Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Samuels Jewelers Files for Bankruptcy

It is the fourth U.S.-based company impacted by the multibillion-dollar bank fraud scandal that erupted in India earlier this year.

Wilmington, Del.—Samuels Jewelers Inc., the Texas-based jewelry chain controlled by Mehul Choksi, has filed for Chapter 11 bankruptcy.

The filing for the 120-store chain comes in the wake of a $1.8 billion bank fraud allegedly perpetrated by Choksi, who is the owner of Samuels parent company Gitanjali Gems, and his nephew, Nirav Modi, both of whom are wanted by Indian authorities.

According to an affidavit filed in U.S. Bankruptcy Court in Delaware on Tuesday, the bank scandal Choksi is implicated in “amplified the headwinds” already pounding Samuels Jewelers.

The retailer has seen sales slide and profits shrink in recent years due to competition from discount and online retailers.

When news of the scandal broke, Samuels Jewelers lost a major source of its products and funding in Gitanjali (which, according to court papers, has not been in operation since February), and vendors began to pull out, refusing to supply the retailer with merchandise on consignment.

According to court papers, the retailer is looking to sell itself as a going concern, but, in the meantime, plans to close more than 100 stores and has brought in Gordon Brothers Retail Partners and Hilco Merchant Resources to start selling off inventory in order to begin paying off its debts, which total more than $100 million and include millions owed to Wells Fargo N.A. and GB Credit Partners LLC.

The company also owes millions to vendors and service providers.

Court papers show that Samuels Jewelers’ five largest unsecured creditors are: Exclusive Design Direct Inc., a Sterling Heights, Michigan-based collection agency (owed $9.1 million); Taipinyang Trading Ltd., a Hong Kong company (owed $6.1 million); New York-based lab-grown diamond company GoGreen Diamonds Inc. (owed $5.5 million); New York-based Jewel Evolution Inc. ($2.4 million); and Austin, Texas-based jewelry company Voyager Brands Inc. (owed $973,952).

Samuels Jewelers joins A. Jaffe, Firestar Diamond and Fantasy Inc., which were owned by Nirav Modi, in filing for bankruptcy in the wake of the Indian bank scandal.

A. Jaffe has since has been sold as a going concern, and companies have purchased inventory held by both Fantasy and Firestar.

Tuesday’s filing marks the fourth trip through bankruptcy court for the chain that today is known as Samuels Jewelers, employs 690 people and has stores in 23 states operating under five nameplates: Samuels Jewelers, Rogers Jewelers, Andrews Jewelers, Schubach Jewelers and Samuels Diamonds.

David Blum and Gerson Fox founded the specialty jeweler

According to court papers, in the mid-1980s, the chain took advantage of lenient credit standards, increased consumer spending and the rapid expansion of indoor shopping malls to open more stores and acquire Mission Jewelers from Zale Corp. and Samuels Jewelers from Peoples Jewelers.

In the early 1990s, after almost a decade of growth and acquisitions, the company began to experience “financial distress.” It filed for Chapter 11 bankruptcy in February 1992.

It emerged from bankruptcy but was struggling again toward the end of the ‘90s, filing for Chapter 11 for the second time in May 1997.

When it emerged this time, 36 percent of the company was owned by DDJ Capital Management, and its board decided to change the company’s name from Barry’s Jewelers to Samuels Jewelers, its “most successful and, to the consumer, easily recognizable division,” court papers state. They also moved the company headquarters from California to Austin.

The retailer filed Chapter 11 for the third time in August 2003, and Gitanjali Gems bought the retailer shortly thereafter, in December 2006. It later acquired Rogers Ltd. and added Rogers Jewelers and Andrews Jewelers to its stable of U.S. retailers.

Gitanjali merged the two companies in 2010.

The Latest

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Registration is now open for The Jewelry Symposium, set to take place in Detroit from May 16-19.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.

Jewelry is expected to be the No. 1 gift this year in terms of dollars spent.

As star brand Gucci continues to struggle, the luxury titan plans to announce a new roadmap to return to growth.

The new category asks entrants for “exceptional” interpretations of the supplier’s 2026 color of the year, which is “Signature Red.”

The White House issued an official statement on the deal, which will eliminate tariffs on loose natural diamonds and gemstones from India.

Entries for the jewelry design competition will be accepted through March 20.

The Ohio jeweler’s new layout features a curated collection of brand boutiques to promote storytelling and host in-store events.

From heart motifs to pink pearls, Valentine’s Day is filled with jewelry imbued with love.

Prosecutors say the man attended arts and craft fairs claiming he was a third-generation jeweler who was a member of the Pueblo tribe.

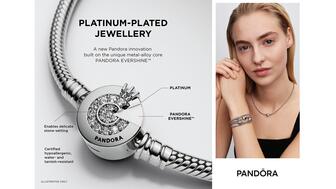

New CEO Berta de Pablos-Barbier shared her priorities for the Danish jewelry company this year as part of its fourth-quarter results.

Our Piece of the Week picks are these bespoke rings the “Wuthering Heights” stars have been spotted wearing during the film’s press tour.

The introduction of platinum plating will reduce its reliance on silver amid volatile price swings, said Pandora.

It would be the third impairment charge in three years on De Beers Group, which continues to grapple with a “challenging” diamond market.