The first watch in the series commemorates his participation in the Civil Rights movement, marching from Selma to Montgomery in 1965.

Charming Charlie To Close All 261 Stores

The accessories retailer has filed for Chapter 11 bankruptcy again and expects to shutter all stores by August 31.

Wilmington, Del.—Accessories store Charming Charlie filed for Chapter 11 bankruptcy Thursday, with plans to close all of its 261 locations by August 31.

The Houston-based retailer claimed $81.8 million in debt with $6,000 in cash on hand, as per a court filing.

Known for organizing its sections by color, the stores sell fashion jewelry, handbags, clothing and giftware.

Court documents show the company employs 3,342 people, including 856 full-time and 2,486 part-time workers.

Chief Financial Officer Alvaro Bellon pointed to “unsustainable” operating expenses, including “onerous leases” and constrained liquidity under its existing loans, as the issues hindering long-term sustainability in a preliminary statement in court filings.

The retailer leased all of its stores with aggregate occupancy costs totaling $47.4 million in 2018, as per court filings.

Bellon explained that to boost its credit line, the company had to buy more lower-quality inventory because its borrowing base expanded alongside its inventory level.

However, the inventory wasn’t up to the standards customers had come to expect, said Bellon, so it sat on shelves, leading to markdowns and lower margins.

Bellon said all these factors, combined with the “continued decline” of the brick-and-mortar retail industry, made operating the business difficult.

This is the Houston-based retailer’s second bankruptcy filing in less than two years, previously filing in December 2017.

The reorganization plan at the time included closing about 100 stores and its Los Angeles office as well as reducing the headcount in its support center and distribution center in Houston.

The retailer emerged in April 2018 with new owners, naming Boston-based private equity firm THL Credit as its majority equity holder.

The company is partnering with creditors, including Second Avenue Capital and White Oak Commercial Finance, taking out a loan for $13 million to assist with operations until the stores close.

The going-out-of-business sales, facilitated by Merchant Resources and SB360 Capital Partners, have already started and are expected to raise $30 million.

Orders can no longer be placed on the website.

The Latest

The catalog contains a complete listing of all the loose gemstones in stock, as well as information about the properties of each stone.

The company added a retailer dashboard to its site and three new birds to its charm collection, the cardinal, blue jay, and hummingbird.

As a leading global jewelry supplier, Rio Grande is rapidly expanding and developing new solutions to meet the needs of jewelers worldwide.

An additional 25 percent tariff has been added to the previously announced 25 percent.

Its Springfield, Massachusetts, store is set to close as owner Andrew Smith heads into retirement.

Designer Hiba Husayni looked to the whale’s melon shaped-head, blowhole, and fluke for her new chunky gold offerings.

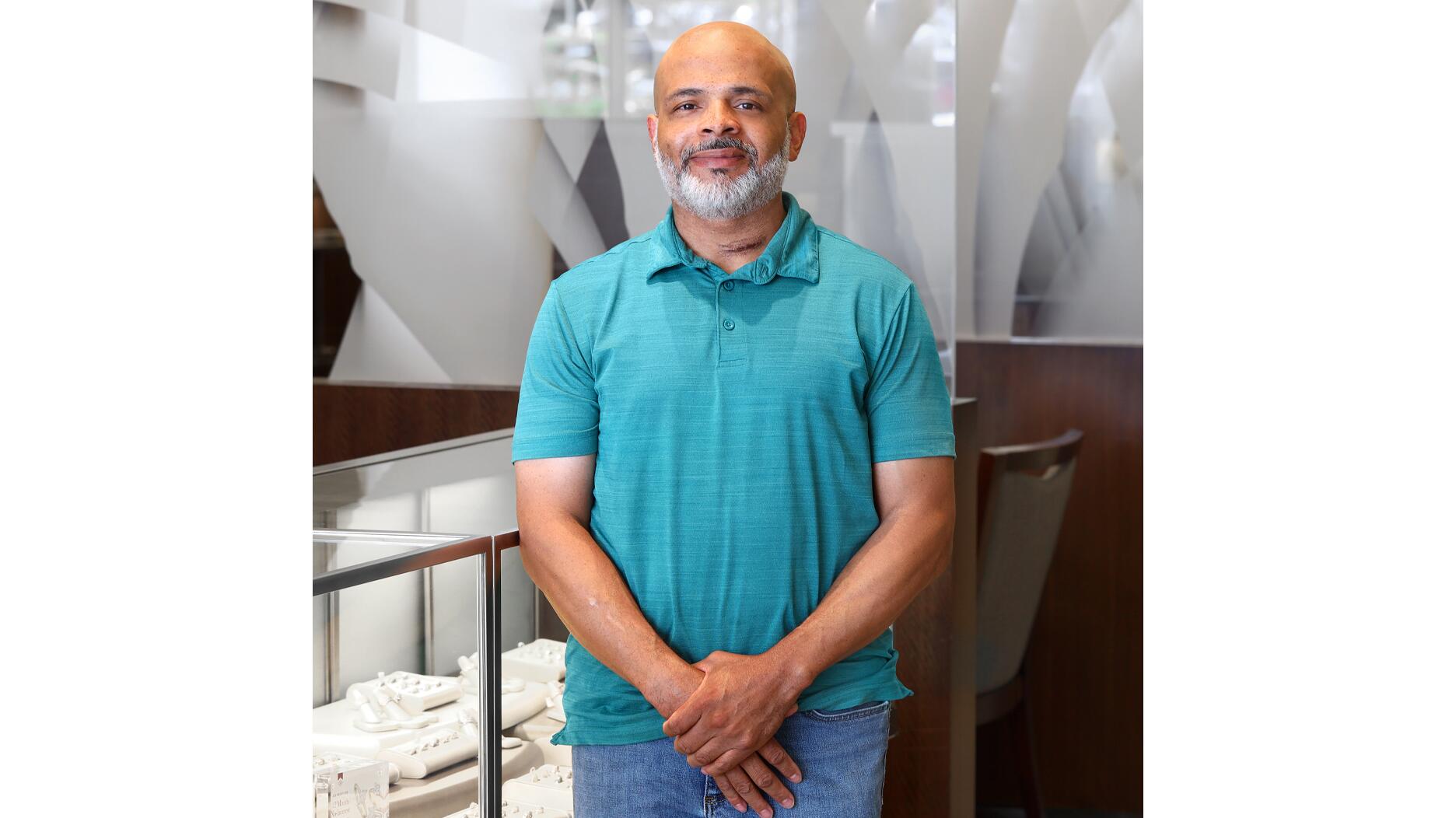

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

She will present the 23rd edition of the trend forecasting book at Vicenzaoro on Sept. 7.

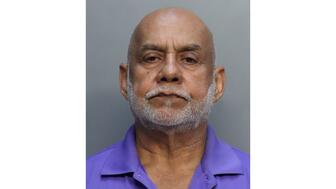

Omar Roy, 72, was arrested in connection with the murder of jeweler Dionisio Carlos Valladares.

The New Orleans-based brand’s “Beyond Katrina” jewels honor the communities affected by the storm.

Lilian Raji explains why joining an affiliate network is essential for brands seeking placements in U.S. consumer publications.

The organization has awarded a total of $42,000 through its scholarship programs this year.

The winner of the inaugural David Yurman Gem Awards Grant will be announced live at the 2026 Gem Awards gala.

As summer winds down, celebrate the sunny disposition of the month’s birthstones: peridot and spinel.

Moshe Haimoff, a social media personality and 47th Street retailer, was robbed of $559,000 worth of jewelry by men in construction outfits.

The addition of Yoakum, who will lead Kay and Peoples, was one of three executive appointments Signet announced Thursday.

The insurance company’s previous president and CEO, Scott Murphy, has split his role and will continue as CEO.

The nearly six-month pause of operations at its Kagem emerald mine earlier this year impacted the miner’s first-half results.

The necklace uses spinel drops to immortalize the moment Aphrodite’s tears mixed with her lover Adonis’ blood after he was fatally wounded.

The diamond miner and marketer warned last week that it expected to be in the red after significantly cutting prices in Q2.

Jewelers of America’s 35th annual design contest recognized creativity, artistry, style, and excellence.

Tratner succeeds Andie Weinman, who will begin stepping back from the buying group’s day-to-day operations.

The president made the announcement via Truth Social Wednesday, adding that India also will face a penalty for its dealings with Russia.

The luxury titan’s star brand Gucci continued to struggle amid a "tough" environment.

Its opening marks the completion of the retailer’s new 11,000-square-foot store in the Texas capital.

Respondents shared concerns about tariffs and commentary on the “Big Beautiful Bill.”