In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Millennials, Gen Z Account for Two-Thirds of Diamond Jewelry Sales

According to De Beers Group’s latest Diamond Insight Report, diamond jewelry sales reached a record $82 billion high in 2017.

Hong Kong—Diamond jewelry sales last year reached a record $82 billion high in 2017, with much of the purchasing coming from young consumers, according to De Beers Group’s latest Diamond Insight Report.

According to the diamond miner’s study, the millennial and Gen Z generations made up two-thirds of that demand in 2017. And while the former makes up the largest group of diamond consumers now, Gen Z will be an even bigger customer base.

Millennials are currently aged 21 to 39 and make up 29 percent of the global population. Last year they represented 60 percent of diamond jewelry demand in the United States and close to 80 percent in China.

The Gen Z demographic is currently aged up to 20 and represents 35 percent of the world’s population. Despite the generation’s youth, 18- to 20-year-olds already accounted for 5 percent of diamond jewelry sales last year.

De Beers noted that both generations share values like holding love in high regard, growing up with the Internet, being interested in social issues and prioritizing authenticity and self-expression.

They differ however, in matters of trust. Millennials are a less trusting consumer, while Gen Z is more individualistic and optimistic, interested in building their own personal brands.

To better understand these two groups, the report broke down three ways the diamond industry can reach these demographics, keeping in mind how the generations overlap and differ in the aforementioned values.

First, diamond sellers should evolve how they talk about love to these consumers.

Romantic love is still the main driver of diamond jewelry sales, and millennials and Gen Z still want to follow tradition, but they want to do so on their own terms. Bridal sales account for 27 percent of diamond jewelry demand, but diamond gifts unrelated to marriage are still significant, representing 12 percent of the market.

Retailers should focus on more customizable offerings that represent the broad spectrum of love and commitment, rather than just diamond engagement rings.

Second, perhaps unsurprisingly, diamond sellers and retailers need to bring their selling experience onto multiple platforms, reaching these generations on their favored channels: Instagram and Snapchat. Facebook, Twitter and Pinterest are still important, but will reach an older consumer, not Gen Z.

These consumers want an omnichannel experience that’s completely seamless.

Sixty percent of Gen Z and millennial women in the United States aged 18 to 39 research diamond

In China, 98 percent Gen Z and Millennials aged 19 to 29 do research through at least one social media channel prior to purchasing.

Lastly, companies need to appeal to these consumers’ social conscious, and it can’t just be all talk.

De Beers said that Gen Z, in particular, won’t buy in to corporate storytelling. They want to see proof of ethical sourcing or the good that diamonds are doing for communities from which they came.

“Diamond jewelry demand reached a record global high in 2017; however, with the younger consumers’ desire for qualities that diamonds can perfectly embody—including love, connections, authenticity, uniqueness and positive social impact—the most exciting times for the diamond industry are still ahead of us if we can seize the opportunities,” De Beers Group CEO Bruce Cleaver said.

“The younger generations present wide-ranging opportunities for the diamond industry with the significant size and purchasing power of today’s Millennials and tomorrow’s Gen Z consumers. While both of these generations desire diamonds just as much as the generations that have come before them, there are undoubtedly new dynamics at play: those diamonds may now be in different product designs, used to symbolize new expressions of love and researched and purchased in different ways to mark different moments in life.”

The Latest

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

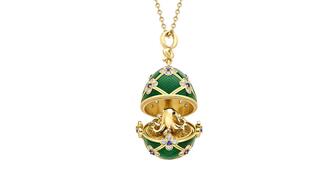

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

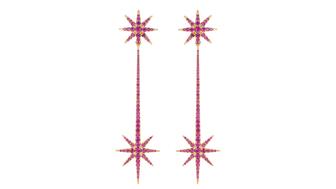

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.