 million carats in 2021 with sales topping $4 billion.

The diamond miner is listed under Directive 3 under E.O. 14024 from OFAC, which prohibits transactions and dealings by those in the United States in new debt of longer than 14 days or new equity of Russian state-owned entities.

In explaining its decision to sanction Alrosa, the U.S. Treasury said the company is responsible for 90 percent of Russia’s diamond mining capacity, which accounts for 28 percent globally.

The Russian government also holds a 33 percent stake in the company.

The sanctions are not an outright freeze on Alrosa’s assets, nor a complete ban on doing business with the company, the Jewelers Vigilance Committee explained.

They also do not apply to goods acquired from Alrosa or Alrosa USA before Feb. 24, 2022, though JVC recommends businesses hold on to records showing the date Russian-origin goods were acquired and pass along this information to customers if they ask.

What the sanctions do mean for the jewelry industry is that any open memo agreements with terms longer than 14 days should be amended to shorten the terms and/or closed, JVC said.

JVC also advises any U.S. business currently doing business with Alrosa or Alrosa USA should “evaluate the status of any transactions and work to ensure that their transactions do not violate the sanctions.”

The Treasury also launched new actions against influential Russians in President Vladimir Putin’s inner circle or in positions of power within Russia.

Among them is Alrosa CEO Sergey Ivanov Jr., added to the OFAC Specially-Designated Nationals list because he is the son of Sergey Ivanov Sr., a high-ranking Kremlin official who has been on OFAC’s Specially Designated Nationals list since 2014, and because he is a board member of Gazprombank, Russia’s third-largest financial institution and another sanctioned entity.

While the sanctions on Ivanov don’t necessarily prohibit transactions with Alrosa, JVC Deputy General Counsel Sara Yood said non-blocked entities controlled or led by blocked persons are at risk for further sanctions, as per OFAC.

She added that U.S. businesses considering transacting with companies controlled or led by sanctioned individuals should be sure they’re not making any missteps, such as inadvertently signing a contract with the blocked person.

As of press time, Alrosa had yet to issue a statement on the sanctions.

Thursday’s sanctions build on those levied earlier this week, when OFAC announced sanctions on two Russian banks, the Corporation Bank for Development and Foreign Economic Affairs Vnesheconombank (VEB) and Promsvyazbank Public Joint Stock Company (PSB), as well as 42 of their subsidiaries.

OFAC also levied sanctions on five high-ranking officials in President Vladimir Putin’s government.

“Our actions, taken in coordination with partners and allies, will degrade Russia’s ability to project power and threaten the peace and stability of Europe,” Secretary of the Treasury Janet L. Yellen said when Thursday’s sanctions were announced.

“We are united in our efforts to hold Russia accountable for its further invasion of Ukraine while mitigating impacts to Americans and our partners. If necessary, we are prepared to impose further costs on Russia in response to its egregious actions.”

JVC will address the Russian sanctions at its first compliance briefing of 2022, scheduled for Friday from 11 a.m. to noon Eastern. (It is for JVC members only.)

Jewelers of America said: “We are concerned about the evolving crisis in Ukraine and we are evaluating the real-world impact of sanctions. We will be issuing guidance to members in the coming days.”

In light of the sanctions released earlier in the week, both JVC and JA are urging U.S. jewelry businesses to determine if any of their suppliers or customers are using bank accounts connected to the sanctioned financial entities and, if so, to stop doing business with those accounts.

The full list of entities and individuals sanctioned Thursday can be found here and those sanctioned earlier in the week can be found here.

OFAC’s updated Specially Designated Nationals list is also available to search.

Anyone with questions or a need to obtain authorization to wind down transactions under a general license should contact the OFAC hotline at 1-800-540-6322.

The Latest

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

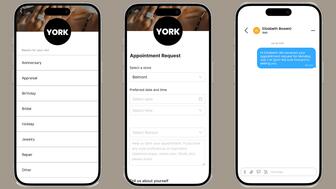

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

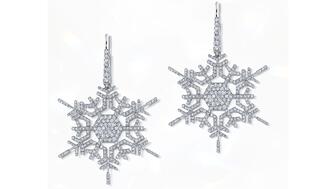

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

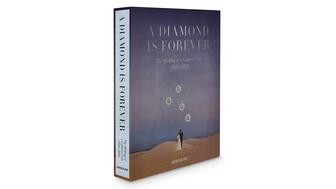

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.

Was 2025 a good year for jewelers? Did lab-grown diamonds outsell natural? Find out on the first episode of the “My Next Question” podcast.

Whether you recognize their jewels or are just discovering them now, these designers’ talent and vision make them ones to watch this year.