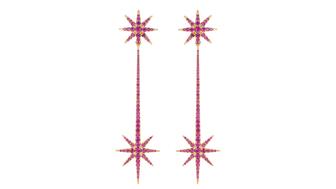

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

Jean-Paul Tolkowsky’s Diamond Co. Files for Bankruptcy in US

Exelco North America Inc., Diamond Trading USA, Exelco NV and FTK Worldwide Manufacturing BVBA all filed for Chapter 11.

Wilmington, Del.--Exelco NV, the diamond company co-owned by master cutter Jean-Paul Tolkowsky, has filed for Chapter 11 bankruptcy protection.

Antwerp-based Exelco NV and FTK Worldwide Manufacturing BVBA, along with U.S.-based affiliates Exelco North America and Ideal Diamond Trading USA, filed on Sept. 26 in U.S. Bankruptcy Court in Delaware, listing up to $100 million in liabilities, court papers show.

The filing follows Exelco losing its status as a De Beers sightholder in April and lender KBC Group NV seizing goods from Exelco’s office in Antwerp over the summer in an effort to recover some of the money it’s owed.

An Antwerp court later ruled that KBC had to return the goods because Exelco was on track to repay its loans, but the company’s U.S. bankruptcy filing shows that the bank isn’t giving up.

According to court documents, Exelco originally filed the rough equivalent of Chapter 11 in Belgium but then withdrew that and filed in the United States, informing KBC of what it had done.

Despite this, court documents state, KBC continued to pursue legal action in Belgium that would allow it to seize and liquidate Exelco NV’s assets.

Exelco filed a motion for a temporary restraining order, invoking protections afforded under U.S. bankruptcy to block KBC’s actions overseas.

A U.S. bankruptcy court judge granted the TRO Friday, in an order that states in part that KBC is enjoined from “seeking to seize and/or liquidate [Exelco’s] assets and from further attempts to use the Act on the Continuity of Enterprises in Belgium or other legal proceedings to seize and/or liquidate [Exelco’s] assets. KBC is hereby directed to immediately withdraw all pending requests for relief against the debtors or their assets in the Antwerp Commercial Court (and any other court).”

A spokesperson for KBC said the company cannot comment on the case, as it is a pending legal issue involving a client.

Neither Exelco nor the attorney listed as representing it in the case, Wilmington, Delaware-based Michael R. Nestor, responded to request for comment.

Documents filed in U.S. Bankruptcy Court list Exelco NV’s creditors as numbering between 50 and 99, and puts its assets at $10 to $50 million.

According to a filing made by the company in Belgium and cited by Bloomberg, among the company’s biggest creditors are KBC and another former diamond industry lender, Standard Chartered Plc, which are owed $15 million and $35 million, respectively.

The largest unsecured creditors include a number of

Tolkowsky, a member of the family of famous diamond cutters, started Exelco in 1993 with Leon and Lior Kunstler.

The company is a mid-stream supplier of diamonds, buying rough from miners and then cutting, polishing and/or setting the stones and selling them to retail jewelers.

Among the company’s clients is Signet Jewelers Ltd., which carries Tolkowsky-branded collections at its Kay Jewelers and Jared the Galleria of Jewelry chains.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

Black Friday is still the most popular shopping day over the five-day holiday weekend, as per the National Retail Federation’s survey.

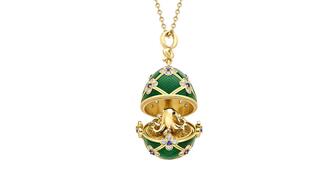

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

In addition, a slate of new officers and trustees were appointed to the board.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.

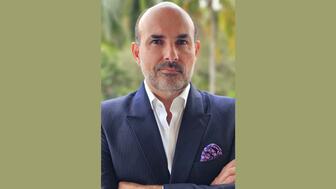

Luxury veteran Alejandro Cuellar has stepped into the role at the Italian fine jewelry brand.