In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

Pandora to Close 50 Stores Following Weak Q1 Results

Quarterly revenue in the United States fell 12 percent as charm demand waned.

Copenhagen, Denmark—Pandora had a rough start to its fiscal year, reporting weak first quarter results as slowing demand for its charms sent like-for-like sales tumbling.

Quarterly revenue totaled 4.80 billion Danish kroner ($719 million), slipping 6 percent compared with 5.12 billion kroner ($820.5 million) in the previous first quarter.

Like-for-like in-store sales were down 10 percent as foot traffic fell 14 percent.

The in-store sales decline mainly occurred at jewelry stores and other outlets that carry Pandora, rather than at the company’s own stores, Q1 results show.

Revenue from company-owned retail outlets was up 16 percent in the quarter, accounting for 64 percent of its total sales. Wholesale, which accounted for 31 percent of total sales, decreased 34 percent in the quarter.

Online sales rose 7 percent. Pandora’s online store generated 10 percent of total revenue in the quarter with almost 1 million orders placed.

On a regional basis, quarterly revenue in the U.S. dipped 12 percent to 977 million DKK ($146 million).

Revenue in the Americas overall, which includes Canada, Latin America and the Caribbean as well as the United States, was down 5 percent.

Revenue from the EMEA region, which includes Europe, the Middle East, and Africa, declined 11 percent while sales in the Asia-Pacific region fell 6 percent.

China was one of the only regions to see revenue growth, up 15 percent in the first quarter. Pandora released a 15-piece Peach Blossom collection, exclusively available in China, in April.

Breaking it down by category, Pandora’s charms are still its bread and butter, accounting for 51 percent of its sales, but their popularity seemingly continues to wane.

Revenue from its charms segment sank 17 percent in the first quarter, while the necklaces and pendants segment saw double-digit growth, up 14 percent in the quarter.

Revenue from rings and earrings were also on the rise in the low-to-mid single digits while bracelets, a carrier for the charms, saw a slight dip in revenue.

Pandora is in the midst of Programme NOW, its two-year turnaround plan that aims to cut costs and revitalize the brand.

On Tuesday, the company announced it will close 50 “low-margin” concept stores, including those that are not profitable or diluting margins.

“The brand as well as the company has reached a point of maturity and it is not without some serious challenges,” new CEO Alexander Lacik said in the company’s earnings release. “The recently announced transformation Programme NOW, which I fully support, is a

Also as part of the transformation plan, Pandora will reduce the size of its sell-in packages, buy back inventory from wholesale partners and run fewer sales.

The company said it has saved 100 million DKK so far, scaling back on everything from consultancy costs and employee benefits to workforce scheduling and lease agreements.

Pandora Chief Financial Officer Anders Boyer noted that while the first quarter “emphasizes the need for our planned brand relaunch,” the company’s initial commercial pilots and marketing tests show “good results.”

The company’s fiscal year financial guidance remains the same, with organic growth expected to decline 3-7 percent with like-for-like sales improving slightly.

The Latest

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The new catalog features its most popular chains as well as new styles.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

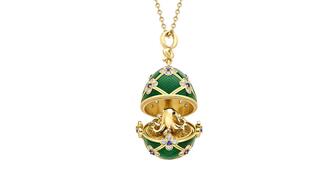

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Kadet, a 1994 National Jeweler Retailer Hall of Fame inductee, helped grow the family-owned retailer in the Chicago area and beyond.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

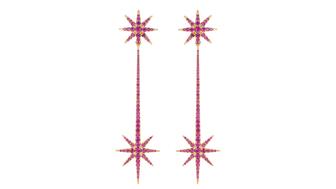

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.