Set in a Tiffany & Co. necklace, it sold for $4.2 million, the highest price and price per carat paid for a Paraíba tourmaline at auction.

What's next for De Beers class-action suit?

After the whirlwind of news that was the last two weeks I feel compelled to circle back around and delve deeper into one of the big headliners: the decision on the De Beers class-action lawsuit. As many of you probably...

After the whirlwind of news that was the last two weeks I feel compelled to circle back around and delve deeper into one of the big headliners: the decision on the De Beers class-action lawsuit.

As many of you probably heard, on July 13 the U.S. Court of Appeals for the Third Circuit rejected the 2006 settlement De Beers reached with diamond buyers who sued the diamond giant based on allegations of price fixing, a violation of U.S. antitrust laws. Under the settlement, De Beers had established a $295 million fund to be distributed to millions of diamond buyers separated into two classes. Under the settlement, direct purchasers--companies that bought directly from De Beers or De Beers' mining competitors-were to share a pot of $22.5 million. Indirect purchasers, a group that includes retailers and consumers, were to divide up the remaining $272.5 million.

The court's latest decision likely leaves those with interest in this case (including interested consumers and retailers) with two main questions: Why was the settlement rejected? And, when will I ever get my money?

I'll attempt to answer these questions below, with input from Howard Bashman, the Pennsylvania attorney who filed the successful objection, and another class attorney in the case, Joe Tabacco of Berman DeVallerio in San Francisco.

Why?

In filing his objection, the point Bashman made--which the Third Circuit Appeals Court in Philadelphia agreed with--is that under antitrust laws in some states, you can only sue if you're the direct purchaser of a product or service.

So, Bashman argued, it was unfair for indirect purchasers from certain states to receive a portion of the settlement, since antitrust recovery is limited to only direct purchasers in the states where they reside. (As a point of note, according to the suit, the states are divided on the issue: about 25 allow indirect purchasers to recover in antitrust suits and 25 don't.)

"In this settlement, everyone got to recover no matter what state you're in," Basman says. "The consequences are people like my client are going to get less."

Bashman represents a single individual in this case, a woman from Texas, one of the states that allows indirect purchasers to sue in antitrust cases. Bashman is based in Willow Grove, Pa.

This is a short, simple explanation of the 75-page ruling in the case, which you can read in its entirety by clicking here.

Look at pages 29-31 for a breakdown

While much has been written and said about the attorneys involved in this case, particularly those for the objectors, I think two points need to be made here. One, like the delay or not, Bashman brought forward a valid point of law or the court never would have agreed with his objection. Two, the court ruling points out that this type of sweeping settlement has never been attempted in an antitrust case before. The lawyers in this case were trying something new that seems to have failed, at least for now.

What happens now?

Bashman said the attorneys in the case have until July 27 to ask the appeals court to reconsider their decision. If they chose not to, or if the appeals court denies the request, it returns to the trial court.

There, any number of things could happen. What Bashman would like to see is a new settlement organized on a state-by-state basis and limited to indirect purchasers who live in states with antitrust laws that allow them to sue, potentially meaning more money for those individuals.

Or, as Gemological Institute of America (GIA) diamond expert Russell Shor speculated in the July 16 GIA Insider e-newsletter, the case could splinter into separate lawsuits.

Will I ever get my money?

It's pretty widely known at this point that while the big diamond guys--the direct purchaser class --could net a substantial sum, the recovery for smaller players isn't going to be as much. But these days, money is money and I don't know many retailers that would turn down a check for any amount, no matter how miniscule.

Tabacco said the appeals court decision could delay the distribution of funds by four to 12 months or longer.

Stay tuned...

The Latest

The jeweler’s “Deep Freeze” display showcases its iconic jewelry designs frozen in a vintage icebox.

Take luxury gifting to new heights this holiday season with the jeweler’s showstopping 12-carat sphene ring.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

This year's theme is “Unveiling the Depths of the Ocean.”

In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

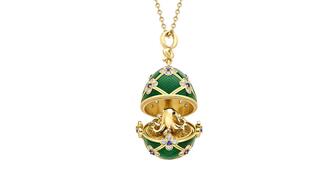

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

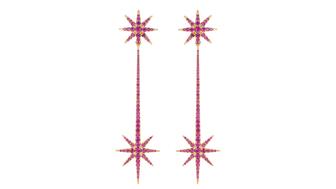

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.